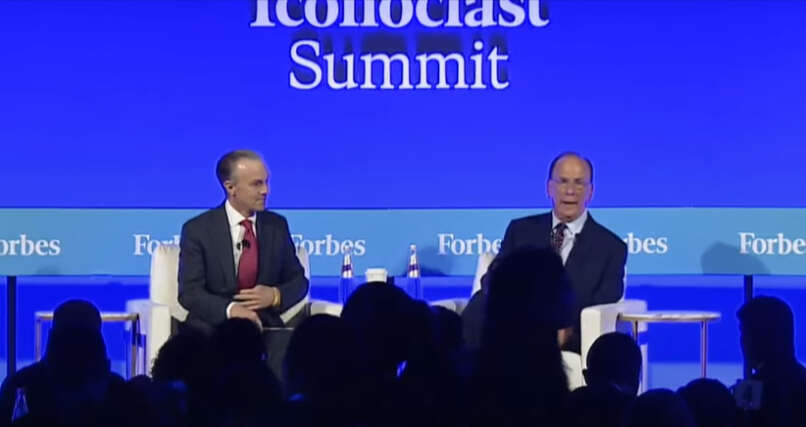

The following is the full transcript of BlackRock CEO Larry Fink in conversation with Greg Fleming, CEO of Rockefeller Capital Management at the 2025 Forbes Iconoclast Summit. (June 5, 2025)

Listen to the audio version here:

Introduction

GREG FLEMING: Thank you, everybody. Good morning. Larry, welcome!

LARRY FINK: Greg. Hi. Hi, everyone. Does anybody know what bank this was? Do we?

GREG FLEMING: You know, I don’t, but I’m going to jump right into it.

LARRY FINK: Beautiful.

BlackRock’s Remarkable Growth Journey

GREG FLEMING: Come back on the bank. So we’re going to start with BlackRock. Larry founded BlackRock in 1988, 37 years ago. And he and I have known each other since 1994, when I was a vice president at Merrill Lynch, raising closed end bond funds for BlackRock, which had a market value at the time of $300 million.

You fast forward five years to 1999 and Larry takes BlackRock public. We take it out at $14 a share. Merrill Lynch led the underwriting, and I was leading that team. The market value at the time, market capitalization was approximately $900 million. The BlackRock stock price closed yesterday at $988.97, a market capitalization of approximately $153 billion. And this is the fun part. The stock price increase from that time is 6,964% and the market capitalization has increased 17,000%.

So my first question for Larry comes out of these milestones. What in your view have been the most critical moments and decisions in your leadership that created that trajectory?

LARRY FINK: Well, it’s great to be here. I want to thank Forbes for inviting us. So great to be here.

Probably the most fundamental thing that we did was building a team of leaders that constantly were willing to be challenged every day, challenging everybody who was part of the organization to try to stay in front of our clients, never stand still.

And then I would say the fundamental concept of believing in the capital markets, it is our views that economic activity was going to be driven more and more through the capital markets, less through banking system.

And then it was augmented. Then after the great financial crisis, when regulators worldwide elevated bank capital and required banks to have 20, 25% more capital, which meant banks were inhibited by 20, 25% in lending. They had to shrink their balance sheets or grow their capital base. And if you think about the growth of private credit, that was stimulated basically by the rising capital standards of the banking system.

But also, I believe, if you look at the fundamental growth trajectory of different parts of the world, and if you just looked at the growth of Europe versus the growth of the United States. Post financial crisis, the US GDP grew 7 and 9, 10% compounded over 15 years, more than Europe. And I believe today the fundamental problem with Europe was they did not grow their capital markets at the same time. Capital standards were lifted in Europe and they had no source of new capital similar to the United States. I do believe Europe is now moving towards that and having plans to create a capital markets union. But if I talk about when I go to Japan or India or Saudi Arabia. Wait, wait.

Building BlackRock: Then and Now

GREG FLEMING: Before we go around the world, I want to bring you back to BlackRock just to. Okay, if you were starting BlackRock in 2025 and then we’ll get to global markets, don’t worry. 2025, what would you do differently and what would be exactly the same?

LARRY FINK: Gosh, I mean, we were so fortunate in the founding. Eight people were so connected and we really believed in each other. 37 years later, all eight of us are still. We still remain to be very close friends, just a very connected team. Only three of us are left at the firm.

GREG FLEMING: One of them’s on the board.

LARRY FINK: One of them’s on the board. And I report to her now. Report to Greg too, and me.

Now, it’s the foundation of any organization is the team and culture. And if you have the right team, the right culture, it doesn’t matter when you start and how you start. It allows you to grow and to move forward. And I truly believe, if I look back over the last 21 years, since we started M&A activities, I believe we’re a better firm in how we integrate the organization when we acquire different organizations. And I’m very proud of the roots of BlackRock, of all the different organizations that became a part of the firm.

And we’ve, you know, last year we announced three different mergers. Spending $28 billion in three mergers. Two of them are already onboarded. July 1st we’ll close the last one. But all of it is additive to the foundation. The firm is all additive to the leadership team. And importantly, in every acquisition we’ve done, we did it for growth purposes, not for consolidation.

And I really believe it’s the fundamental of the team and then growing the team, obviously way beyond the founding eight, but continue to drive a leadership team that is connected, a leadership team that believes in our mission, our leadership team that is trying to singularly grow the organization on behalf of clients. So we’re about what, $12 trillion of money that we’re responsible for, but none of it’s our money. And our job is to treat that client who gives us $1,000 of their hard savings the same way we’re treating a big sovereign wealth fund who gives us tens of billions of dollars.

Leadership Through Acquisitions

GREG FLEMING: To come back on the leadership. Because I’ve witnessed this over all these years. I mean, the first deal that you mentioned was we took Merrill Lynch’s investment business, investment management business, and merged it into BlackRock in 2006. And at the time, Merrill took back a 49% ownership stake from that deal through the iShares deal to their most recent deals.

One of the things that you do that you rarely ever see in firms that are doing acquisitions of this scale is you take the leadership team of the entity you bought and you work it in to the BlackRock leadership team without changing the culture that started 37 years ago with those eight people. How do you make that happen so regularly and now through so many major acquisitions?

LARRY FINK: Well, I would say specifically in the last two deals with HBS, which will be closing July, GIP, which closed last October, in those two cases, similarly to the earlier transactions, we spent a lot of time talking about culture and team. And if we could not find a connectivity and a unity of opinions and ideas, we were not interested.

The valuation is the most simple thing. And in both cases, there we probably were having two months of conversations about culture, team, directionality, organizational issues before we even utter the conversation about valuation. Valuation is actually pretty darn easy, you know, if you could get the culture and the team.

And the other thing is, you know, Greg, we’re pretty strident in a few things. So we tell every organization that comes on board with us, one culture. We’re not going to have appendages. We’re not going to be an amalgam of different boutiques independent of each other. One firm, one culture. We can have different brands. I have no issues on the branding part of it, but it has to come down to that. We have a unity of a firm, a unity of opinions, and then probably the most strident thing we believe in is one technology platform.

And so the whole organization is run under Aladdin, which is, I think, the biggest technology platform for investors in the world today. But we’re the largest client. And so those are the things that create, I would say, the culture, the team, the spirituality of an organization.

Macro and Geopolitical Trends

GREG FLEMING: It’s fantastic because I think those two central themes which you’ve driven for 37 years, one culture and one technology platform. I don’t know a great organization anywhere that doesn’t have consistency on those two things. BlackRock’s right at the top of that list.

So let’s go to broader macro for a second. Larry, you travel extensively all the time meeting with world leaders, CEOs, the biggest and most sophisticated investors all over the planet. From your seat today, what macro or geopolitical trends, you think they may be underestimated? Underestimating.

LARRY FINK: Well, let’s start off, I mean I did an editorial a few days ago in the Financial Times and I said I have no idea what this next seven days are going to be, but the next seven years I’m very confident in.

And so yes, I mean the United States is shaking up, I would say, the foundation of globalization, shaking up how we work together with allies we are trying to, you know, and I wrote about this. We need globalization 2.0. Globalization worked for those who have savings, who invested. Globalization lift more human beings than any time in the history of human beings over the last 25 years. More human beings were lifted to middle class at any other time.

That being said, many segments of society have been left behind. And if you go back to 2014, 15, when you started having talks about Brexit and then you ultimately had Brexit and you had rising populism in many countries and that is a direct result of globalization worked for the entire world but did not work for many segments. And I think those segments were left behind. And globalization 2.0 and I think this is a fair assessment. We need to broaden the economies to make it work, working it for more.

And so that’s the conversation I’m having with leaders. My conversations in Europe are very different than my conversations I’m having here. I mean, it’s true. And I wrote about it. First conversation you have with everybody is, you know, what’s going on, where are the tariffs going? And you know, I know as much as anybody else on that, but I would say the biggest thing that we are missing here in the United States is the inflationary backdrop that if the tariffs are instituted over the next five months, I think we’re going to see very elevated inflation, recent economic activity showing that there’s a weakening and the weakening is occurring because there’s more and more uncertainty.

And if you study behavioral science, when there’s an uncertain period of time, as you make decisions, your decisions are biased, negatively biased by that uncertainty. And I can say the same thing. When everybody’s ebullient and happy, we make aberrant decisions that are probably overly optimistic. So at this time we’re seeing more and more, I would say in terms of probability results, we’re seeing it being skewed to more pessimism and more, I would say, conservative outcomes.

And so in the United States, I think we’re miscalculating. And with the bond market 10 year being at what at 4:37 today, as.

GREG FLEMING: As much as four and a half.

LARRY FINK: You know, it came down quite a bit on the backdrop of a weakening economy. But I do believe we are going to start seeing the impact of these inflation, these tariffs that are going to start impacting the economy over the course of the next five months.

The US Fiscal Situation

GREG FLEMING: Two things. One, I want to stay with that, but I do want to go back to the phrase you used in the bed piece on global growth into local wealth. But before we do that, since you’re on the US here, let’s talk about, you’ve mentioned tariffs. Let’s talk about the fiscal situation.

You know, we have seemed to under either party fallen into a situation where we have 6 to 7% of GDP deficit year in and year out, creating things like interest expense on the debt being bigger than military spending. And it seems to me after watching this for years now and you that it’s actually really reaching an apex in terms of the focus and the concern that the bond market is going to react to that and to the tariffs.

So, you know, long term US Resilience, how is that going to work in the face of let’s leave the tariffs aside and the inflationary effect of tariffs? Simply the fiscal situation and the unsustainability of that. Can you talk about that for a little bit?

LARRY FINK: Well, I have written about this. The two most major issues, economic issues that are facing the United States are two issues that we don’t talk about at all. And maybe there’s a little bit dog right now. One is the deficits and two, the fear of retirement by so many Americans.

And to me, getting back to my optimism, I’m optimistic generally over long cycles because we solve problems. You cannot solve problems if you don’t have a conversation. And the issue of fear of retirement and our growing deficits are the two most consequential issues that we don’t talk about. I was in Washington yesterday and I saw many members of Congress and deficits are not truly a part of a.

GREG FLEMING: Conversation even after the, I mean, Musk is tweeting.

LARRY FINK: Yeah, I mean it’s been elevated a little bit. But let’s set the context. After 223 years of being a nation. In 2000, the deficits in the United States were $8 trillion. Took 223 years to create a $8 trillion deficit. And in the last 25 years, both parties are guilty of this. Our deficits are now at 36 trillion. And now we have a pending tax bill. So going to add 2.3, $2.4 trillion on the back of that. To me, this is if we don’t find a way to grow at 3% a year, real growth, real growth at 3% a year, we’re going to hit the wall.

GREG FLEMING: Now, another way of doing the math on the.

LARRY FINK: Let me just finish this. I think it’s really important. This is why I’ve been writing about we need to unlock more private capital. This is getting back to the capital markets. This is another way of helping retirement. We need to unlock private capital in this country. We need to be streamlining, permitting. We need to be focus on rebuilding our infrastructure. If you believe that we are going to be the leader in AI, we’re going to have it’s estimated a shortage of 500,000 electricians in this country.

And so divide all this pessimism. I mean the foundation of growth isn’t there. We just need to unlock it. And if we can unlock that growth, I’m not as pessimistic about the deficit, but if we cannot unlock the growth and if we’re going to continue to stumble along in a 2% economy, the deficits are going to overwhelm this country. And importantly, 25% of the US treasury market is owned by foreigners. That’s not a good situation when we are now battling many countries related to tariffs. And so you’re starting to begin to see a weakening of the dollar. There is, there are some big questions on the vitality of the United States. I think long term that’ll be proven wrong. And then you have the whole intersection of crypto and what role can bitcoin play before we get there?

GREG FLEMING: Let’s just finish on the macro. So Secretary Benson, when he took office talked about 3% inflation, 3% real growth and a 3% budget deficit as a percentage of the economy by 28. You know, it seems like that’s going to be quite difficult to reach at this point. And if we don’t get the 3% real growth, your point? Then the fiscal situation becomes that much more dramatic.

LARRY FINK: That’s no question. No, but it’s attainable. If we unlock private capital, we cannot rely on federal spending as much. That’s the irony. If we unlock locked private capital when you know we have $12 trillion sitting in money market funds. If we unlocked private capital and we, and we lifted the uncertainty to have more certainty of where we’re going, I think there’s some great opportunities for investors, long term great opportunities to invest in America, to build America.

But if we don’t unlock private capital, if we don’t allow a streamlining of permitting so we have better understanding of the length of time it takes to put the shovel in the ground and building things, if we don’t start focusing on more public private types of financing vehicles, we’re not going to grow at 3%. Flat out, we’re not going to grow at 3%.

And the last thing I would just say talking about the deficits, we will never grow out of our deficit problem. If we think we have to cut spending, the reality is we need to unlock growth opportunities because as you said, Greg, the interest payments of our deficits are just going to be overwhelming. And we’ve been cutting back entitlements already. And so these are some of the big fiscal issues that we’re facing. And we need to have that conversation.

GREG FLEMING: Don’t we have to though? On the spending side, From World War II through 2024, receipts were 17% of GDP and spending was 19%. And we had, you know, deficits, but they were constrained. In fact, when Clinton left office, we had a surplus.

LARRY FINK: We had surplus for the last three years.

GREG FLEMING: In the last five years, receipts are 17% of GDP. 19, 2019 to 2024 and spending is 27% of GDP.

LARRY FINK: Right.

GREG FLEMING: Don’t they in addition to growing, don’t we have to deal with the spending levels?

LARRY FINK: Well, the best way you’re going to be doing that is through unlocking more private capital. But the answer is yes. But I think we’re not taking advantage of all the private capital and getting, and I think it’s intersected with retirement. If we get more savers, this is true for Europe, for Japan, for all parts of the world. If we get more savers investing in the growth of their economy, their country, you know, to see drop in piece.

GREG FLEMING: This is what you’re saying.

LARRY FINK: You know, I believe whether you keep your money in a deposit or in the bond market, you’re a creditor. We need our savers to be long term believers in our economy, in our great companies. We need to show them why the compounding of return is so beneficial for them and the outcome over a long period of time.

Let’s be clear, over the last 40 years, pessimism has not worked. And we’re right with pessimism right now. And I don’t think there’s any, any changes over a short period of time. Pessimism may work in a substantial way, but over a long cycle. If you believe in the entrepreneurialism of this country, which I do, the fundamentals of our educational system, we’re the model of the world.

And I had a conversation with a leader of another country last night and we talked about what differentiates the United States from Europe and other places is our capital markets. And more and more countries are trying to emulate even the Europeans. Well, the Europeans must do it. And if the Europeans don’t create a more solid banking union and a more solid capital markets union, the enthusiasm that we are seeing in Europe is probably going to be misguided.

Leadership in Today’s World

GREG FLEMING: Another example of it leaving. I want to turn to leadership while and spend some time on that because it’s such an important part of the BlackRock story and it has defined your life. So beyond BlackRock, where your leadership has been indisputable, you are relied on by friends, colleagues, world leaders, so many people for guidance and support all the time.

And I have an example I wanted to share here to show you how long Larry Fink has been playing that role on a broader basis even than Blackrock. After September 11, I was at Merrill lynch and I was running a 300 person group there, the financial Institutions group. And we were out of our towers downtown, the north and the south tower because of the trade centers going down and we were looking for space.

I called Larry a couple days after September 11th and I said, I don’t know where I’m going to put these 300 people for the next six months. And he said, we’re moving from Park Avenue to a new space. I have space here. And I said for all 300 people? And he said for all 300 people. We moved in and we worked for from there for the next six months. And he made that happen instantaneously. That is an example of things that happen dozens of times in Larry Fink’s world over the last few decades. When we come to today. How do you define leadership today and how has that changed over the course of this career you’ve had?

LARRY FINK: Well, I think the only big difference in the last 30 years and it’s not, you know, the qualities of leadership haven’t changed. But I think that when you’re living in a world of populism and the growing influence of social media, the I would say the transparency of Everything we do, you have to be a lot more guarded. Like I can’t say everything I really want to say to all of you right now.

GREG FLEMING: And we’re not going to do that just before anybody looks at it.

LARRY FINK: No, but I mean, the reality is, the reality is you have to be a lot more systematic in what you say and how you say it internally or externally. I mean, we live in a terrarium today, we live in a glass bottle. And so I think those, the transparency, which has many fine and good elements and many negative ones, you have to lead differently. You have to be a lot more thoughtful in every word you say. But also you can use social media for positive things too. So you can use your voice in positive ways too.

So I think the greatest change is, is the role of social media, the role of the openness of, I would say of corporate behaviors, good and bad. But the qualities of the human experience has not changed the young people today who are, you know, I think we have, this week we have our incoming training program of 600 young people coming into the office.

GREG FLEMING: We have 23.

LARRY FINK: So a little bit different, but the qualities are no different, different. Their hopes and desires are no different. To build a life and build a career, to have success. And the one thing I would also say, and it surprises me every time, but you have to also understand your leaders need to be led too. It doesn’t matter where you are in the pecking order of an organization, how successful you are during times of stress, 100% during times of uncertainty, you have to be, you know, you have to be a much more transparent leader.

I had a trip to my European offices a few weeks back right after Liberation Day. And quite frankly, the Europeans were quite frightened. They were frightened of, you know, their partners, the United States, and where this may go. But what I was probably the most surprised when they were frightened because we’re a US based company that is BlackRock changing too. And I said we’re not. We are going to be the same firm. Yet we were 37 years ago that we were going to be in the next five years.

And it was just a wake up call even for me. And I think I’m pretty well experienced in this stuff. Again, when there’s great moments of uncertainty, even your top leaders need to be led. You need to confirm who you are and what are the responsibilities of us as an organization. And that’s just a wake up call and the responsibilities of leadership.

And the last thing I would just say, if you can’t get your messaging properly with your employee base. And we have 23,000 employees at BlackRock globally. How are you going to get those messages across to all your clients? And we have clients in over 100 countries. And then importantly, in this era of, I would say, rising populism and rising nationalism, more importantly, if you’re going to be a global firm in each and every country, you have to show your purpose. We have to be Japanese in Japan, we have to be Italian in Italy, we have to be Mexican in Mexico. We have to be British in the UK and if we are not, if we don’t show that connection, you’re not going to connect with your clients.

And as the largest retirement manager in the world, we’re the largest retirement in Japan. In the UK, we have to show that purpose every day. And so there may be political challenges and political uncertainties, but the key for every in each organization is showing your team, your leaders, your clients, the governments, where you operate, that you’re as purposeful today and that your objective in each and every country is to lift that country. So our responsibility, especially because we’re the largest retirement managers, to lift more people.

The Annual Letter Process

GREG FLEMING: This whole answer is exactly why BlackRock has been BlackRock for 37 years. I did want to ask you about the annual letter, which you’ve had enormous impact with.

LARRY FINK: Too much.

GREG FLEMING: Well, but people are also curious about how that comes together. And it’s interesting to get kind of the inside baseball on that. So is that you sit down late in a year and put 10 topics on a page and say, okay, I really want to go with this one. Or are you on a plane back from somewhere around the world? You’ve had a conversation and it might even be this time of the year. And you’re like, you know what? I think this is the seed for next year’s letter. How does that work each year?

LARRY FINK: Well, the process. Well, it depends if it’s an election year or non election year. Okay, so let’s start there. If it’s a non election year, I start focusing on the ideas in September. If it’s an election year, I start pushing it off to post election in November.

But I would say the sum of my. The letters that I write are just taken from client conversations. I don’t think there’s anything unique or original. I just sum up all these conversations I have and try to put it in a framework that can make sense. So this is the joy of traveling, joys of being connected with so many clients worldwide, talking to employees worldwide, talking to governments, political leaders, regulators, and just hearing what’s on their mind.

And if there’s a common thread, I try to pull that forward. If there’s a commonality of a hope or a commonality of a fear, how can we translate that into something that can make sense? And then you just, you know, we have very unique relationships as one of the largest owners of companies in the world, having a 5 plus percent ownership in almost every company in the world.

And the beauty of BlackRock, because most of that ownership is in the form of ETFs and index funds, we’re long term investors. And so as we expand, obviously in the alternative space, we’ve witnessed already that some of the major companies in the world want to partner with BlackRock because we have been a key connector of them. And so the relationships, the conversation we’re having with CEOs, with government and with clients is really incredibly fulfilling and fun. And I learn something every day, but most importantly, I’m able to synthesize those conversations and hopefully I come up with something coherent and something meaningful.

GREG FLEMING: I think you do every year. And as you said, sometimes it’s been provocative, sometimes it’s been interesting, but it’s all, you know, everybody’s waiting for every year.

LARRY FINK: But it’s never meant to be provocative. And I would say lastly, there has never been a moment in time where I thought what I was writing had any political overtones. So despite the far left’s attacks on me or the far right’s attacks, it was meant to be a conversation with me and our shareholders, our clients and the companies we invested.

GREG FLEMING: I want to do one more question and then we’ll wrap. You’ve been ahead of the curve so much in your career. What do you see 10 or 20 years out that others might miss that you want to talk to this audience about?

Looking to the Future

LARRY FINK: As I said, stay on top of all the noise and all the seven days of fear. We as a species, we find solutions. You know, we could be really pessimistic in the short run, but I just challenge anybody to be a pessimist over the long run. And I truly believe the opportunities to invest in global growth, global opportunities is great today as it was 37 years ago.

And the beauty of the role of technology and how it’s going to reshape our world, our economy, we just have to be mindful. Yes, we are going to be. The combination of robotics and AI is going to reshape the whole workforce and it’s going to be very rapid. At the same time, it’s going to create some incredible jobs, incredible opportunities we as leaders of companies, of businesses we have a responsibility of working with governments and helping them plan that out so we can have a broadening of our economies. And if we could do that, those who are joining BlackRock this week are going to have an incredible opportunity to have as robust a career as you have had Greg or I have had.

GREG FLEMING: Fantastic. So Larry Fink is basically saying the same thing that Ernest Shackleton said over 100 years ago. Optimism is true moral courage. Larry is one of the great leaders of our generation. Last December we gave him a well deserved lifetime leadership award from Yale alongside Tim Cook.

And I like to close every setting like this with a quotation and I have one in honor of my long term friend. John Quincy Adams said quote “if your actions inspire others to dream more, learn more, do more and become more, you are a leader” and Larry Fink is a leader for our time. Thank you very much Larry.

LARRY FINK: Thanks everyone. Thanks Greg.

Related Posts

- Transcript of The Jewish Parent’s Guide to Money, Work and Family: Moishe Bane

- Transcript of Ken Rogoff’s Interview on A Charlie Rose Global Conversation

- Transcript of In Conversation With Yanis Varoufakis at 2025 QEF

- Transcript of Jamie Dimon on Economic Risks, Federal Reserve, China Business

- Transcript of Secretary Scott Bessent Remarks on Trump’s Tax Bill