Success Stories: Traders Share Their Experiences with the Most Powerful Crypto Trading Bot

In the dynamic world of trading, which spans from forex to stocks and the bustling crypto market, the use of algorithmic trading bots is on the rise. These tireless trading bots tirelessly analyze market fluctuations, assess probabilities, and execute trades with astonishing speed, far surpassing human traders. For those who want to experiment without risk before trading with real money, a demo trading account is an excellent way to familiarize themselves with these advanced tools and test strategies in a safe environment.

Why not dive into some fascinating stories from people at the forefront of this exciting field and perhaps learn something from their experiences?

But first, let’s start with the basics:

What Are Crypto Trading Bots and How Do They Differ from Stock Trading Robots?

Crypto trading bots and automated stock trading bots are algorithmic tools that execute transactions autonomously in their respective markets, each with unique operational features.

Crypto Trading Bots:

- Operate 24/7: Since the crypto world never sleeps, these bots are always active, ready to take advantage of any trading opportunity at any time.

- Handle High Volatility: Crypto bots are designed to navigate the wild volatility of the crypto market, making smart decisions even when the market is turbulent.

- Support Multiple Cryptocurrencies: These bots work with a variety of cryptocurrencies, from the well-known Bitcoin to various altcoins, each with its own market rhythm.

- Light Regulation: With fewer restrictions in the crypto space, these bots have more freedom to experiment with bold strategies that may not be feasible in the stock market.

- Integration with Crypto Exchanges: These bots are seamlessly integrated with crypto exchanges, connecting via APIs to perform transactions and monitor market activity.

Stock Trading Robots:

- Fixed Trading Hours: Stock bots follow the hours of the stock exchanges, operating only when the markets are open and taking a break when they close.

- More Stable Markets: Unlike crypto bots, stock bots prefer the predictability of stock market movements, typically following long-term strategies.

- Specific Assets: These robots focus on stocks and ETFs, trading company shares and showing deep knowledge in that field.

- Strict Regulation: Stock bots operate in a highly regulated market, so they must comply rigorously with the rules.

- Integration with Brokerage Platforms: Just like crypto bots, stock trading robots connect with brokerage platforms but are also skilled at handling complex orders and trading scenarios.

Both types of bots are intelligent and use sophisticated strategies to execute trades.

They are programmed to detect market trends and act quickly. Whether in crypto or stock trading, both seek to capitalize on market movements for the benefit of the trader. Now, let’s see what traders think about their experience with these bots.

How to Create a Crypto Trading Bot: Useful Tips from a Real Trader

We asked one of our trader friends, Toby, to walk us through the steps of creating a crypto trading bot. Here’s his story:

Step 1: The Plan

“It all starts with a plan,” Toby began. “You need to know what you want your bot to do. Are you looking for arbitrage opportunities, or do you prefer dollar-cost averaging?” Toby recommended writing down the specific strategies you want to implement.

Step 2: The Toolbox

“You can’t build a house without tools, right? For a trading bot, you need the right programming language. My favorite is Python because it has a lot of libraries for data analysis and it’s easy to learn.”

Step 3: The Bot’s Heart

“Data is the heart of your bot,” Toby explained. “Real-time data feeds it, so you need to access the APIs of exchanges. This is how your bot ‘sees’ the market.”

Step 4: The Test Bank

“Test, test, and test again,” he emphasized. “Backtesting your strategies with historical data can save you a lot of headaches. And don’t forget to do paper trading; it’s like a rehearsal for your bot.”

Step 5: The Safety Net

“Risk management is your safety net,” Toby said. “Set your stop-loss orders and understand your risk tolerance. Your bot needs to be bold, but not reckless.”

Step 6: Launch

“And then, you launch it,” Toby said with a smile. “But stay vigilant. Keep an eye on it. Bots are smart, but they don’t have your intuition.”

Step 7: The Evolution

“A bot is like a plant; it needs care to grow,” Toby concluded. “Keep refining your algorithms, stay on top of market conditions, and adapt your strategies. Remember, building a bot is a journey. Enjoy it, learn from it, and let it help you make money in crypto. It’s possible.”

With Toby’s advice, any trader can build their own crypto trading bot, equipped with knowledge and some real-world math.

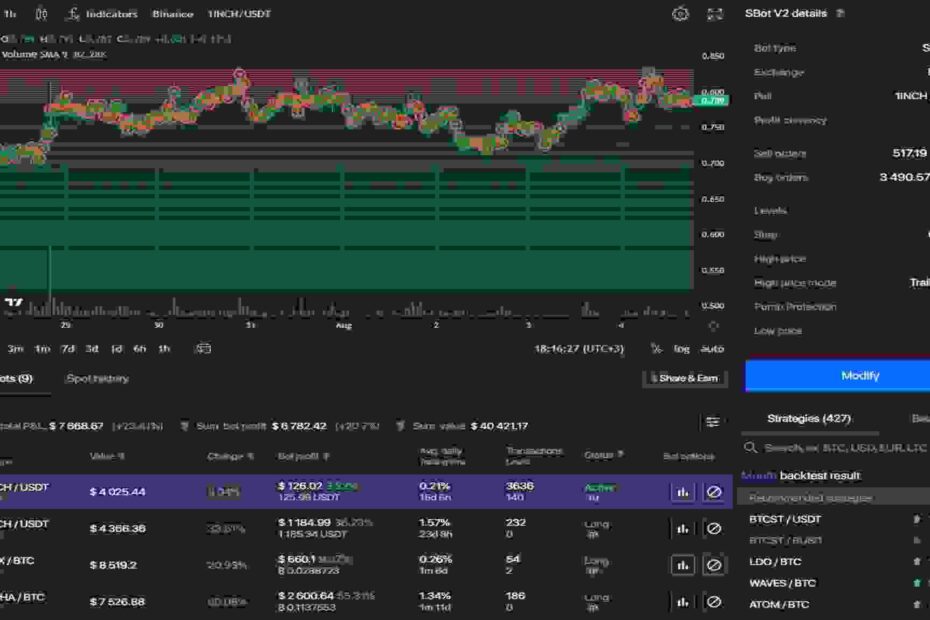

Another Success Story: Now, with the Bitsgap CryptoTrader Bot

In an impressive financial journey that demonstrates the power of intelligent trading strategies and the robust capabilities of Bitsgap, Kian, an up-and-coming cryptocurrency trader, achieved extraordinary profits using the GRID and DCA bots from the platform. In just four months, Kian made an incredible 125% profit, and then earned an additional 23% in the following two months. Here’s his story:

“I had heard about GRID and DCA strategies, but it was the Bitsgap platform that helped me truly understand them,” Kian said. “The interface was really easy to use. I set up the GRID bot, and it started buying and selling within the parameters I set, taking advantage of every small opportunity for profit in market movements.”

“The DCA bot was my steady hand in the midst of chaos. It bought my chosen coins little by little, regardless of market drops, averaging the cost of my investment. Bitsgap really made these strategies accessible and effective.”

“With all the horror stories about hacked exchanges, security was non-negotiable for me,” Kian said. “Bitsgap gave me peace of mind. I’ve never doubted the safety of my funds on their platform.”

“And whenever I ran into an issue or had a question, their support team was right there, answering quickly and helping out. That kind of support is priceless.”

“The pricing is as clear as it gets,” Kian continued. “No hidden fees, no confusing structures. Plus, I got an annual subscription at half price during one of their promotions. Now that’s value for money.”

“The Bitsgap community is like my trading family. Whether it’s on Telegram, Discord, Twitter, or Reddit, there’s always someone sharing ideas, strategies, or just offering moral support. They’ve been a huge part of my success.”

Kian’s story is not just about the profits he made but also the journey he’s had with Bitsgap by his side.

“It’s more than just a platform; it’s a trading partner that’s given me the tools, support, and confidence to thrive in the crypto world,” he concluded.

The Future of Automated Crypto Trading

As more traders explore automated systems, it’s important to understand that trading bots are not magic money-making machines—they are tools that require strategy, discipline, and continuous optimization. Successful traders know that the true power of a bot lies in the algorithm behind it. Choosing the right indicators, setting the proper stop-loss limits, and ensuring the bot reacts appropriately to volatility are what separate a profitable bot from an unprofitable one.

Data Quality: The Foundation of Every Successful Bot

Moreover, data quality plays a major role. A bot can only perform as well as the information it receives. Inaccurate or delayed data feeds can result in missed opportunities or poor decisions. That’s why most experienced traders invest in reliable API connections and test latency before committing to live trading.

AI and Machine Learning: The Next Evolution

Another growing trend in the world of algorithmic trading is the use of AI and machine learning. Modern bots can now learn from historical performance and automatically adjust their strategies. Some even use sentiment analysis, scanning social media or news headlines to predict potential market moves. This combination of data analytics and AI-driven adaptability is pushing the boundaries of what bots can achieve.

Balancing Automation with Human Judgment

Yet, automation doesn’t eliminate human oversight. The market can shift dramatically due to sudden news events, regulatory announcements, or unexpected global developments. Smart traders strike a balance between automation and manual intervention—allowing the bot to handle repetitive, emotion-free tasks while maintaining the final say on major strategy changes.

Ultimately, the future of crypto trading bots looks promising. With more transparency, smarter algorithms, and stronger security measures, these digital assistants are becoming indispensable allies for traders aiming to maximize profits while minimizing emotional errors.

Conclusion

Without a doubt, for those with the technical know-how, following Toby’s steps and creating a custom trading bot is a viable option. This route offers a personalized trading experience tailored to individual strategies and preferences. On the other hand, for those who prefer to leave the complexities to the experts, opting for a reliable third-party automated trading platform, like Kian did with Bitsgap, is just as effective. Each approach has its pros and cons, largely depending on the goals, mathematical skills, and practical capabilities of creating solutions independently.

Related Posts