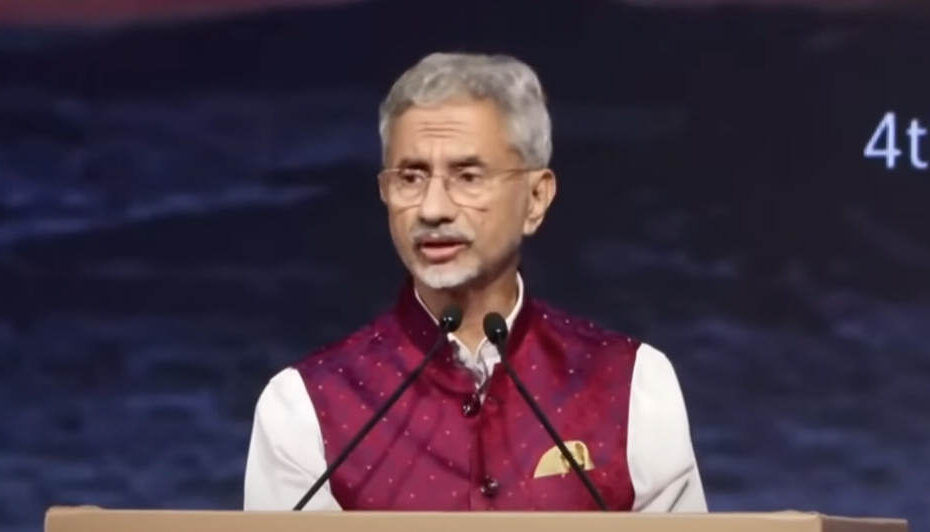

Read the full transcript of External Affairs Minister S. Jaishankar’s remarks at the Kautilya Economic Conclave 2025 in Delhi, October 5, 2025.

NK Singh: Very fresh, you make some observations on your recent experience which has been pretty rich. There has been hardly one day where you have not been in some interaction or the other to share some initial thoughts of yours. Thereafter, I will pose some issues and questions for your consideration. Then of course we have two very distinguished panellists and they will put across their point of view, and hopefully there will be time for one or two questions from the audience.

EAM JAISHANKAR: Mr. NK Singh, Mr. Trichet, Mr. McGregor, dear friends, it is a great pleasure to be back at the Kautilya Economic Conclave. Let me offer some thoughts to kick off the discussion. I would begin really by saying that every generation believes that they are seeing unprecedented changes. In fact, probably every conference believes that they are discussing unprecedented changes, but this time it is for real. So I do want to say that turbulent times may actually be an understatement. I hope prosperity is not.

The Global Landscape: Unprecedented Changes

I would begin really with the landscape. When we speak about turbulent times, my point would be that by every metric of measuring the international economy, of assessing in a sense the state of the world, we are actually going through an extraordinary and intense period of change. Let me give you a few examples.

Manufacturing Concentration and Its Consequences

Let us start with the most basic, which is production. What we have been seeing is that when one-third of the world’s manufacturing has shifted to one country, it has had very significant consequences on the international economy. It has had consequences on the supply chains.

The Energy Transformation

Let me shift to a second metric: energy. Again, one of the big changes of the last few years has been that the United States, which for decades worried about its exposure to external energy requirements, has not only become self-sufficient—it is actually today a significant exporter of energy and has made that energy export an important part of its strategic outlook. Now, just as the US has emerged as a champion of fossil fuels, China has also established itself actually as a leader in renewables. So pretty much any path you take on renewables, finally all roads lead back there as well.

Data Models and Big Tech Dominance

Let me shift to something else: data. When we look today at the models before the world, we have an American model which is very unrestricted, private enterprise driven. We have a Chinese model, very statist. We have a European model. In many ways, we have an Indian model, and no doubt there would be others as well. Deriving from that, related to that, if one looks at the role of big tech—now there have always been big companies driving the global economy, but the position, the salience of big tech in today’s world really represents a new level of prominence and influence of a few companies.

Trade Anxieties and Supply Chain Vulnerabilities

I come back to trade and what we have today. Starting end to end, I said production and therefore concerns about concentration there, then the worries about supply chains and the narrowness and fragility of supply chains, and then now the concern about overexposure or dependence on single markets. So really, end to end today, it looks much more anxious than it did a few years ago.

New Dimensions: Connectivity, Finance, and Resources

A different dimension is connectivity, where we have new routes which are being built—some man-made, some being opened up by nature—and which have really, particularly the Polar Route, the ability to revolutionize logistics as we know it currently.

When it comes to finance, what we have seen in the last few years is of course a completely different level of application of sanctions. We have even seen the seizure of sovereign assets. We have seen the advent of crypto. So as I said, by every metric, even in terms of resources today, the competition for rare earths and critical minerals has become a very major factor in competition between nations. What it has also seen in parallel is a return of technology controls which people thought was beyond them, behind them in the era of globalization.

When it comes to mobility, demographic demands are competing today with social reactions to mobility and there is a tension there which is playing out in different societies. And of course, the nature of weaponry, the nature of war has today fundamentally changed. We have seen that in multiple conflicts starting with Azerbaijan-Armenia, Ukraine-Russia, Israel-Iran. So contactless war often with standoff weapons, but which can have a very impactful, sometimes even a decisive outcome. These are today the characteristics of this landscape of these turbulent times. And of course, the sentiment which characterizes these turbulent times is a growth in the opposition to globalization in many parts of the world.

Now it is not just that all of this is happening. All of this is also happening in a very short time frame. So the intensity of this multiple happenings actually converging on the global economy at the same time, this is today actually setting into motion a paradoxical situation where on the one hand the very factors which are referred to encourage higher risk taking. At the same time, because of the consequence of this, there is a serious effort also to de-risk every facet of both politics and economics. So this playing out of, I mean, it is almost like you are raising the height of the trapeze and removing the safety net with each passing day. And that is really today the state of the international polity.

Strategic Consequences of Global Turbulence

Now the strategic consequences of this I think are quite obvious. We have seen a weakening, sometimes even discarding of international regimes and rules. We have seen economically that cost may not any longer be the definitive criteria, that ownership or security or reliability, resilience is equally important. We have seen politically that alliances and understandings are being revisited. We have also seen in a few cases, in the cases of really the major polities, that their belief in balance of power is probably much less. They seem to think they may not need the rest of the world as much as they did before. So if they have margins of power, they are prepared to exercise those margins in pursuit of their policies and actions.

We have therefore seen overall the global needle move much more towards competition and away from compacts. And that global needle is moving because there is today a tendency to weaponize almost everything. And that if a state has a tool in its toolkit, an instrument to be used, there is much less reticence, particularly on the part of the major powers to use that. So all in all, yes, times are turbulent to say the least. And we have therefore this challenge of how do we ensure prosperity.

Different Countries, Different Predicaments

Now every country faces this predicament, obviously so does India. But every country faces a different predicament. In the case of the United States, a country which in a sense underwrote the international system as we know it, has really been the harbinger of change. It is not only more assertive, but it has really allowed or encouraged its national interest goals pretty much to drive its approach towards partnerships and cooperation.

In the case of China, I think while they had clearly mastered the old system as we know it, this change perhaps catches them at a time when many of the new concepts, mechanisms, institutions which they were pushing are not yet in place. But clearly what we can see is that the US-China relationship in many ways is going to influence the direction of global politics.

In the case of Europe, what was a sweet spot in terms of US-Russia-China—US particularly security, Russia energy, China trade—has actually got turned around. And every one of those aspects today has become a challenge.

In the case of East Asia, I think for a geography like ASEAN, being caught between US and China is a very difficult predicament. For those further East, the question marks about both economic and security question marks today are big concerns.

In the case of Russia, you can see that the current goals and the future opportunities perhaps are not aligned on the same plane.

India’s Unique Challenge

But what is, I think, in a way what differentiates India is most of these regions, they are actually defending their interests. They are trying to maintain their positions. Whereas the challenge for India is how to go beyond that, that how do we rise in these turbulent times. Because for us, just defending what we have is simply not good enough.

This has caught us at a time in our own history, in our own sort of curve you can say, where we have to not only internalize and absorb these risks, but find a way of going beyond and continuing with our eyes and that in many ways actually brings us to the domestic policy choices and governance and I am sure many of the other sessions would have discussed it.

But I do from my vantage point want to make one observation, obviously as a minister I sit in the cabinet, in the cabinet we have different committees, we have a committee on security, we have a committee on economic affairs and we have of course the entirety of the cabinet. But whenever I see any proposal come up to the cabinet and I am using this as a shorthand really for decision making in this country, I look at it from the vantage point of what I presented to you, how does it help me to navigate and advance in these turbulent times.

Domestic Policy and Comprehensive National Power

So when I see a proposal to deepen manufacturing, when I look at a mission to actually promote advanced manufacturing, semiconductors for example or electric vehicles or drones or space, when I look at a project or a set of projects or policies which would take forward infrastructure or which focus on human resources and skills because again this is something which India particularly brings to the table at this point of time. When we look at ease of doing business or of ease of living for the common citizen, I want to say from my vantage point every bit of this actually adds to a comprehensive national power and helps me actually to deal with these turbulent times.

That for India in many ways the answer for a more difficult world is not just outside, a large part of that answer is inside. That if we can get our human resources better developed, if we can get our infrastructure moving faster, if we can get manufacturing to deepen more, if we can get new trade flows because I think given the volatility, the uncertainty that we have seen this year, it is very clear that there is a very strong case really to diversify further the trade account as well.

If we can address energy security, food security, health security, again partly through a mixture of national capabilities but by diversifying sources and spreading the risks. This is really today a strategy for India to pursue and the posture that India adopts and to my mind it is a common sense posture, is really to have as many productive relationships as possible but to make sure that none of them are exclusive and result in the denial of opportunities in other relationships.

Multi-Alignment Strategy

So how do we actually practice this multi-alignment or this multiple relationships with different agendas and with different partners sometimes in different regions. This is really the external challenge, the internal one of course is to improve every dimension of our comprehensive national power and in my view, we have laid a very solid foundation in the last decade. I think these five years given the international environment will test us like it would test every other country in the world but I think it is a test with which we approach it with a degree of confidence, with a degree of firmness and certainly with a degree of hope that this approach that I have laid before you will give us the results that we need.

So thank you again for your attention and I will go back and join my fellow panelists.

Unprecedented Changes in the Global Order

Mr. Trichet, Mr. McGregor, dear friends, it is a great pleasure to be back at the Kautilya Economic Conclave and let me offer some thoughts to kick off the discussion and I would begin really by saying that every generation believes that they are seeing unprecedented changes. In fact probably every conference believes that they are discussing unprecedented changes but this time it is for real.

So I do want to say that turbulent times may actually be an understatement. I hope prosperity is not. And I would begin really with the landscape when we speak about turbulent times. My point would be that by every metric of measuring the international economy or the Bretton Woods or the future of the WTO indeed or the future of the United Nations itself as a product of the Second World War.

NK SINGH: So do we take it that the regional multipolarity in whatever form congruous or incongruous also means a rank to the old world order which you inherited from the post Second World War. That is my first broad suggestion to you. The second is…

I thought that it was rather brilliant that you brought up the asymmetry in the way in which issues of energy security are being pursued. The United States, which was at the front line of us in seeking renewable fuels, is now gone back to fossil fuel. China, which was the culprit all along for excessive emission, has gone back to one, has indeed embraced renewable fuels in a manner which is unbelievable. How does it reconcile this?

If someone, people who have worked on this for a very long time, like say Nick Stern who is here, and along with some of his colleagues, would say that forget about all this, market economics would settle this, because if the market economics propels you in the direction that the cost of renewables is significantly lower than the cost of the fossil fuel, then the promotion and seeking of market economics would be an important driver.

My third and somewhat very selfish question is that it’s alright we see these uncertainties looming large, that’s understandable, we see no end game to this uncertainty. But in all this, as we seek to promote a 6.8%, consolidate a 6.8%, I do not agree with some naysayers who have been proved wrong in the past, but continue to propel that view, 6.8% is a recalibrated growth figure, which the RBI has adopted only day before yesterday. How do we get from 6.8 to about 8%, that certainly entails, apart from improvement in incremental capital output ratio, which means productivity, would entail a significantly higher foreign direct investment.

My immediate concern is, do you think and do you believe that the current Indo-US divide on multiple issues is going to significantly and adversely impact the prospect of securing direct foreign investment?

My last point addressed to you, Minister, that in the earlier period, you had taken multiple initiatives, some of which were laudable in seeking out, in diversifying the sort of interests which we had. Quad was one of them, which we promoted. How do you see the future of these alternative arrangements, which was an important factor in the earlier, somewhat earlier period? Do you think that they will taper out to a whimper, or do you still think that there’s life left in them?

Understanding Multi-Polarity in Global Order

MINISTER S. JAISHANKAR: I think each one is a subject for a lecture, but let me start with the multi-polarity. You know, multi-polarity is partly happening, but multi-polarity partly has to be built. That individual countries have to make efforts to actually build their strength. All of it will not happen by itself.

Now I say that because again, multi-polarity sounds a very neat quantitative description that if there were X number of powers now, there’d be 3X or 4X or whatever it is. It’s far more complicated than that, because what we are also seeing in many cases is a tendency for, in different regions, for the regionally influential set of countries or a single country to actually take a lead. So you are seeing the old order actually mutate in different ways. It is partly fragmenting, it is partly multiplying, it is partly decaying, you know, all of this is really happening at the same time.

So multi-polarity somehow suggests that, you know, we’re going to have a very neat movement into the next phase. I’m afraid it’s actually probably going to be a longish, messy, twilight zone with many things happening in many regions, often contradictory to each other.

Energy Economics and Market Realities

On the energy question, again, I mean today, of course, you could argue that, you know, at a time when you have price caps on energy, when you have sanctions on energy, when you have subsidies on renewable, I’m kind of scratching my head and wondering where is market economics in all of this. So I think when you have, again, a world where trade, the central, you know, consideration of trade has now become tariffs, please explain to me, you know, where comparative advantages and competitiveness go.

So I, you know, it’s not just the basics of politics that we are revisiting, in many ways it is also the basics of economics.

India-US Trade Issues

On the India-US issues, we have, yes, we have today issues with the United States, a big part of it is the fact that we have not arrived at a landing ground for our trade discussions. And the inability so far to reach there has led to a certain tariff being levied on India.

In addition, there is a second tariff, which we have said, we publicly said, we regard it as very unfair, which has picked on us for sourcing energy from Russia, when of course there are other countries who have done so, including countries who right now have a far more antagonistic relationship with Russia than we do. So I don’t want, I’m not minimizing the issues, but I don’t think we should take it to a point as though this is going to percolate to every dimension of the relationship and there is something very fundamental at stake there. I think we need to see this in proportion. There are problems, there are issues, nobody is in denial of it, those issues need to be negotiated and discussed and resolved, which is exactly what we are trying to do. But I would really hesitate to read very much more into it than the issues themselves.

I think I also want to say a large part of the relationship is actually continuing either as business as usual or in fact in some cases even doing more than it was doing before. And the final question on the Quad, this year we’ve had two meetings of Quad foreign ministers, one in January, in fact it was the first meeting after the Trump administration came to power, and one in July. The Quad has a bureaucratic structure at different levels, in different dimensions, people engage with each other, that continues. So Quad is alive and Quad is well, I want to make that point.

So again, when times are turbulent, when there are challenges, it’s important to read both the landscape in a responsible manner and to assess that particular problem in the context of that landscape. So I would caution against both extremes, either complacency or denial and saying the problems don’t exist and everything is okay, or to suggest that things are catastrophic when they are not.

UNIDENTIFIED SPEAKER: Thank you very much, Foreign Minister, because those are very candid comments to somewhat provocative questions from me, deliberately so, because there would like to be potential investors who would like to be assuaged that our reform trajectory, which we are currently engaged in, will take us in ways which this could be reinforced by external factors as well, including the fact that you mentioned that there may not be much of an impact, what I draw on the investor confidence. It will be a burst of adrenaline to potential investors, both domestic and foreign. On this issue which you mentioned, Minister, about market economics, I’m sure that this will come up in the question and answer session.

Thank you very much for those comments. I now request Jean-Claude Trichet, a very, very eminent central banker, perhaps not to ask your questions, Jean-Claude, only from the vantage point of your central banking, but in the wider canvas in which you have seen many of these economic and political factors at play.

Jean-Claude Trichet on Global Economic Changes

JEAN-CLAUDE TRICHET: Thank you very much indeed and thank you for having invited me in this marvellous colloquium. I was very impressed by what the Minister said and I have to say that I felt myself very much in line with most of his remarks particularly on the remark that every generation thinks that things are changing extremely rapidly during his own time but it is true that there is an acceleration and I can be I would say confirming that when I look at what happened over the last 25 years from my own standpoint, global economy, global finance, monetary policy since the beginning of the century until the great financial crisis we had a period which was considered wrongly so by a large bulk of, I would say, economists, observers and market participants as being a period of great moderation.

We had found the best way to deal with inflation, growth. We had steady growth without too much volatility with price stability and there was some kind of emerging consensus on that and then we had the big financial crisis the great financial crisis which was the worst since World War II so it was a terrible wake-up call particularly for the advanced economy the heart of the global financial system and economic system was totally, totally at the epicenter of what was happening when before the epicenter was generally in the developing world or in the emerging world but not in the advanced economy.

Then after that we had a long period where the main problem was the threat of deflation in the major economies, in the advanced economy but also by way of consequence in many economies of the world, many countries in the world which were more or less observing what was happening in the core, if I may, of money and finance with extraordinary accommodating monetary policy and again a new emerging consensus now we will have very low inflation ever.

The problem is not inflation; the problem is to concentrate on other issues. And then again exactly like we had the wake-up call of the global financial crisis, we had the wake-up call of the surge of inflation at the very moment. Practically we had a very large consensus on the fact that it had been eliminated to the extent that even those central bankers that were at the heart of everything at the time were thinking that it was only transitory, that inflation was not really a problem.

And it was the official statement of the major central banks, including the US central bank in year 21… until at the end of 21 there was a recognition that unfortunately it was much more than transitory, that it would be a medium term issue. And then we were in a totally totally different environment. So it gives a lot of credit to what you say minister that changes, it is a rollercoaster. We were in a rollercoaster and we are not entirely out of the last episode, because a very good job has been done it seems to me by all central bankers in the advanced as well as in the emerging world in the developing world. They are fighting, also I would say very courageously in difficult circumstances but we don’t know where we go now because even if in Europe one can say that really the control of inflation has been regained in the US.

It looks more difficult and particularly for political reasons also taking into account the fact that the independence of the central bank looks like being in, I would say, a very difficult situation vis-a-vis the executive branch. So we will see, it is history in the making but again very very rapid changes. And we have to adapt to extraordinary rapid changes. India being such a huge country, the most populous country in the world being a case in point to adapt. And if I may, I don’t know which time you are allocating to us if I have a minute more, I could perhaps.

NK SINGH: Jean-Claude one or two minutes more and then perhaps we are going to request Richard to make his comments. And there is a very great degree of interest in what the foreign minister has said hopefully we began 15 minutes late. And so perhaps we will be able to take some more questions.

JEAN-CLAUDE TRICHET: But if you give me one minute more two minutes already, that is extremely generous thank you very much indeed only to say that as regards the multipolar world issue we are in a multipolar world in my opinion since quite a long period of time. And it is precisely because we were in a multipolar world and this multipolar world is more and more at stake obviously we need more, even more than in the past solid multilateral institution and rule-based agreement to run the global economy. So I don’t draw the consequence from the multipolarity that is emerging strongly. I don’t draw the conclusion that we are in a totally different universe, and that we don’t need any more rule-based handling of the global economy and no more, any more multilateral institution.

It is for me exactly the contrary, even if it seems to be contradicted more or less by some in the global arena. The last point, which could be my provisional conclusion, I am very impressed by the ambition of India and by the fact that your own question, which seems surrealistic in my own perspective, how would you do to get 8% growth per year, which is possible, doable clearly, because you are already at a level which is quite close and perceived in a global perspective.

I would say strategy, global perspective, it’s true that India taking more and more influence and place in the world is very important in my opinion and part of the overall stabilization of the complex world in which we are. And I would be bold enough to say that Europe has also to develop, and not only of course in terms of economy and finance, but also perhaps in terms of going a little bit more rapidly in the direction of political federation, which seems to me more or less commanded by our own situation with Russia on the one hand and the US not being so keen on being a closer ally on the other hand. And I will stop there. Thank you.

MODERATOR: Thank you, Jean-Claude. Can I request now Richard to make some comments? Before Richard you do that, I think perhaps considering your last comment Jean-Claude, I think I’d like to inform the Foreign Minister that the day before yesterday, Foreign Minister, there was a special session which we had at the Kautilya Economic Conclave where Jean-Claude unveiled his ideas on what Europe can learn from the Indian Federation, and what he has said today is really the elaboration of what broad conclusion he had already reached a day before yesterday. So that was just by way of information from Mr. Richard.

Richard’s Perspective on Multi-Polarity

RICHARD: Thanks very much. I’ve often thought why stop at eight? China grew at 10% for many years. What’s wrong with that? But I applaud the ambition. Look, I will start where I was going to finish because the Minister and Mr. Trichet both spoke about multi-polarity. Now there’s many forms of that obviously, but as the Minister said, it sounds neat but it needs to be built, or you could end up as you said in a messy twilight zone.

Let me give you a few examples of multi-polarity at the moment. Europe is multi-polar. They’ve had a war for three years and it could get much worse. No centre of power, multi-polar. The Middle East is quintessentially multi-polar. You’ve got Israel, Iran, Saudi Arabia and so forth. They’ve also had a war for about three years or however long continuously. No real centre of power.

Asia-Pacific: The Exception to Multi-Polar Conflict

What about the Asia-Pacific, and I’m not speaking here about India. You know, we often read that the Asia-Pacific is the cockpit of global tensions, a fuse waiting to be lit. But the Asia-Pacific in fact hasn’t had a big long war for a long time. Thailand and Cambodia had a border skirmish recently. That was one of the wars Mr. Trump claimed to have stopped.

So why is Asia in fact the exception when we keep being told it’s so volatile? I think the reason is because Asia is bipolar. It’s the US and China which far outrank all the other powers in the region. And I think that’s a big reason why the Asia-Pacific has prospered, been peaceful. Of course it’s peaceful until it’s not. And I’ll come back to that.

But it’s worth mentioning here that, you know, this is here in India. India I think is a pole of its own, one that’s getting stronger. Most countries are never going to be superpowers. Most countries don’t have anything like one billion people in them. So they have to be much more agile in how they’re managing the new circumstances.

Building Internal Resilience and External Options

My personal motto that I apply to Australia I think also applies to many countries. We have to build internal resilience and external options. And that’s a real challenge. And that by the way is why India is so important these days for countries which are caught in the middle of the US-China contest.

In the US-China contest, I think you’ve probably been to many conferences where you’ve heard about the Thucydides trap, the so-called idea that a rising power inevitably is going to fight with the established power. I want to say, by the way, that word Thucydides, if you’re doing an after-dinner speech, don’t try and say that word after you’ve had a few drinks. But I think that framing is wrong for the moment we’re in. I think Thucydides said something else which was much more apposite.

And to paraphrase what he said, he said, “It’s dangerous to build an empire, it’s even more dangerous to give it away.” And that’s really where we’re at with the United States at the moment. Donald Trump has the odd sort of imperial spark so he can show the world how powerful he is by bombing this, that or the other country. But essentially he’s turning his back on the world that the US built and the imperial role that was embedded in that.

Now I don’t want to blame all the problems in the world on Trump. He was obviously right to be concerned about European defence spending and national security spending. Trump is not the only person, isn’t leaving the only country to have had concerns about Chinese trade practices. There is a joke about Trump that he’s the wrong answer to the right question. But it’s important to remember the question. Donald Trump was not created in a test tube. He’s responding to real world circumstances and that’s why he’s been so successful.

Benchmarking Trump’s Policies

So the key question I think with Trump is how we should benchmark his policies and what that means for China and other countries. If you’d asked me 10 years ago I would have said that the US was a predictable power, China unpredictable. These days it’s the opposite. I think China is a very predictable power. We know what they want. They want to be a globally dominant tech power. They want to do to the US what they think the US is trying to do to China, leverage with controlling technologies.

That flows into I think the second objective which is separate but related. China wants to be the dominant power in the Asia Pacific. So everybody has to take account of their interests in every decision that they make. Now to me there is nothing remotely surprising about that ambition. In fact it would be strange if it were otherwise given China’s history and size.

Trump’s Unpredictability and Tributary Diplomacy

The US I think Trump has become unpredictable by design. You can argue this unpredictability is tactical. In other words the direction of policy, at least in trade, is relatively clear. How he gets there not so much. In fact the funny thing is Trump’s diplomacy I think, what does it remind you of? It reminds me of the old Chinese imperial system of tributary diplomacy. In other words the emperor would demand that people come to court, give him gifts and once they’ve given him gifts and sort of confirmed their inferior status they would be patted on the head, allowed to go away and live in peace.

Trump is doing much the same. I don’t know how else you describe the sort of conga line of people going to the White House, knocking on the door and offering them deals. I mean it’s humiliating but it’s meant to be. The one country that ironically has not played that game is China itself because China has leveraged in this case critical minerals and it’s using them. Trump is playing a tariff game. China is playing a supply chain game and I think that is far more effective.

Trump’s Two Aims

Not too much longer. I think Trump has two aims. That’s to cut imports and on that I think he will probably fail or he’ll fail on reducing trade imbalances. His second is that he wants other countries to pay more for their defence or pay more to the US if they’re providing security and I think in that case he might succeed.

I was in Taiwan recently at the headquarters of a big tech company and the head of that tech company said something like this about Trump and the US and defence. He said it’s like somebody was guarding your factory for 40 years for free and now they want to be paid and we’re not quite sure how that occasion will play out.

China’s Growing Influence

I’ll cut to cut my remarks. Yes, so China has proved it has a lot of leverage at the negotiating table. Sure its economy is growing more slowly. It remains robust. Its military capabilities are expanding diplomatically. Its convening power I think is greater than ever. Also look at a place like ASEAN for example. Every single ASEAN foreign minister would meet Wang Yi, the Chinese foreign minister, at least three times a year. Once in their country, once in his country, once at an international forum. They’d be lucky to meet a Secretary of State once a year.

So are we looking at a situation in the region, Asia Pacific, not so much the Indo-Pacific, that the existing hegemon is being eclipsed and a new hegemon is about to take their place?

In other words, the king is dead, long live the king. And I would say not so fast. Why is that? First, the US is far too big and far too powerful on so many benchmarks to be dethroned or ignored. But I think more importantly, let’s look at China’s position in the region. China cannot and will not be the US on trade. In other words, the final destination for imported goods. China’s imports have been flatlining lately. It’s mainly raw materials and intermediate goods. Its exports have been booming. China will have a global trade surplus this year of about $1.2 billion. So that is the reverse of the United States. China will not be the final point of demand as you might expect a big economy to be.

Secondly, look at the geopolitics. The US is a resident power in Asia but it has no territorial disputes in Asia, obviously, because its land mass is a long way away. Look at China, and I’m not talking about continental China here and India. Look at maritime China. China has disputes of different kinds with South Korea, Japan, Vietnam, Malaysia, Indonesia, Brunei, the Philippines, and that’s without even mentioning Taiwan. Now, all of those disputes have their own history and dynamic. There are many other cross-claimants in the South China Sea. But even so, does that sound to you like the foundation for a sort of happy hegemonic arrangement? I don’t think so.

And then there’s the issue of trust. Certainly Donald Trump is doing a good job of destroying trust in the United States but I think the antagonism towards the US is more directed at Trump rather than at the US. If you took Trump out of the room, it’s possible things would change, as they did with Biden. You wouldn’t get a snapback on trade but you might get a snapback on regional security. China, by contrast, struggles to build trust. And as Joseph Liao said in a session yesterday, look at the South China Sea. China scores lots of tactical victories and it promotes them with vigour. We have a minute. I’m going to finish in less than that. Lots of tactical victories but lots of strategic losses as support for it in the region drains. So that’s why when you look at the US giving up its empire, you don’t hand over to another hegemon, you in fact create a vacuum. And that’s indeed why we’re in such a dangerous moment. Thank you.

Question and Answer Session

UNIDENTIFIED SPEAKER: Thank you very much. Those are absolutely fascinating remarks in many ways. With your indulgence, Minister, since there’s a wide variety of interest and since we began, we have roughly ten minutes for questions and answers. It’s time to take four questions, Nick, you are first to go, Nick.

AUDIENCE QUESTION: Thank you first and foremost for a really splendid panel, it gave us so much to think about. I wanted to pose my question to the Minister of External Affairs, but to pick up on a question essentially which NK began. We’ve talked a lot about growth and resilience and particularly of course growth and resilience in India. My question is that would you recognize a strategy that says we actually build our resilience through growth by investing in the technologies of the future, by investing in a way that builds on the strengths that India has and that you described so clearly. So in other words, this is a moment to increase investment in India, this is a moment to work very hard on making it rather more efficient and of course to invest in a way which embraces the technologies of the future. To use one sporting analogy, I think when it comes to energy, China is skating to where the puck is going and the United States is skating to where the puck used to be and India I think can look through that and this is where the economics comes in, invest where the costs are actually attractive over the medium term and which builds on India’s extraordinary strengths in its natural resources, particularly solar and of course its people. Thank you.

UNIDENTIFIED SPEAKER: The Minister will take all the four questions together, given the shortage of time. Next you want to ask a question, you’re up here Lando.

AUDIENCE QUESTION: Yes, it’s a question for the Minister as well. To which extent are geopolitics going to be driven by technological competition between the main powers? How would you assess the chances of China overcoming the US in major technologies and how do you assess the role of India in that competition?

UNIDENTIFIED SPEAKER: So I will pose a hypothetical. The case on tariffs in the United States is in the Supreme Court and we’ll probably hear it sometime during this month.

Suppose that the Supreme Court rules against President Trump and says, well, you really don’t have this power, how do you see that impacting both India and the rest of the world? Thank you.

DR. RAKESH MOHAN: Thank you. Thank you very much Honourable Minister for really a very thoughtful and thought provoking address. There was a mention of India diversifying its trade, given what’s happening with the US in particular I would suppose. How do you see the prospects of India diversifying its trade more towards Asia and given that the huge trade deficit we have with China, the only way in some sense to go for diversifying trade with China is for us to be exporting more to them? And do you see any prospects for that? And do you see any possible segue towards India possibly thinking of proceeding towards joining the CPTPP?

Building Advanced and Traditional Manufacturing

EAM JAISHANKAR: Alright, Minister. I’ll make my comments and perhaps my fellow panelists would like to add to it. One, yes, I mean this is with regard to the next question, yes absolutely. I think today our challenge is to build manufacturing because you know there were decades where in a sense I would call it lost decades but manufacturing certainly was concerned in this country. So we have to play catch up in many areas but not play catch up in a way in which we miss the contemporary opportunities.

So if you look today at the kind of policies which the priorities which the government is pushing. So you look at semiconductors, you look at electric vehicles, you look at renewables, you look at drones. I think we need to do both advanced manufacturing as well as you could say orthodox ones and try to get the optimal mix of it and you have to do that because at the end of the day it is technology which is going to make a big difference and certainly when one looks at the promise of potential of AI.

The Revolutionary Potential of AI

You know, for me this year probably I was at Munich the day J.D. Vance delivered his famous speech but I was a few days before with the Prime Minister at the AI summit in Paris where also J.D. Vance spoke about AI and the revolutionary possibilities it holds if you don’t restrict it. So we ourselves are holding an AI impact summit next year. So today if there was a single, if there is an X factor I would say, again I’m giving it to you from my perspective in terms of the capabilities of countries and their sharpening ability to compete, a lot of it would be technology and certainly would center around AI.

Geopolitics and Technology Through History

On the question of geopolitics and technology, yes I mean historically a lot of geopolitics has been driven by technology, in fact I tomorrow would be going back to my alma mater and my own PhD subject was how nuclear technology coming in the early 40s as the Second World War was going on actually ended up shaping the attitudes of the major powers to each other and in a way became the conceptual strategic foundation of what later on became the Cold War. So geopolitics has to a large extent been a function of technology competition for centuries and there’s no reason it should be any different now and to the where the US stands vis-a-vis China.

Again it’s very hard to give a sweeping answer but the fact is that in many areas clearly the US is going to get a run for its money which would not have been the case a few decades ago and these are I would say instructive for a country like India which is how do you build those deeper strengths, how do you create a workforce, the startup culture, the entrepreneurship, the institutions really to look at imbibing, absorbing and creating technology.

Dealing With Trade Realities

The hypothetical question you asked is very difficult to answer because it is hypothetical. I think I deal in a world of realities and my reality right now is a 25 and 25% and 50% and that is what right now we are negotiating. So whatever happens at the end of the day there has got to be a trade understanding with the United States. There has to be one because it is the world’s largest market but also because it is much of the world has reached those understandings but it has to be an understanding where our bottom lines, our red lines are respected.

You know in any agreement there are things you can negotiate and there are things you can’t and I think we are pretty clear about that and we have to find that landing ground and that’s been the conversation really which has been going on since March.

Diversifying Trade and Free Trade Agreements

Finally on diversifying trade moving towards Asia, you know most of our initial free trade agreements were actually almost all with Asia. They were with ASEAN, they were with Japan, Korea, they were individually with some ASEAN members and the challenge today which we face is that in many ways these are economies which are competitive and in many cases because of the supply chain nature they have also provided a pathway for China.

So I would very honestly say our focus should be on FTAs with economy that are not competitive, where there is really a deep, sustainable, predictable and real market economy at work, which is why we are very pleased with the UK FTA, which is why we are very serious about an EU FTA, and which is why we are striving for an understanding with the United States.

UNIDENTIFIED SPEAKER: Did you want to chip in to say one word, since the minister said that in case the panelists wish to respond to any of the questions.

Understanding China’s Innovation Model

UNIDENTIFIED SPEAKER: I’ll say one thing quickly. Yes. I think on Chinese technology, I think finally people have realized this old idea that since China is a state-led economy, it can’t be innovative, it can’t be creative, that’s completely wrong. We’re still coming to grips with understanding the Chinese system. When Japan was beating the world, whole libraries were devoted to new Japanese management techniques just in time, etc.

So I think we kind of need to do the same thing with the Chinese system, the Chinese factory, whatever, as well. China has speed and scale. Yes, they waste a lot of capital, but they’ve done much more than that in skilling their workforce on so many different levels technically. So I think, however you see it, whatever you think of China, their achievements are formidable.

UNIDENTIFIED SPEAKER: Okay. Jean-Claude?

India’s Confidence and Long-Term Prospects

JEAN-CLAUDE: Only to say that the human resource of India, and I understand the kind of lucidity you have on the medium and long term chances and challenges of India, is such that I have to say that it reminds me the kind of confidence I was myself experiencing years and years and years ago in South Korea where they had the feeling that nothing was impossible.

And in India today, and your own speech and the speeches of the members of the government give me the impression that you have attained a level of confidence in the long term, I would say, evolution of your own country, that is the promise of a catching up exercise of first magnitude equivalent to those we have observed in the past in Asia, and are very, very impressive.

So, and I re-say that the Indian growth and the Indian influence is part of a better world, in my opinion, in the future.

UNIDENTIFIED SPEAKER: May I just add one sentence?

UNIDENTIFIED SPEAKER: Please go ahead, Minister.

EAM S. JAISHANKAR: I would say that that very spirit also leads us, gives us the confidence that any trade agreement we would negotiate with anybody would be fair and balanced.

Closing Remarks

UNIDENTIFIED SPEAKER: Well, with those sanguine words, these are the closing remarks, to the closing session of the Fourth Kautilya Economic Conclave, we end with a degree of optimism, not only emanating from what the earlier interventionists have said, but with the Foreign Minister agreeing fully with what Jean-Claude has said, namely that the voice and confidence of India would be decisive as a contributor to global prosperity of which India would also be a beneficiary.

So thank you very much, Foreign Minister, for the honour you have done, and thank you for your continual support.

Related Posts

- Transcript: Trump-Mamdani Meeting And Q&A At Oval Office

- Transcript: I Know Why Epstein Refused to Expose Trump: Michael Wolff on Inside Trump’s Head

- Transcript: WHY Wage Their War For Them? Trump Strikes Venezuela Boats – Piers Morgan Uncensored

- Transcript: Israel First Meltdown and the Future of the America First Movement: Tucker Carlson

- Transcript: Trump’s Address at Arlington National Cemetery on Veterans Day