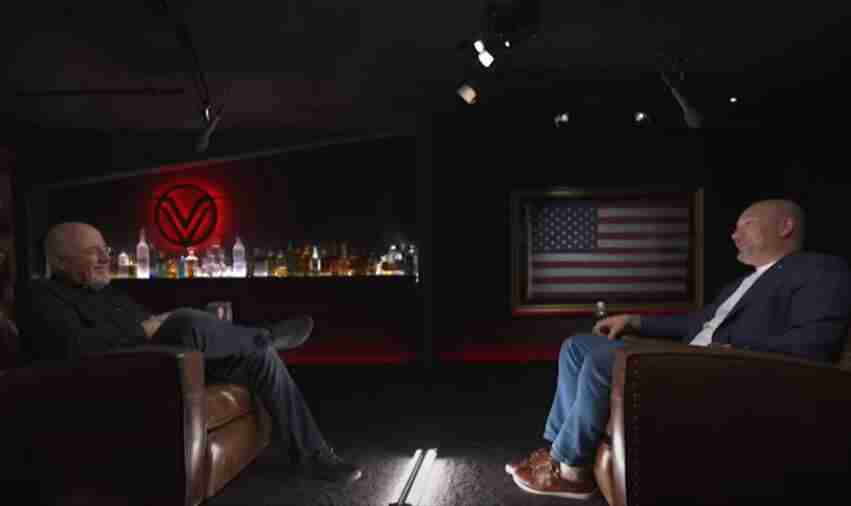

Here is the full transcript of personal finance expert Dave Ramsey on Shawn Ryan Show Podcast #191 episode titled “Dave Ramsey – CEO, Ramsey Solutions”, premiered on April 14, 2025.

The interview starts here:

Introduction

SHAWN RYAN: Dave Ramsey, welcome to the show.

DAVE RAMSEY: I’m so honored to be here. Thank you, my friend.

SHAWN RYAN: My pleasure. Well, I’m honored to have you and been trying to make this happen for quite some time. And it’s just awesome to have you here. We’ve got a lot to talk about.

DAVE RAMSEY: Kind of ridiculous. It was so much trouble because I’m just right there.

SHAWN RYAN: Literally right down the street.

DAVE RAMSEY: Stupid schedules, yours and mine, but here we are.

Personal Impact of Dave’s Financial Teachings

SHAWN RYAN: Here we are. But, you know, I just… I don’t even know where to put this in the interview. So I’m just… You’ve been a mentor of mine since before, way before we ever met. And I was doing a contract anti-piracy stuff off the coast of Yemen. And my dad had given me your book and wanted me to read it. I kind of skimmed through it and I was like, I get it, get out of debt, whatever. I don’t need to read this stuff. But I didn’t have anything to do on that ship other than possibly shoot some pirates. And so I dug in and I’m not a big reader. I just don’t enjoy it. And I read your book from front to back in about a day and a half. And I was just glued to it.

Totally changed my life. And I was making pretty good money back then, contracting, but I was spending it all on bullshit. I bought like a $30,000 chopper and all kinds of BMW, all kinds of stuff that I didn’t need. And I read that book on that little deployment. It was about three weeks long. Came back home, sold everything I had, paid all my debt off.

DAVE RAMSEY: No way.

SHAWN RYAN: Yep. And I’ve lived like that. Paid my house off, sold everything. All the stuff that I didn’t need, that I had loans on. And it had, you know, I guess, equity in some of it.

DAVE RAMSEY: And so what, the switch flip, you just realized it’s not giving you joy? The stress of the debt didn’t offset the fun of the…

SHAWN RYAN: Exactly. And then, I mean, I was hesitant, because I really liked my motorcycle and I really liked my BMW at the time. But the peace and the freedom that came from getting rid of my mortgage payment, credit card debt, and all the other stuff car payments, it just… That was probably 15, 16 years ago. And I’ve just lived like that ever since.

DAVE RAMSEY: Wow.

SHAWN RYAN: And even today, you know, I’m debt free. I build my business, never took on debt, only grew as much as what I could afford at the time. And I mean, now we’re building, you know, we went from the attic of my house to this. Now we’re building a 7,000 square foot studio out in the woods. And all of it, there is zero debt. And so I just want to say thank you.

DAVE RAMSEY: Thank you. That’s a great story. I didn’t know that part. Been friends for a while. I never heard that part.

SHAWN RYAN: Well, and then, you know, you continue to be a mentor of mine, and we had a discussion at your house, what, a couple months ago, and I was looking for a CEO and wanted to get your advice on that. And you told me, don’t get a CEO. You have to be the CEO. And I think you mentioned you’re probably looking more for a COO. And you just met Eric downstairs. This is the beginning of his third week. So I wound up hiring a COO.

DAVE RAMSEY: Okay.

SHAWN RYAN: So I just want you to know that everything you say, I take it in. And I know a lot of people do. And so this, what I’ve built here is somewhat of a product of your mentorship.

DAVE RAMSEY: Wow.

SHAWN RYAN: So.

DAVE RAMSEY: And I didn’t even know. Wow. That’s very cool.

Dave Ramsey’s Background and Achievements

SHAWN RYAN: Well, now, you know, that’s neat. Now, you know. But everybody starts with an introduction here. So here we go. Dave Ramsey, you’re a legend of the personal finance world who’s helped millions climb out of debt and take control of their money. You’re the host of the Ramsey Show, a nationally syndicated radio program that’s been teaching money management for over 30 years. You’re an eight-time best-selling author, including Total Money Makeover, the book that changed my life. Your newest book, “Build a Business You Love” is set to release on April 15th. Tax Day. Is that an accident?

DAVE RAMSEY: Who knows? Like it was a good day. I don’t know.

SHAWN RYAN: You’re the founder and CEO of Ramsey Solutions, a company that’s all about giving people hope through practical, no-nonsense financial advice. You’re introduced into the National Radio Hall of Fame in 2015. You’ve been a husband to Sharon for the last 43 years. You raised three children together. And most importantly, out of everything I mentioned, you are a Christian.

DAVE RAMSEY: Thank you.

SHAWN RYAN: And I’m sure I’m missing a ton there, but 43 years. Congratulations.

DAVE RAMSEY: Thank you.

The Secret to a Successful Marriage

SHAWN RYAN: So let’s kick it off. What’s the secret to a successful marriage?

DAVE RAMSEY: Wow. Well, the joke that I always use, which is accurate, I tell her if she leaves, I’m going with her. And then she just giggles. But the truth is, I met God about two years after we were married. And she probably wouldn’t—we still wouldn’t be married if I hadn’t because the guy that she married was a twerp. He was a hell-raising, beer-drinking hillbilly with a big temper and wasn’t much of a man, much less much of a husband.

But thank God she’s not still married to the same guy that his life has been transformed by Christ. And so every year a little better, every year a little less dumb, every year a little whatever. Nothing perfect, obviously. But we’ve both grown in our faith and in our relationship steadily over those years and went through hell, losing everything in our early days. And, you know, that was a defining moment in relationship and everything else.

But, yeah, I’m not the same dad I was when I started. I’m not the same husband I was when I started. I’m not the same man I was. I’m not the same leader I was when I started. Thank goodness. You know, good Lord. Who would want to just sit in the same poop all the time and not change anything, right? I mean, you got to change, you got to get better. And the thing that has impacted that is just trying to figure out how to do those things. And the instruction manual I used was the Bible. Because I didn’t know anything else. But I was pretty much a wild animal.

SHAWN RYAN: Really.

DAVE RAMSEY: Yeah.

SHAWN RYAN: I can’t see that with you.

DAVE RAMSEY: Well, it’s a long time ago, but.

Dave’s Spiritual Journey

SHAWN RYAN: So you didn’t grow up going to church? Christianity, none of that?

DAVE RAMSEY: None, no. It’s in my heritage. My great grandfather was a circuit riding preacher and this kind of stuff, got his old Bible from the 1800s. That’s pretty cool keepsake. But my parents were just, you know, they weren’t particularly angry about it or anything. We just didn’t go. And the people we ran around with weren’t church people necessarily, or Christians of any kind. If you asked them, they would have said they were, but I don’t remember… my grandmother, when I was like 9, they were in church, she paid me $10 to memorize the Lord’s Prayer. That’s the closest I’ve ever come to, you know. And if we went to her house, we went to church, but hated it, didn’t want to go.

I mean, little kids getting all dressed up and not being able to squirm and yell and whatever and miserable. But that was 10 times in my life. Maybe. But no, I didn’t know anything. I was just a character.

Growing Up in Tennessee

SHAWN RYAN: Where did you grow up?

DAVE RAMSEY: Just over the tracks over here in Antioch. Antioch, Tennessee.

SHAWN RYAN: Antioch, Tennessee?

DAVE RAMSEY: Yep.

SHAWN RYAN: What were you into? What was it like growing up?

DAVE RAMSEY: It was… Nowadays it’s a very international community, but in those days it was just suburbanites and just redneck kids. I mean we were just hillbillies and all. Most of our parents had grown up on the farm and had moved to town to take a job or something. And so they bought all these little, you know, some nice little suburban homes and it was a little suburbia, Leave it to Beaver and so.

But I mean this was a neighborhood where it’s blue collar, maybe some white collar, but I mean it’s a different world. A long time ago. But neighborhood where little boys got in fights and big boys got in fights and it wasn’t like we have anything today. I can’t think of one of my grandkids being in that situation today at all. But it wasn’t horrible, but it was just tough. Just tough neighborhood, you know.

SHAWN RYAN: What did your parents do?

DAVE RAMSEY: The real estate business.

SHAWN RYAN: The real estate business.

DAVE RAMSEY: Owned a residential real estate company there in the Harding Mall area. And so I got my real estate license three weeks after I turned 18. That’s what I was going to do. I was going to be a big real estate guy.

SHAWN RYAN: Were they successful realtors?

DAVE RAMSEY: Yeah, I mean they were in it for many, many years. They had finally closed it in one of the downturns and went on to other stuff. But I guess they were in it for probably 10 or 15 years. Most of my growing up years. That’s what they did.

And so that was the good news because they were very entrepreneurial and taught us, you know, took us to sales conferences. And so we were, you know, I’m sitting in conference, 12 years old, listening to Zig Ziglar, you know, talking about attitude. And I’m like, yeah, okay. But I learned to sell early. And that’s… I grew up in a salesman’s household. So there’s a lot of wonderful qualities come out of that. And also you get grit, you know, out of a situation like that. You learn how to deal with a bully. You learn how to deal with, not back down on everything that comes at you.

SHAWN RYAN: Yeah, I think that’s good lessons that seems like we’re starting to lose these days.

DAVE RAMSEY: Yeah, I mean, you can learn them without them necessarily being in that environment. But yeah, it’s something that moms and dads, we have to be really intentional with our kids to let them fail, let them get a bump, let them develop some grit, some character, some courage. You know, how do you handle a high intensity conflict situation, and not something like you’ve done. I don’t mean that, but I mean, just in business, if you just got somebody that’s going to bow up, what are you going to do? You’re just going to walk away every time? Sometimes walking away is a good idea, but sometimes metaphorically, busting them in the nose is a real good idea too.

SHAWN RYAN: Interesting how, I mean, so with you growing up like that and then you’ve built like this massive business, how did you teach your kids grit, courage, stick with it, stand up for what you believe in? Well, totally different environment.

Raising Children with Strong Values

DAVE RAMSEY: Yeah, it is. And, but you know, we just, again, we, in our house, we were doing it through the lens of scripture, through the lens of, okay, perseverance matters. Rejoice in your suffering because suffering produces perseverance and perseverance character and character, hope. And so perseverance means you’re engaged in something that is uncomfortable and there’s friction oriented. And so put them in some situations like that.

And so, I mean, not with anger or not anything like that, but it’s like, don’t helicopter them out of every little thing. Let them flop around in a little bit and, and then talk about, okay, what would Christ do? How do we handle this? What’s the tough aspect of this? What’s the compassionate aspect of this? And you know, what’d you learn? And what was God talking to you about while you were sitting there in this thing?

And you know, you’re dealing with this teacher that’s a jerk. You’re dealing with a situation, you know, a social situation or whatever as your teenager, all that kind of stuff. And so, you know, we just walked through all that as far as working around the business and stuff.

Anytime we’re doing anything, I’m a. One of the things we grew up with too was hard work ethic. I mean, you just work. When in doubt, just go to work. Shut up, just go. Leave the cave, kill something, drag it home. I mean, something needs to move. And so we taught them that.

And if you’re going to work around Ramsey and you’re a 12 year old working the book table or shipping department or whatever, you got to work twice as hard, three times as hard as everybody else. And you got to be three times as cheerful as everybody else and kind as everybody else and strong as everybody else, because otherwise you’re not going to be respected. They’re going to assume you’re a wussy little boss’s kid that’s worthless.

And so our kids, it was not. It was like they were coaches’ kids. We were tough on them around the business. And so, you know, my middle daughter Rachel was working the book table and Williamson and one of my guys, one of my leaders, looked over and saw her goofing off, looking on her phone and they’re like, you don’t do that here. And he corrected her, you know, and she’s like, she tells that story and that’s good. That’s exactly the environment we wanted to put them in. So, you know, those things are the building blocks of having a high quality life. So you got to put them in there. It’s a big deal.

Starting Young in Business

SHAWN RYAN: When did you… When you grew up with an entrepreneurial spirit, when was your first business?

DAVE RAMSEY: 12 years old. I told Daddy, I said, I want to go down to the Kwiksack and get an Icee. I need some money. He said, you don’t need money. You need a job. He said, your lawnmower’s in the basement. Go knock on the closest 50 doors.

And I said, oh, I don’t know. He goes, I get in the car. And he took me down Nolensville Road over here, little print shop. Printed up 500 business cards, said, “Dave’s Lawns.” I said, “Dad, that’s a little overkill. I just wanted an Icee.”

He came home and he said, “Go knock on the closest 50 doors and ask them if you can have the opportunity to provide their lawn care needs. Don’t look at your feet and say while you’re standing on the man’s front porch and say, ‘You don’t want me to cut your grass, do you?’ You go in there and you throw your shoulders back and you smile and you give them service and they’ll hire you.” And dad gum if it didn’t work. I had 27 yards to cut at 12 years old.

SHAWN RYAN: No kidding.

DAVE RAMSEY: Which, you know, I think it’s called child abuse now, but made me keep a profit and loss statement on my business. My income minus his lawnmowers I tore up equals net profit. But it was, it was, you know, and I loved it. I, I it because I always kind of been a little business nerd, I guess.

And so I’m cutting slugger Carnahan’s yard for $3, and my buddies are working at Burger King Whopper floppers. And, you know, they’re making this long. This is 70s, right? So they’re making buck and a quarter an hour. So I’m figuring, all right, I got to cut this grass in faster than two hours or I’m making only what they’re making.

SHAWN RYAN: You were thinking like that already.

DAVE RAMSEY: While I’m mowing, I’m like, going, looking at my watch, going, I got to get these dollar per hour. I got to keep this. I got to make this work. And that’s how I price the yards out so I can make more. I wanted to try to make about double what my buddies were making if they were flopping whoppers at minimum wage. If I’m going to sweat like that, I need to make some money.

SHAWN RYAN: Wow. So 12 years old, you’re going, that taught you confidence. That taught you responsibility of business.

DAVE RAMSEY: And you’re already thinking, interacting with adults, you know, and acting like you have your crap together.

SHAWN RYAN: How long did that last?

DAVE RAMSEY: I guess the rest of my life. Oh, the yards.

SHAWN RYAN: Yeah, the yard.

DAVE RAMSEY: Oh, man, I cut enough grass by the time I was 18. God said I never had to it again. I ain’t cutting grass in a long, long time. Oh, man. Yeah. No. When I took off to college, when I got up into high school, I started doing home repairs, too, because they would buy an old house and fix it up, and they’d put me in there to fix it up, or one of their buddies would buy a house in the real estate business and put me in there 16 years old to paint it and change the dishwasher out and that kind of stuff. So I did all that. So I paid cash for my first car doing that. And then that’s how I actually paid for the first couple semesters of college. Just working my butt off, swinging a hammer, turning a screwdriver no good.

SHAWN RYAN: And did your… Did your dad instigate that or…

Learning Practical Skills

DAVE RAMSEY: Oh, yeah, he could do it. He could fix it. That neighborhood we were in, everybody had a tool belt. Everybody could fix anything. And so you didn’t throw stuff away in those days. You had it repaired or you fixed it, you know, today, you know, our stuff’s throwaway. We don’t, you know, send a tea. There’s no television repair shops in today, you know, but in the old days, you know, you’d send it over there, they’d put a new tube in it or something, you know, or we would take it apart and look at it and see if we could figure it out. And so, yeah, those guys all turned a wrench on their own cars. So we all learned to turn a wrench on a car and that, you know, it’s all wonderful heritage to have.

It’s not necessary to be successful, but I’m not uncomfortable. I remember when I was taking my wife out on a date in college. I think it was about our third or fourth date. I think I had $1.16 in my checking account. I was so broke, I couldn’t pay attention. And I had a 1974 Monte Carlo that I was on the third engine and the second transmission and I had changed them. I’d run the wheels off that car and it had 200 something thousand miles on it. It was a piece of crap.

And I was explaining to her how someday I’m going to be a millionaire. And we went across the railroad track and the muffler fell off my car. But I had a crash, my toolbox in the trunk with a towel to lay on and a towel to pick the muffler up and a 9:16 wrench to run the U bolt up. And it had fallen off before. So I knew how to fix it and just rolled up under there, fixed it and dust my hands off. When we went on the date, she’s like, just fixed the car and got back in right after you tell me you’re going to be a millionaire. Okay? She thought I was full of crap because I was what?

Teaching Entrepreneurship to Children

SHAWN RYAN: You know, just like we were talking about before the interview. I mean, I got two little kids and I really want them to become entrepreneurs, you know, I just, I see the… I’m experiencing the freedom that you get. And, you know, with that being said, it takes a tremendous amount of self drive and as you said earlier, perseverance. But I think your kids are… your kids entrepreneurs. So what age do you, what age did you start instilling that into them?

DAVE RAMSEY: Well, I just… Sometimes people get from a job working for someone else the illusion, and it is a delusion or an illusion that somehow that’s safe. And if you’ve ever been on the other side of that table where you’re actually the guy making the payroll, you know, they’re not safe because, you know, you gotta run this whole thing right or, oh my God, we’re going to, you can’t pay them, but they’re under the illusion that this stuff’s automatic because they just get their check on Friday and everything’s okay.

And so what the first thing we did was break that illusion with the kids is that, you know, your success is not dependent on plugging into some safety mechanism somewhere. Your safety mechanism is your ability. Your safety mechanism is your skill set, your safety mechanism. And so even if you’re working for someone else, you’re self employed, you just have one client and you need to go, okay, if I’m an architect and I lost that job, I wasn’t leaning on that particular firm for my future, my life, the quality of my life, I was leaning on my skills as an architect.

And so if you’re going to do that, do it in such a way that you’re always marketable, but you view it as, I’m dependent on me, I’m self dependent. And then what? That does automatically lead you into wanting to run your own thing. You know, you don’t want to work for somebody else because you want to go, you know, I will take the risk of, I will accept the fact that there is risk. I’m not delusional about it and I’m going to just do it anyway.

And so entrepreneurs don’t necessarily have to start something from the ground up. My kids haven’t. They’ve come into Ramsey and, you know, are the next generation of leaders and owners of that organization. And all three of them are very capable, very different personality styles, very different approach to that, but they’re just not under the illusion that someone else is going to do it for them or that their success is dependent or entitled or it’s none of that, it’s sowing and reaping.

SHAWN RYAN: What age did that start and how did you instill that into them? How did you show them?

Teaching Kids About Money

DAVE RAMSEY: Well, you want to be age appropriate. I mean, you’ve got babies, so don’t send them to the salt mines. But you know, three or four years old, we start to go, okay, there’s consequences and cause and effect going on. Again, the Bible talks about sowing and reaping. You’re going to reap what you sow. And so, you know, as quickly as we could, we started teaching them three or four things about money, which were life lessons that we back into this conversation.

It’s like all kids need to age appropriately, need to learn to work, to give so that they’re not self centered, they’re other centered to save. So they’re future oriented, not just present oriented, which is emotional maturity, which not going to have much of that at 4. And to spend wisely. So work to make money, then save some, give some and spend some. And then you get opportunities to teach them and let them fail under your wing.

And so, you know, early, you know, it’s as simple as, okay, you’re four, your job is to pour the dog food into the dog bowl. This is your dog, it’s our family dog. But the dog eats because you put the food in there. And when you do that, you get a dollar. Or your job is to clean up toys in your room, which when you’re four usually means mom and dad clean up 80% of them. And we make a game out of it and we sing songs. But you’re the best room cleaner in the world. I’ve never seen anyone clean a room as good as you clean a room. You’re amazing. And here’s a dollar and then we get some of those dollars together and we go to the store sometime and we get something. And that’s as a result of you being the best room cleaner in the world.

And it all begins with something that primitive and that simple. So it’s positive reinforcement, but emotionally you’re starting to tie. Work equals money. Work equals money. Because I meet 50 year olds that don’t know work equals money. They haven’t figured that out. Nobody ever taught them. And they’re still waiting around for somebody else to fix their freaking life. And so I didn’t want that.

And you know, and by the time they’re 10 or 12, it starts to get pretty sophisticated. And then we said, okay, we’re going to do the money aspect. We said, we got, you know, your car when you turn 16 is your responsibility. But we’re going to help. We’re going to 401, Dave. We’re going to match. So whatever you save, I’ll match it. If you save nothing, get ready for a real nice Bicycle. So your little butt’s going to be walking because you’re going to pay for your car. But I’m going to put whatever you save now, I will tell you, you’re starting young. Make sure you put a limit on that. Because the third one figured it out. Yeah, he had 15 grand. And I’m looking at buying a $30,000 car for a 16 year old. Not a chance.

SHAWN RYAN: Damn.

DAVE RAMSEY: So we talked that down and we worked that out and he ended up giving some of that to a ministry. And there was an earthquake in Peru about that time and he’d been down there on a missions trip and some of the kids down there didn’t have anything. So he gave some of that money that, and we matched it, the whole thing anyway, but some of it was generous. And then he bought a real cool jeep, but it still wasn’t 30,000 freaking dollars. But I had to keep my word because I had set this thing up. So I’m warning the rest of you, make sure you put a limit on it. But we did that on all three of them.

And I’ll tell you to this day that they had great pride the way they drove the car, the way they took care of the car. Their friends didn’t leave crap in the car. You know, you take care of my car. I worked for this. And they did, they worked, they babysat, they cut grass, they worked at the company, they sold books, whatever. They at the company, they were working for us, whatever they had to do. But yeah, we just. So it built character and confidence and dignity and responsibility and all of those things got woven into this little money lesson of you’re going to save, you’re going to save, you’re going to save, you’re going to save, you’re going to save, you’re going to give, you’re going to give, you’re going to be other centered, not just self centered. This whole axis of the world doesn’t run through the top of your little head. It ain’t about you, baby. And so we’re going to be selfless, not selfish. And we just talked about that like I guess all the time. And they probably got sick of it, but they turned out.

Early Career in Real Estate

SHAWN RYAN: So it’s okay, man, that’s great advice. And so you started, you start. Back to you, you started, you were a real estate agent at age 18. How did that start?

DAVE RAMSEY: Well, I turned 18 and I passed my real estate test like two weeks later and I sold a house like three weeks later. Which who pass a house from an 18 year old? What Kind of. But I talked some guy into it, a guy from high school, $42,750 on East Ridge Drive off of Haywood Lane, right over here in Antioch. And that house today would be 800 grand probably, you know.

But I went off to college and I was to get a degree in real estate because I wanted to be. I wanted to do commercial real estate. Mom and dad did houses, residential. And I wanted to do big numbers and I thought I was cool or whatever. And so my goal was to be a big, you know, like a shopping mall guy or whatever, all that stuff. And so. But I went, moved my license down to East Tennessee and went to the University of Tennessee and I lived in Maryville, Maryville is how it’s spelled, but over there we call it Merville, Tennessee. And drove back and forth to UT and sold real estate there. And while to get through school I made enough to get through school and I graduated from there. And when I got home I had a couple jobs and then I ended up working for a home builder. And then I left that and started buying houses and doing flip this house. And that’s when I got wealthy.

SHAWN RYAN: How many years did it take you from, I mean, how many years did it take you from selling houses to buying your first house?

DAVE RAMSEY: Well, I mean, I sold houses all the way through college. And when I got out of college I went to work for a home builder selling houses. And I worked there like a year.

SHAWN RYAN: So how old?

DAVE RAMSEY: I bought my first house probably to flip when I was 22 or 23, something like that. And I flipped it. But there wasn’t cable TV to tell you how to flip this house. There wasn’t TikTok and Chip and Joanna hadn’t been born. I mean, it’s so, I mean, it was not. This was just me going out there digging up a foreclosure deal and talking some banker into loaning me the money. Because I borrowed money up to my eyeballs and I was doing flip this house. And so, yeah, we started from nothing. And by the time we were 26, we had about $4 million of real estate and a little over a million dollar net worth.

SHAWN RYAN: By 26, you had $4 million in.

DAVE RAMSEY: Real estate, made 250k that year, which, and that’s a million dollars now a year. But I had too much debt and the bank looked down and said, there’s a child that owes us a million dollars. And they were our notes and we spent two and a half years losing everything. And so by the time I’m 28, I’m bankrupt. Made 250k one year and the next year I made 6000. And the odd thing is when I was doing really good is when I met God. I met him on the way up, but got to know him on the way down.

Finding Faith

SHAWN RYAN: How’d you meet him?

DAVE RAMSEY: I went to a sales conference with my beer drinking buddy and we were so stupid. We would go to happy hour and then go make sales calls and couldn’t figure out why people wouldn’t buy from us. That’s how stupid we were. So, yeah, anyway, we go to a sales conference, me and him, and we’re sitting on the back row up on top, and we’re kids and this guy comes on stage and makes 400k a year and we’re like, I gotta. I want to be him.

So, okay, here’s the five things I want to learn from him before he came up, because we knew the guy was coming and we’re like, I actually used that. Our little questions. He didn’t have our questions, we hadn’t submitted them, but he somehow answered every one of those questions so he had credibility. Before he walked up there, he was a great speaker. And then by the time he read our mail, he owned us.

And he said, and there’s one more thing. And we’re like, no, there’s not. We got all. That’s it. That’s all we got. No, there’s one more thing. “If you don’t know this man named Jesus, you need to get introduced because it will change the way you do business. You change the way you do relationships. And business is all relationships. You’re going to be more successful when you understand how human relationships work. And you will not understand that except through Christ.”

And my wife had been ragging on me to go to church and I don’t go to church. She’s like, we’re going to church. I’m like, who are you? We got married and she remembered she was a Baptist and so she forgot that prior to marriage. Then she comes home and, oh, we’re going to. No, I’m not going to church. Sunday’s when we drink beer and watch football and she would cry and get mad and go out and find her little Baptist people and go to church.

So then I come home from the sales conference and I’m like, I think we ought to go to church. And she’s like, who are you? What you doing with my husband? And so we went into a couple of churches and they were boring as crud. I’m like, if God’s here, if he was here, he left. Because nobody here is excited about it. And if there’s a God, you got to be excited about it. I mean, come on. Hello.

And so we go in the back door of this little church over on Oaker Boulevard over here, Christchurch, and you know, you sit on the back row so you can eject in case they get weird, you know, or in case they get. I don’t want to talk to people. I’m just here, I’m checking this out, you know, you probably didn’t do that, but that’s how I did it. I want to be able to eject.

And couldn’t get away from that place because this old school pastor, he’d stand at the back door and shake everybody’s hand as they left. Only about 400 people in there. And his wife was a big squishy woman. And she’d give you a big Jesus hug, you know, like grandma hug. And oh, man, that woman hugged me into the kingdom.

And I’m standing there and he got up on there. I thought Christians were wusses. That’s what I figured. I figured they were a bunch of sissies, you know, and that’s how I grew up. And so this guy stood up and he was a man, and he’s like, “this is what the Bible says. And if you don’t agree with that, you’re what’s known as wrong.” And he would call out stuff in the political spectrum and say, “this is morally wrong, our nation.” You know, stuff. And I went, you know, that’s right. And he’s got like a backbone and stuff. Wow.

And, you know, they had this choir up there, and this is a long time ago. I mean, this is 80s, right? So everybody wore a suit to church and all this kind of stuff. In those days, you didn’t come in with coffee and shorts, hat, you know, but nowadays it’s what I wear to church. But. But then you certainly didn’t. But there’s woman in the choir, starts waving her hand, raising her hand. I’m like, Sharon, if they get snakes out, I’m out of here. This is crazy. You know, and it’s like, so, yeah. And, you know, somebody says something about the Holy Spirit. And I said, I don’t have any idea what that means.

And we just kept coming. And we didn’t know what was drawing us back, but we found out later it was the spirit of God. We could feel it, and it was just attractive. And Sharon was pregnant with our first kid and we were making money. But, you know, Jaguars and Rolexes weren’t satisfying. How long? It wasn’t enough.

# SHAWN RYAN: Yeah, sorry to interrupt. But I see it didn’t take me long to figure that out. I don’t think a lot of people ever figure that out. You see it all over social media – the greed and the flash. I think it actually detours a lot of people. They think it’s unreachable because a lot of it’s fake.

You know, they have businesses now where you can just rent a jet, not even fly in it, just take a picture in front of the private jet. Or rent a Lambo or whatever. They put all this on social media which makes people think success becomes unreachable.

When I finally started making money, I bought some dumb things – the BMW, the chopper, all that kind of stuff. I’m just curious, how long did it take you to figure out that possessions don’t fulfill you as a person?

# DAVE RAMSEY: You know, I don’t know that it was a singular moment. It was probably on a gradient, truthfully, because that was my deal. I’m going to go get some stuff. I was in acquisition mode from 18 to 26, 27. And it worked, by the way, except it didn’t stick because of the principles I used built a house of cards.

But the concept worked of “I’m going to go get some stuff.” And I went and got some stuff. But you start to realize pretty quick – it’s like, you know, if you eat enough lobster, it tastes like soap. I love lobster, but I never had lobster until I was 12 years old and Red Lobster came to town. I thought, “Man, I’m going to eat all that I can get. I love this!”

But I always just laugh and go, if you get enough of anything – enough cars, enough suits of clothes, enough houses – eventually you just go… it’s unfulfilling. And it doesn’t take a genius to grasp that.

Finding Meaning Beyond Material Possessions

Probably what happened was I started going to church because my wife was dying for me to do that. I’m sitting there and they’re talking about Christ and they’re talking about being – it’s not all about you. First will be last. And those that are happiest are those that serve, and the most fulfilling thing you can do in your life is serve and not gather up another Jaguar or Lambo or jet or chopper.

I’m in there for other reasons, but that’s gnawing in there also. So I think it was probably almost a byproduct of a spiritual shift and going, “Okay, I’m no longer lord of my life. He is. I’m going to change that. You’re in charge. What do you want to do? Because I obviously screwed this up. I went bankrupt, I lost everything.”

My wife thought she married Sir Galahad. Turns out it was goober. I mean, obviously I don’t have my crap together, so obviously I need a new instruction manual. I need someone else running my life other than just me, because I’m pretty self-sufficient, but I need some instruction.

When I went broke, I wasn’t just broke, I was broken. And so you hit that bottom. And then with that I go, okay, there’s nothing wrong with getting some stuff. Get some nice stuff. I just drove a really nice truck up here today. The house you’re building is really nice. The house I live in, you’ve been there, is nice. There’s nothing wrong with that.

But what’s wrong, where it becomes wrong, is if you are asking the stuff to do something it’s not capable of, which is give you peace. And only the nail-scarred hands can give you peace that passes understanding.

That’s what I got early, there in my 20s. And then I’ve been able to rebuild from losing everything over the last 35 years and become much wealthier than I was before. But I don’t have any emotional or spiritual attachment to it at all.

I got a super expensive sports car and I parked it in front of a burrito place. The other night I went to speak at this church thing and a kid comes in, he goes, “Hey, is that your car outside?” I said, “Yeah.” I thought he was just admiring the car. And he goes, “I just hit it.”

Kid, you have no idea what it’s going to cost. I go out there, it’s a little ding about like this on the thing, but that’s probably going to be $50,000 or something. And he’s like, “I don’t know. My insurance, I don’t… My parents are going to kill me.” He’s like 17 years old.

I’m like, “Here’s what I’ll do. I’m going to go over here and puke in the bushes and you’re just going to go home and we’re not going to worry about it.” He goes, “You’re letting me go?” And I’m like, “You can’t do anything about it anyway. It’s out of your control. You’re over your skis and I’m not real happy and I’m not mad at you.”

I got home and Sharon’s laughing at me and she’s like, “Yeah, your problem is you just don’t care. You like the car, but you don’t love the car. You’re not worshiping the car. It’s just a fun car.” It’s a ridiculously cool car, but I’m not attached to it. So I can just let the 17-year-old go home and not kill him.

We’re asking those things to do something for us that they’re not capable of. It’s almost like asking your wife or your husband to be your Jesus – they’re going to fail miserably. Your husband’s going to leave his underwear on the floor and you’re going to realize right quick he’s not Jesus. You can’t ask things to be God that aren’t capable. That’s the problem with idol worship. That’s the core of it.

# SHAWN RYAN: When you mentioned that your business mentor said you need to implement Christ in your life into your business, what did he mean by that?

# DAVE RAMSEY: I think he just was saying your character has changed and you become other-centered rather than self-centered. When you’re selling, if you’re a taker, the people buying can smell it on you. If when you’re selling, you’re serving, they can smell that on you too. So again, selfless or selfish, other-centered or self-centered.

We teach the sales team at Ramsey, you work at a five-star restaurant with the best wine list on the planet. Your job is to be the best server possible so that when the people leave doing business with Ramsey, they’ve had an experience like a dining experience where they were served.

If you’ve ever noticed, fine food is one of my favorite sports. In that kind of setting, the server makes all the difference because they’re not just slapping stuff on the table. You can have the finest food, the finest wine list in the world and still have a crummy experience because you weren’t served.

# SHAWN RYAN: Interesting. So how would a sales pitch have gone without that implemented? And then what did it look like next?

# DAVE RAMSEY: Well, it’s manipulative without. Because my goal is for me to win if I’m selling. All I care is that you buy. I don’t care whether you buy the right thing. I don’t care if you need it. I don’t care if you finance it and the finance contract ruins your life. I don’t care about you at all. I’m trying to get a unit out the door, and you are a unit of production for me. You’re not a human being that I’m trying to make your life better.

So it changes the language, changes the body language, and we all know it. Even people that aren’t in marketing or sales know it. When you go into an ice cream store, you can feel it. Are they there to help you, or are you just another dip?

You meet someone and they light up. It’s very contrived now, but it’s “Welcome to Moe’s!” I mean, like, “We’re glad you’re here. Come into my house.”

We were at a nice, wonderful restaurant down in Mexico a few weeks ago, and we walk in, the guy’s Italian, and it’s like you went to his home. He met us at the front door with a glass of champagne. “Come into my home.” And he had great joy in making sure that you had an amazing experience. I think the food was good, but I got lost in the moment that he created. It’s just fabulous. I love that kind of stuff.

# SHAWN RYAN: Very cool. So, yeah, it sounds like be personable, listen to what they want.

# DAVE RAMSEY: Help them. What would you do if it’s your little brother? What would you do if it’s your mama? Make sure they got taken care of. Treat every one of them like that. That’s a great message, blow their mind.

# SHAWN RYAN: What went wrong in your business that you went bankrupt?

The Bankruptcy Story

# DAVE RAMSEY: We had $1.2 million in 90-day notes because I was buying property, fixing it up. I had rehab crews running. So I’d buy a property, fix it up and flip it. At the end of 90 days, you’ve got to pay the whole thing or you can renew the note, pay the interest and renew it for another 90 days if the bank allows that. And they did, because I’d never lost money on a deal.

If I had a house that we didn’t get finished and it took six months instead of three months to get it fixed and sold, I paid the interest, renewed it and it’s not a problem. The problem was when they looked down and said, “Oh, we want it all right now.”

So basically I had 90-day notes coming due for $1.2 million. And it’s all tied up in real estate. You got to move it all right now. Well, there’s a word for real estate sold super fast: it’s cheap. I started giving stuff away to meet the note obligations, so the income stopped because the income was from the profit. And the profit all went away because I was selling it so cheap to get rid of it.

I really wasn’t in over my head. I had a million dollars in equity. I was sitting at 75% loan-to-value ratios. So that was all working. I hadn’t really lost money on deals. I lost money on a couple of them here or there, but I was making enough to cover that. I was pretty good at it.

But I had built it on this fragile, unsustainable platform where the bank had control of my life. I didn’t realize that they had their hands around my neck until they started squeezing.

When that guy walked in and said, “You’re going to pay all this right now because we’re not going to renew any of this. We fired the guy that did these deals with you.” I’m like, “Why?” “He shouldn’t have done them.” I’m like, “He didn’t do anything wrong. He was doing what you told him to do.” Anyway, big argument.

So we had that bank called their notes, and then the second largest bank had $800,000 with them. And they heard through the grapevine that Dave was in trouble, so they called their notes too.

We spent one year making $250,000. The next year I made $6,000 because all I did was sell the houses. All I did was just try to do the right thing and pay the bill and be honorable. But it didn’t matter. They were coming after me. Every time I would make a move or do anything trying to help them get their money, they would stick me again. So I was bleeding from every pore.

I was bound and determined I was going to make it. And I almost made it, but I didn’t. I ran out of emotional and spiritual fuel. I was a baby Christian. I was really struggling with the idea that a Christian doesn’t pay his bills. That’s awful. There’s nothing about bankruptcy in the Bible, so what allows this?

They’re coming to take the baby bed next week on one of these lawsuits. They’re going to take all the furniture out of our house. I got a brand new baby and a toddler. Marriage is hanging on by a thread.

# Dave Ramsey’s Bankruptcy Experience

SHAWN RYAN: And I’m like, oh, so you had kids when this happened?

DAVE RAMSEY: I had two kids. Rachel was born in April. We filed in September. So she was a little baby and Denise was a toddler. And Sharon would have left, but she didn’t have a car. I mean, it was awful. And I stood in the shower as hot as I could stand. I’d just stand there and cry. I was so scared. I couldn’t breathe. I didn’t know what to do. And, yeah, so. But I just ran. My tank ran dry. My emotional, spiritual courage, whatever you want to call it, is dry. I didn’t know what else to do.

And finally they’re coming to take the furniture. And I got all redneck. Like, I took everything else. They can’t have the baby bed. I couldn’t get another baby bed. So we filed on Thursday night, Thursday afternoon, to keep them from the truck backing up at the house on Friday morning. I took it that far. Two and a half years of hell.

SHAWN RYAN: That was two and a half years?

DAVE RAMSEY: Yeah. Water got cut off. And I’m not proud of this, but I went and hooked the water back up and then they cut it off again and then I went and hooked it back up again and then they took the water meter out because I kept turning it back on. Pirates. My own water. We had two little kids in the house. I didn’t know what else to do. I was so broke I couldn’t breathe. And it’s awful. And my fault, all of it was my fault. And there’s the shame and the condemnation and then you start to heal. And those scriptures. There is therefore now no condemnation.

SHAWN RYAN: So how was it? Was it a two and a half year long process of them taking everything?

DAVE RAMSEY: From the time they called our first notes, we thought it, we said, okay, and I gave them the middle finger, I’m taking you people out of my life. And I started selling everything. And I really was under the illusion I could sell enough of it fast enough to just pay them all off and be done and then figure out something else to do or whatever. But I couldn’t get it all moved. And then they started foreclosing and I had unsecured notes out too, and they started suing me on those.

I got sued like 78 times. We were on a first name basis with the old boy at the sheriff’s department that brings those pink lawsuit papers. Yeah, Sharon is like, “Come in, Harold, got cookies on.” But it was hell.

Payne is a thorough teacher. So it’s no wonder Dave Ramsey doesn’t borrow money. When they say the borrower is slave to the lender in Proverbs, I went, uh huh, yeah, got that one. Got that one. The rich rules over the poor and the borrower is slave to the lender. Got that one. I will never be another banker’s slave ever in my life except where I make deposits. And none of you people will ever have that power over my life again. I gave you that power once. I’m not stupid enough to do it again. You’re going to put me back in shackles.

Building Ramsey Solutions

SHAWN RYAN: Well, I think I know the answer to this, but I mean we’re having discussions about private equity and all this stuff. I mean, have you ever taken any of that?

DAVE RAMSEY: Nope.

SHAWN RYAN: Nothing?

DAVE RAMSEY: Nope.

SHAWN RYAN: Everything’s built grassroots and…

DAVE RAMSEY: Yeah, we’ve organically cash flowed. Everything is the business answer to the question. The reason was that again I didn’t simply go bankrupt and I didn’t simply meet God in the process. The whole thing melded together and it took me all the way to powder to ground zero and went okay.

So when I started talking about opening up a business again after that, when I healed, I mean I went back to doing some real estate deals just to eat and I was able to get some food on the table. But a couple years later I started learning this stuff. The Bible says, get out of debt and learning biblical finance, which is common sense. And I thought, okay, I think we can do this.

And Sharon and I started saying, okay, we’re going to handle our marriage by the book. We’re going to handle our kids by the book. We’re going to handle our finances by the book. And you know, the beautiful thing about going broke is you no longer care what everybody thinks. So I’m not taking a poll. I love you, I appreciate you, but you don’t really get a vote. We get one vote. Jesus gets a vote. He’s the only one who gets a vote.

And so this is how we submit yourselves one to another. This is how we’re going to be married. That means I got to dry dishes, and that means I got to serve my wife as a high quality husband. And so how do you lead? How do you hire and fire? How do you, anything I could figure out, I’m going to do it this way. Whatever this book tells me, this is what I’m going to do.

And these people in my life that are new friends in my life, to the extent that they’re doing one of those things well, according to this book, I’m going to listen to them. And so I had like one friend who had an incredible marriage. He wasn’t a great business guy, but I could learn how to be a husband from him. And I had another guy who’s a great business guy, wasn’t necessarily incredible at his marriage, but I could learn some Christian business principles from him. And so I took that and put it all together.

God’s Company

And so all that is to say that the first principle was, I don’t own the business. God owns it. I’m a manager. Old English phrase in the King James is steward. I’m a steward, which just means I’m a manager of other people’s property. So I don’t own Ramsey. God owns it.

And so when I started it, I’m like, okay, God, what do you want to name your business? And sat there with a yellow pad and nothing, couldn’t hear anything, didn’t know what to name it. And I kept on and I thought, what we’re going to do is we’re going to help people. We’re going to give hope. We’re going to help people that are hurting. Like, we’re hurting.

And, so I sat there with a yellow pad. I’m like, okay, God. Next morning, an hour, sitting there with a yellow pad, nothing on it. And I wrote down a couple things, and I’m like, that wasn’t God. That’s last night’s pizza. And, you know, figuring out the difference in the Holy Spirit and pepperoni, right?

And finally I wrote down “light.” And I honestly looked up and I went, you’re just really not good at marketing. Light consulting. I mean, light. Light. That’s awful. I’m having this argument with God, like, he’s worried about me.

And I was over at the church doing something, helping this little couple that had their car payment behind, and they had these concordances in the church, these books that you can look up what the Greek or Hebrew meaning is. And I thought, okay, we’re going to open this business. We’re going to help people, and we’re not going to rub their nose in our Christianity, but they’re going to at least know where we got the information. This is where we’re coming from, okay? So we’re going to talk about it, but not be thumping people with it, right? Because nobody wants to be Bible thumped.

And so anyway, I opened that book up. I thought, wouldn’t it be interesting if the word light only appears one time? Because there’s always multiple Hebrew words or multiple Greek words for the word light. And so I’ll go down through there. Sure enough, there’s a Hebrew word, but it applies, shows up like 10 times. Okay, that’s not helpful. And so then there’s a Greek word for light that shows up multiple times. And here’s another Greek word that only shows up one time in scripture. I thought, well, I wonder what that is. That’s interesting. It’s Matthew.

And I pull open the English Bible, I’m like, okay, the word is “lampo,” which obviously we got our word lamp from light, right? And so I flip open the Bible and it says, “Don’t hide your light under a bushel. Put on a lamp stand for all to see.” Which is what we were promising to do, that we were going to be a light to people. Okay? That’s you, God. And so the company that actually owns Ramsey is called Lampo.

SHAWN RYAN: No kidding.

DAVE RAMSEY: The Lampo Group, Inc. is the actual corporation DBA doing business as Ramsey Solutions, ran it that way, publicly facing for a long, long time. But we started doing some branding shifts. But so God named the company. It’s his company. He runs it. I don’t own it. And if he decides to bankrupt it or it’s not going to be generational, it’s his. He gets to do with it, what he wants to do with it. Just like that stupid car that the 17-year-old backed into.

Taking Care of People

And so now based on that, God, what do you want to do with your company? How do you want your employees treated? How do you want your team treated? How do you want people to be compensated? How are you going to treat the girl that gets cancer that works on the front desk? Oh, we paid her and she wasn’t at work for three years. For three years she’s back at work. One of my best friends. I love the girl.

SHAWN RYAN: She beat it.

DAVE RAMSEY: You know what? God would do it, but what would Jesus do? He would take care of her, her family wouldn’t, oh, you got cancer. We’re going to write you up for not being at work. And you get rolled up three times, you’re going to get fired. Right? I mean, I don’t think that’s how God would run a business. So we’ve done stuff like that.

And we had a kid get hit in the head with a ball at camp over in North Carolina and his daddy, I was in Scotland, but my leadership team did this and they called me to tell me they chartered a plane to send dad over there because the camp, the hospital called and told the dad, the kid’s got four hours to live. You can’t get to Asheville, North Carolina from here in four hours, but you can if you charter a jet. And you know, if that was me, and my kid is over there. What would I want somebody to do for me? Well, we sent him over on a jet. And the good news is, again, kid made it. The hospital was wrong, thank God.

But we don’t do any of that for any reason. But the interesting thing is when you love your people well, the rest of them are watching. And it becomes one of the best places to work in America because it’s one of the best places to work in America because God runs an incredible business.

SHAWN RYAN: You know, I run this very, very similar to that. I really got a great relationship with everybody that works there. I care about them. I consider this like a family to me.

DAVE RAMSEY: Yeah, I can feel it when you walk in.

SHAWN RYAN: And you know, I got a question for you though, and this is just something that I’ve struggled with, is sometimes I feel like my generosity…

Dealing with Betrayal and Generosity

DAVE RAMSEY: May be.

SHAWN RYAN: Somewhat of a weakness. And so what I mean by that is people see the generosity that I have and there have been a handful of people that come here and they take advantage of that. And so how do you, as a business owner, I mean, how can you tell the difference? How do you have the foresight into that? How do you deal with it when it happens?

DAVE RAMSEY: That and even worse, they… You find out later that somebody’s betraying or stealing or they leave, and then they say nasty things about you after you did something for them. I gave a guy a car one time, and then he’s on a Facebook group. I hate Dave Ramsey Facebook group. And I would like to tell you, I know the formula for that. I don’t. It still hurts my feelings, and I still get pissed off. It’s like I want to go find the guy and choke him, but, you know, but I’m not going to.

The thing I have struggled with the most on that – I’ve got good friends in my life that have walked with me for 30 years, and I got a group of guys that I hang with that don’t work at my company, and a lot of them have been friends for 20, 30 years through this whole spiritual journey. And so I’ll just vent with those guys. I’m like, you know, and they go, “Okay, look, you got 2000, 1500 people or so that used to work at Ramsey. You got 1100 that work there now. Four of them are twerps. Keep the ratio of how much rent you give in your brain to those four.”

Because it really should be about 1% of your thought pattern instead of 25% of your thought pattern. Because I don’t know about you, but I get mad, I get hurt, and then I just ruminate on it. I just run over and over, and I can do this, and I can do this and shut that Facebook group down. And I’ve called out some of these people a time or two, but I end up spending too much of my calories on the wrong things then.

And it’s hard for me, is the answer to your question. That’s a real human emotion. But it doesn’t invalidate the idea – you’re not going to get to the end of your life and go, “You know, I regret helping that lady who had cancer.” You’re not going to go, “I regret giving that, helping that guy with a jet. I regret, you know, whatever the story is,” where you did something that was generous or whatever, use some of God’s money that he let you manage to do something for somebody, one of his other children. That’s what it amounts to.

And, you know, God has some crazy kids, man. Some of them ain’t right. And so, you know, you just gotta go. And I wish I was better and stronger about just letting that roll off my back, but I’m not. I’m trying to tell you it’s probably not gonna quit hurting. When somebody does you wrong, is it transformed? But it doesn’t mean you don’t be generous.

SHAWN RYAN: Yeah, yeah.

DAVE RAMSEY: That’s the point.

SHAWN RYAN: But I… I can’t stop that. That’s just part of who I am.

DAVE RAMSEY: Yeah.

SHAWN RYAN: At the same aspect is that… I mean, has that transformed you into somebody who’s a little more guarded?

DAVE RAMSEY: Yeah, probably. And I’m probably a little wiser about the generosity because I don’t want to throw good money after bad. That’s not… Obviously, I don’t want to be a blessing to somebody who’s going to do something silly. That was not the intent. And so you’re probably just a little more… I was probably a little more disorganized or chaotic in the generosity. Now I’m probably more precise.

And I think about the unintended consequences of this, and kind of sometimes I think, well, if I do all this and then they decide they’re going to be nasty later on social media about Dave Ramsey or something, how am I going to feel? Am I still going to be glad I did it? And I’m like, yeah, because when we give someone a large severance package or something, you know, we’re overly generous there, or we take care of somebody and then later, you know, we’re really not doing that for what we get from it, so let it go.

I have to just have… You could tell I have this conversation with myself a lot. But, yeah, I’m probably more guarded. I’m not cynical. I don’t want to get cynical. But I do want to be more intelligent, more wise about what are the unintended consequences of this, and am I overdoing it out of some kind of sense of weakness or something? Or is this exactly what God would do right now? Because it’s his money? What do you want to do with your money, God? How would you treat this guy? This gal? You know what they’re going to do later? And I’m trying to figure that out. I’m still trying to figure it out. I don’t think I’ll get it figured out this side of heaven, but it’s a fun journey.

The Birth of Ramsey Solutions

SHAWN RYAN: So backtracking just a little bit. So was… I’m sorry, what was the original name of the business?

DAVE RAMSEY: Lampo.

SHAWN RYAN: Is that what was born out of the downturn, the consulting business?

DAVE RAMSEY: Yeah. Yeah. I first started helping people stop foreclosures because I was a foreclosure and I used to buy foreclosures. And so I know how to stop foreclosures, and house is three payments behind. I know how to work the deal with the bank, the deal with the mortgage company and get them caught back up and keep them from losing their stinking house.

And so people was… First thing I did is people would come and pay us a couple of hundred bucks and we would help them get caught up on their credit cards and their car payments and get them on a budget. And there wasn’t a class, there wasn’t anything. It was just me sitting in a room with a yellow pad and a calculator, and I would call the credit card companies and yell at them and work because they’re complete twerps.

SHAWN RYAN: How did you market that? I mean, coming from somebody that’s making $6,000 at $6,000 a year.

DAVE RAMSEY: Yeah.

SHAWN RYAN: Do a consulting business.

DAVE RAMSEY: Well, I… Number one, I, again, I went back to doing some real estate deals. That’s what we were eating on.

SHAWN RYAN: Okay.

DAVE RAMSEY: And I was doing the other stuff at church, just as a ministry. The pastor called and goes, “Hey, there’s a guy in my office getting foreclosed on. Can you help him?” I’m like, “Yeah, I’ll be over in 20 minutes.” And I sat down and that’s the first time I ever did it.

But once you do something good, you know, you help, you show that you have a talent in a church, they’ll have you do it all the time. So I was over there almost every night, pretty soon with somebody that was blowing up in their finances, and I’m showing them this is what we learned, this is what we did. We screwed it up. And that, you know, our story of failure kind of took some of the shame off of them so they could start to heal.

And then we could, okay, here’s what we’re going to do. We’re going to sell this car and we’re going to do this, and I’m going to get you out of this. But it’s going to be painful. But you can make the turn on this and you can get back on top of it.

And then a guy from a restaurant chain that went to our church called me and said, “Hey, one of our managers has got an IRS lien. Can you help him? The company’s going to pay you a $250 fee to go help him.” And it’s the first time I ever got paid to do that. And I was doing real estate deals to feed the family back after being broke.

And so I went over to that guy, that restaurant, and sat down with that guy, and we refinanced his house and paid off the IRS, which was really not rocket science. I don’t know why they didn’t know how to do that. But anyway, I helped him get out of that. And then the guy goes, “Hey, I want you to come over one of our managers meetings and teach this stuff that you’re teaching in that Sunday school class. This get out of debt, get on a budget stuff that you’re teaching that Sunday school class on.” “Okay?” He goes, “We’ll give you $250 to do that.” You don’t pay me to talk. “Oh, yeah, I’m in.”

And then he paid me $250 plus $500 in restaurant credit to go to another city to do one of their other managers meetings. And I’m like, oh, this is so fun. And Sharon and I, and I started doing a little bit more of it and just kept… Sat down, wrote a little book and nobody would buy it. And there was no Internet, you know, there was no platform to launch something on.

And then I went on a broke radio station that was in bankruptcy and agreed to work for free. And they allowed us to come down and do this horrible talk radio show. It’s like a Saturday Night Live skit. Two hillbillies, Darrel and his other brother, Darrell. WWTN. We’re talking Nashville. I mean, it was all awful. So bad. But the answers to the questions where people were in pain, the phone stayed lit up every day. And in a matter of months, we had one of the highest rated shows in the city.

SHAWN RYAN: Are you serious?

DAVE RAMSEY: And we were awful. But it was, it wasn’t anything to do with the broadcast quality, to do with the ability to speak or enunciate or properly form a vowel. You know, it had to do with, we love people and we were just helping them. We were doing it for free. We were just doing it for fun. We weren’t getting paid. It was just kind of a ministry, kind of a cool thing. And I’m going to do a real estate deal. I want to get off the air, feed my family.

And we told the guy around the station, you know, “If we’re really bad, you can cut our pay in half” because he wasn’t paying us anything. But it just, it took off and then Gaylord bought it out of bankruptcy. And it was a big FM station. It’s a huge FM station here today in Nashville. And we were there for 20 years. And that launched the whole thing.

Then we started getting paid because we could sell ads because of our ratings and we’re getting paid for the ads and we could, you know, but it’s all about just, again, helping people and just showing them these common sense things. And it turns out common sense, as Ben Franklin said, is not very common.

SHAWN RYAN: So it was the company that bought them out of bankruptcy that kind of… You turned it into a business.

DAVE RAMSEY: Well, that’s when we actually started making some money at it. And we didn’t even know we had ratings because they didn’t show up in the book because we were in bankruptcy. And so we didn’t… We were illegal because we didn’t say the call letters. You’re supposed to say the call letters once an hour on radio. It’s FCC guideline, you know.

And so we’re just talking. And there were no commercials because nobody wanted to buy on this station. You know, we thought three people were listening and two of them were in our family, you know, but the phone was ringing. We knew that. And we said, “We’re going to do a little seminar at the Ramada Inn.” And 600 people showed up. Holy, holy shit. And I’m like, oh my God, there’s people out there under this radio.

SHAWN RYAN: What time span are we talking here?

The Rise of Dave Ramsey’s Radio Empire

DAVE RAMSEY: Oh, you know, we were on the air for maybe a year. And then we just launched and we said, and then they buy the thing and the tower was broken. They fixed the tower and it’s 100,000 watt FM flamethrower. So it covered from Alabama to Kentucky, all of Middle Tennessee. And all of a sudden this thing’s like a blowtorch. And they started telling us, you got to say the call letters. As a matter of fact, we’re going to change the phone number, make the phone number the call letters.

So we just started. We went from never saying the call letters to every 30 seconds saying them, which drives ratings because people would know the call letters to write down the ratings books. And so the thing went, it was there. It was what we call phantom cum, meaning it was there, but nobody knew it was there. And then we activated it with proper handling of the stupid radio. And we didn’t know what we’re doing.

And they took us to three hours. And the guy running the thing, he goes, “I’m going to put two of your three hours against Rush Limbaugh. Rush is on the other station.” And I was like, “Are you trying to shoot us in the face? You can’t beat Rush Limbaugh. It’s freaking Elvis. He invented rock and roll. I mean, there’s no way.” Because Rush was the man. I mean, he was king of the hill.

And we beat him. You beat him in Nashville. And that was the beginning. Gave us a story to tell with ratings. We didn’t beat him anywhere else, hardly ever. And he became a friend later. But, oh, my gosh, we were like, oh, you know, the King. And so we couldn’t believe it. The ratings came in, went, this is wrong. It’s not wrong. We have a huge radio signal. It’s FM. He’s on AM. We’ve got this other great lineup around you. Gordon G. Gordon Liddy. Remember that guy? He was on in the mornings before us.

And so the thing blew up, and then we were smart enough somehow to say, “All right, we’re going to stay on your station. But you don’t own. We don’t want to be employees. Don’t pay us. You don’t own the show. We own the show, even though it’s worth nothing.” But because someday I want to syndicate this thing, someday I want to put it on other radio stations, and I’ll take no money right now, and I’ll make my money selling books and doing seminars and doing some consulting work.

I can make my money doing that. And radio lost money for 10 years on our P and L. We couldn’t sell enough ads to cover our costs for radio. Well, we started syndicating it, meaning we got other people, other. We went to Russellville, Kentucky, and that guy put us on. Oak Ridge, Tennessee, put us on. Jackson, Tennessee, put us on. Then Jackson, Mississippi, put us on. And then Spokane, Washington, and then Seattle. And we just. One at a time.

Wow. And there’s 640 stations now in the network today. Wow. It’s the second largest talk radio network in America. Sean Hannity’s number one. We’re number two. But it just. It was 30 years of scratching and clawing, fighting and pushing and pulling and putting up with radio business.

SHAWN RYAN: What did that develop into? Where did you go from radio?

Expanding to New Platforms

DAVE RAMSEY: Well, as we’re going on radio, you know, then the guy walks in my office, what, 10 or 15 years ago, the Internet and broadband is starting to have market penetration. And he goes, “We need a podcast.” And I said, “What’s a podcast?” And he goes, “Well, a couple people are doing them and they’re charging, like a subscription thing, and you can make money on it, and you put it behind the paywall.”

And I’m like, “I don’t think I want to do that.” And he goes, “Oh, man, we got to try it. He goes, where it’s going to go.” And I said, “I got this huge talk radio thing. Why would I want to do that?” And he goes, “Well, just take the same exact show and let’s just put it on the Internet.” I said, “All right, but we’re not going to charge for it. Put an hour on there and let’s see what it’s doing.”

And we ran it that way. And talk radio people were freaking out about podcasts. They were afraid it was going to put them out of business or Rush refused to do one. He didn’t want to be disloyal to the radio business. And other people would put out a podcast, but they put it behind a paywall, meaning you had to pay for it.

Now we just put it on there, help enough people, you don’t have to worry about money. So we just put it on there. Just put it out there, see what happens. And then XM Radio before that, you know, XM and Sirius were two companies, and we went up on both of those as soon as they came in, and then they combined and they couldn’t figure out what to do with us since we were on both of them. And they ended up giving us a whole channel for a while on the pair. I think we’ve got probably half a channel right now on there.

And so we just jumped on anything and everything because we weren’t in the radio business. We were in the helping people business. So we’re platform agnostic, and so you could jump to anything.

So then the podcast, I’ll never forget, I was with Brian Mayfield was one of our top. He was our top sales guy, and he had been promoted to run all of our broadcast stuff. And we were in New York and we got off the plane, we’re heading over to do a thing. And Aaron, he goes, “Hey, you know that podcast that kind of working?” And I’m like, “What do you mean?” He goes, “I think we made a million dollars on it last year in ad revenue.” And I said, “For an hour?” And he goes, “Yeah, you can’t run many ads on them. They’re not like radio radio’s full ads. You can put just a couple ads on there an hour and so we made a million dollars.”

He goes, “Yeah.” I said, “Well, why aren’t we making 3 million and put all three hours on there?” And he goes, “We’ll do that when we get home.” So we put all three hours on there and then YouTube started, started popping up and people started putting stuff on YouTube. So we put it on there. And then, you know, Spotify joins the scene and we jump on Spotify.

So anybody comes along, we jump on all of it. And some of it is better than others and some of it’s, you know, for a time one of them will shine and then it’ll dim. You know, there was a time we thought SiriusXM was going to own the world and obviously they don’t. And so we’re just trying to help people and wherever they are, that’s where we’re going to go. And that’s worked out really good for us.

SHAWN RYAN: I mean, rewind it a little bit. So you’re doing the radio show. But this developed into books and coaching and in person coaching and courses. When did all that start happening?

From Radio to Books and Beyond

DAVE RAMSEY: We started on the radio in June 25th of 1992. I kept doing real estate again because we were doing that for free. We did a couple of little seminars here and there and I wrote a little book and I started selling a couple of those. I mean we sold maybe 10,000 of them or something. I couldn’t get bookstores to take it. I couldn’t get anybody to take it. I’d sell it on the radio and then we had to. They had to mail me a check to a P.O. box and I had to cash the check and mail them the book. That’s how hard it was. Talk about friction. Oh my God. It was ridiculous.

And so that’s not. But everything was analog so that’s the only option you had. And you couldn’t get the bookstores to take it because I was a little self published author and the little book was ugly and it worked. It was a good book. And so that had that working.

And at the end of the year of 93, I told Sharon, I ran some numbers and I said I think we could do between seminars and launching a class, which I hadn’t launched at that point, and the sale of these books and some one on one coaching, I think I can make $65,000 next year and quit doing real estate and go all in on financial Peace. The book was called Financial Peace. The class was going to be called Financial Peace.

I think if we go all in that year, I made 130,000. And I said, “I think if we take a pay cut in half, I think this is what God’s telling us to do. We’re doing God’s stuff. We’re helping God’s people. God owns the company. He’s running this. I think it’s time to take this and do this.”

And she said, man, she was hurting. We were still bleeding out of every pore we were eating. Making 130 grand and 1993 is a lot of money. But we talked about it and. And fretted over it and prayed over it. And then one morning she woke up and she said, “I think God’s saying, you need to do this. I think you’re supposed to do this.” And I went game on and stopped doing all real estate and dove all in January 1st, and that year I made $61,000. I was pretty close on my estimate, and I don’t make that anymore. That was the worst year I ever had.

SHAWN RYAN: When did. I mean, the book that I read was Total Money Makeover.

DAVE RAMSEY: That was the second one.

SHAWN RYAN: That was the second one.

The Publishing Journey

DAVE RAMSEY: It was actually the third one, technically, Financial Peace. The book was the first one. It took off that year. And I. What I did was I kept. Every time I got a call on the radio that the book didn’t answer their question, I wrote it down. I kept a little log of it. And, okay, so I updated the little Financial Peace book and put in five more chapters that answered our most frequently asked questions. There was no such thing as FAQs in those days.

But I just, okay, the book needs to be the answer to every question. And so what I would do is anytime anybody would call, okay, here’s the answer to your question. Here’s exactly what you need to go do. And I’m going to mail you a book because it’s going to tell you exactly what I’m telling you right now, and I’ll give it to them on the air. But that gave me a mention on the book every day. And I sold 148,000 of them that year. When I once started doing that with a new cover on it, little green cover.

And an agent called me and said, “You need a publisher.” And I’m like, “No, no, I don’t. You don’t know the difference between margin and royalty, do you? Margin big, royalty little.” And she’s like, “I don’t need a publisher.” I said, “I need a publisher when it’s in the trunk of my car. And nobody would take the book now everybody takes the book and I’m cashing the checks.”

And she goes, “Well, I got a big company, a Viking penguin, who wants to come down and visit with you from New York.” And I’m like, “I’ll always sit down and talk to somebody. I’m not mean about it. But if they think they’re going to buy this book, they need to bring a really big truck full of money because. And I’m going to keep control of every bit of it. Because it’s not my book, it’s God’s. I’m supposed to manage it, not some New York publisher. I’m in charge of this.” And so I said, “I don’t think they got enough money to buy this book.” And turns out they did.

SHAWN RYAN: They did.

DAVE RAMSEY: And we did this very unusual contract where I control every aspect of the book. And they did a lot of stuff for me. I was not sophisticated enough to do at the time. I didn’t understand. And so I was still so primitive and green. But they got a world class publicist, and I’m on the Today show and People magazine, all these other major national hits to launch the book and relaunch the book in hardback now.

And we sold 293,000 of them that month. And it hit the New York Times. And all of a sudden the whole world changes. And that book has now done 3.2 million total since 19, including the ones I used to carry in the trunk of my car in 1992. So it’s a long time and it’s still in hardback and it still looks exactly the same because I control all that and I still get royalty checks from those fine people. They’re sweet as they can be.

And then we went on and that was a two book deal. The other book didn’t do that well. And then Total Money Makeover came from Thomas Nelson here in Nashville. Mike Hyatt was the CEO of that. And he comes over and he goes, “You need to do another money book. It’s been seven years.” And I’m like, “I don’t really have anything else to say. Everything I said is in that book. It’s what I say every day on the radio. Why would I do another? Tell somebody, like something new?”

And he goes, “Well, that book’s what to do. This is how to do it. You need to do a book on the baby steps and show people tactically, you know how to do this.” And that book’s done 14 million now. It’s crazy.

SHAWN RYAN: Wow.

DAVE RAMSEY: That’s the biggest thing we’ve ever done. It’s nuts.

SHAWN RYAN: That’s a damn good book. I hope everybody listening.

Expanding the Business Beyond Radio

DAVE RAMSEY: I didn’t want to do it because I thought it was insincere because I had this other. I’d already said a lot of the same stuff, but I didn’t talk about how to do it. And so “Total Money Makeover” legitimately was how to do it. And obviously that was needed.

SHAWN RYAN: What other aspects of the business, as you start developing, you started with the coaching, went to radio, went to podcasts, books.