Read the full transcript of Ray Dalio’s interview on AI, Job Loss & the Future of the Economy (EP #148) on Moonshots with Peter Diamandis, Feb 3rd, 2025.

TRANSCRIPT:

Introduction

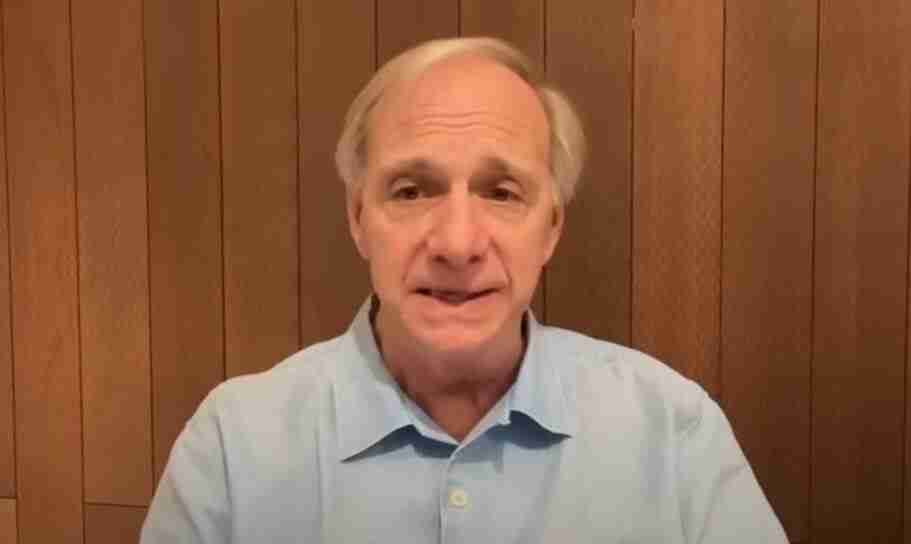

PETER DIAMANDIS: Everybody, welcome to Moonshots. Today my guest is none other than Ray Dalio, the founder of Bridgewater, the world’s largest hedge fund with $130 billion under management. I asked Ray about why he holds gold over Bitcoin, the impact of AI and robotics on the global economy and on the US Economy. His advice for entrepreneurs, building tech companies. Over the next one to two years, we’ll talk about China and we’ll talk about the world ahead. It’s a fascinating conversation with one of the smartest thinkers ever, particular on his new book How Countries Go Broke. And being in the United States, I want to know what’s the impact on me and you as an entrepreneur? Let’s dive in. Ray, good evening. You’re on the other side of the planet. I’m in Santa Monica. You’re in Abu Dhabi right now, is that correct?

RAY DALIO: Yeah.

PETER DIAMANDIS: Well, welcome to Moonshots, my friend. It’s a pleasure to see you. I normally run into you in Riyadh or in the Emirates, sometimes in New York. And I have to say I’ve been so looking forward to this conversation. I think the work that you have been doing recently and writing about how countries go broke, we’ll dive into that really on the back of the changing world order. As individuals, as entrepreneurs who are really focusing on AI and robotics and longevity or think about course of the future, a lot of us really want to have a stable world in which to build our dreams. And I think it’s important for folks to understand the cycles that humanity and countries go through to help them get a sense of where things are going. So no one better than you.

RAY DALIO: Well, I don’t know about that, but I’ll do my best.

The Five Major Forces Driving Nations

PETER DIAMANDIS: All right. Well, let’s jump in. And in particular, you’ve charted what you describe as sort of the five major forces that are driving the health and wealth of nations. Could you give us an overview of those?

RAY DALIO: Yeah, and I will also just touch on how I came by them. I’m a global macro investor and I’ve been for over 50 years a global macro investor and that’s taken me to all different countries and seeing how the systems work. And I’m also very much a systems mechanics person, cause effect, how does the machine work kind of person.

What I learned through my experiences is that sometimes when I was really surprised, I was surprised because the things that happened to me didn’t happen in my lifetime, but they happened in history. So there were three things about five or six years ago that didn’t happen in our lifetimes. And let me go back and find the cycles of rises and declines, of reserve currencies and countries and empires and the first three. And then I discovered really the other two or realized the other two.

The first was of course I knew about the debt, money economy, market cycle. Right. And we know that there’s a short term cycle. We know what that’s like. You have a recession, inflation is down, they put credit in, credit is buying power, they buy, things go up, financial markets go up, everything goes up. You get to limited capacity, inflation rises, they raise interest rates. Okay, we’ve been through 13 of those. We’re in the 13th of those cycles. But there’s also a big long term debt cycle that takes place over 80 years, give or take about 30. Debt rises relative to incomes. And then there’s a limitation to that.

The second cycle very much goes with that is the political or also the internal order disorder cycle. So when you go through that cycle, there are larger wealth and values gaps that increasingly create greater and greater conflicts. The left and the right, populism of the left, populism of the right, and a fight between the two.

PETER DIAMANDIS: And is that typically also an 80 year life cycle?

RAY DALIO: They coincide, they don’t necessarily have to be, but they are usually together. So for example, this cycle, the last cycle began, they have wars and that’s what ends the cycle. And so World War II was also accompanied by many breakdowns of domestic orders and new orders, new systems that came into power. Sometimes they were just total revolutions, sometimes they did not break. In the case of the United States and the UK, we didn’t have a new order, new domestic order, but there was a lot of internal fighting and you came out. But in most other countries cases, they happened at the same time. There was a total breakdown of the order and new orders came about.

Human Lifespan and Historical Cycles

PETER DIAMANDIS: I’m going to, at some point later, I want to get into the conversation, how tied is this to human lifespan?

RAY DALIO: There is, I believe, an important element that’s tied to the human lifespan because these things only happen once in a lifetime typically. So we don’t learn the lessons about war and those things. You know, it’s something like also the idea of three generations to rags-to-riches-to-rags kind of thing. But it is definitely the case, by all measures, that we say, why don’t we learn? Well, because we never experienced it before.

PETER DIAMANDIS: And so I remember my parents used to, you know, they were born during the Depression, effectively, or the tail end, and it changed the way they were wired.

RAY DALIO: That’s right, yeah. My dad and almost everybody at the Depression came out of that wanting to save.

PETER DIAMANDIS: Turn the lights off, son. Eat that food.

RAY DALIO: Right? Because the power of saving and the security. And he never could buy stocks.

So that’s the second. This internal order disorder, which, as you point out is all these parts of the cycle are related. So that mentality affected how we saved and spend and so on and so forth.

The International World Order

The third part of the cycle, what I call the big cycle, is the International World Order. Who was the dominant power? So in other words, you have a war, and then you come out of the war and you say, who sets the rules? Well, the winner sets the rules. And that is the New World Order. And so the United States set the rules. That’s why the dollar is a reserve currency, that’s why the World Bank, the IMF, United Nations, they’re all in the United States, right? Because that was the New World Order. And we created an order is a type of system in which there’s collaboration.

When then, when you have a rising power challenging an existing power, you know, there’s no world court that you plead your case to. And then they say, okay, you win. And we’re going to go by your rules or something. There’s no international constitution or something. Might is right. And so then you have who has the might and you have the war. So that’s the third major force tending to follow that same arc.

Climate and Acts of Nature

The fourth, which isn’t the same, doesn’t have the same 80 year kind of cycle to it, big cycle to it, but it’s a big force and it’s a bigger force than the first three because it’s killed more people and it’s toppled more world and domestic orders and that is climate and acts of nature. Acts of nature, droughts, floods and pandemics have killed more people and changed. Toppled more world orders. Okay. And certainly it’s a big deal now.

PETER DIAMANDIS: You know, when you speak about climate, most people go to the current climate crisis, but you’re really talking about the long cycles of climate causing drought, causing starvation, basically just ending nations.

Technology and Demographics

RAY DALIO: Yes, yeah. And then there’s number five, which is man’s inventiveness in all of its various ways, particularly technology. But that inventiveness. And so it looks something like this, which I mean what I mean is technology inventiveness, you don’t lose it, you rise.

PETER DIAMANDIS: And so it exists on itself. Right.

RAY DALIO: Upward force. And it’s a great upward force now. And then there are these cycles like the business cycle and the political cycle. Left, right, left. You know, we had the left and now we have the right and now we have the left and so on. And these economic cycles are those. And then there’s the big cycle, which is like debt to GDP and those kinds of things.

So that’s visually how it looks to me. And everything that we talk about, although there is one other force, but almost everything that we talk about is one of those five and you drop down. So whenever you’re asking me, anybody, we will go into one of those five and you could almost see where you are in the cycle. And they all relate to each other. Right. So tariffs, relates to economics, relates to geopolitics. Oh, the sixth force, which I didn’t mention, but it’s also very destined, is demographics.

PETER DIAMANDIS: Yeah. We have a silver tsunami, we have an aging populace and we have growing. I mean, it’s interesting, right, because these are the age demographics, I think. I’m thinking they play a much bigger role today than they ever have.

RAY DALIO: And will.

The Impact of AI and Robotics on the Economy

PETER DIAMANDIS: And will. Yeah. Everybody, Peter here, if you’re enjoying this episode, please help me get the message of abundance out to the world. We’re truly living during the most extraordinary time ever in human history. And I want to get this mindset out to everyone. Please subscribe and follow wherever you get your podcasts and turn on notifications so we can let you know when the next episode is being dropped. All right, back to our episode.

I want to get into something and then get into the five stages of the big debt cycle that you write about. And I want to dive into something instantly here which has been bothering me. I did not get a good night’s sleep thinking about this last night as we get ready, which is: are countries going to go broke faster because of AI and robotics?

So if I understand this correctly, the Federal Reserve’s mandate is basically to juggle jobs and inflation, provide maximum jobs, maximum employment, stable prices, moderate long term interest rates, and traditionally you lower interest rates, that boosts employment because companies can borrow cheaply, expand operation, hire more workers. And that’s been the game up until recently.

Now you’ve got Optimus humanoid robot and Figure. The prediction right now is we’ll have billions of them by the mid-2030s. Elon’s prediction when I interviewed him at FII in Riyadh, it was 10 billion by 2040. You had Sam Altman tweet out yesterday that their O3 mini model and their deep research tech will start displacing single digit employed white collar workers right away.

I interviewed Marc Benioff on this podcast two weeks ago and he said, listen, with Salesforce’s new agent technology, we’re 30% more productive and are hiring no new engineers. And so the question becomes, you know, as we’re marching forward here, if a company has access to lower interest rates, wouldn’t they just buy more robots and hire more AI agents and thereby, you know, reduce labor and sort of create this massive decoupling compared to what had been the process?

RAY DALIO: Yeah, it is, I think, virtually certain, but even that’s debatable. But it is virtually certain that it will replace a lot of people and that what we’ve been seeing in the form of wealth impact of technology in which there’s small population that has unicorns and it’s the most wonderful world that we can possibly imagine to be in.

Also we have a population in the United States where 60% of the population has below a sixth grade reading level and is pretty broke. And so that is likely to happen. There’s going to be great disruption. And then the question, and the question for all of these things is how are we going to deal with each other?

I mean the number one question on all five of these and demographics is how do you and I and we deal with each other so that we’re not just dealing with in a greedy way of our own self. Because you can have a great civil war or conflict due to not managing such social issues. And those social issues are difficult to manage because everybody has a polarity regarding those social issues.

PETER DIAMANDIS: I’m going to go a step deeper here because traditionally you would hire workers that would get money in their pockets, they would start consuming, that would fuel demand, they would pay down corporate and government debts. And the challenge again is again in coming from your recent work, how governments go broke. If workers aren’t seeing wage growth and aren’t getting jobs, then who’s driving consumption and then how does that drive our economy? I guess the question is is it going to accelerate your predictions on the challenges?

Technology as a Double-Edged Sword

RAY DALIO: Well, the technology advances are a two-edged sword. The way I think about it is that it’s going to raise productivity, it’s going to raise output per man hour. And that’s a good thing. The power of that good thing means you don’t have to work as much, or anyway you get more out of that result. And then it becomes what do you do with the distribution of that? So it becomes how are you like with each other to deal with these incredible disruption effects.

I think that we all think we’re optimizing for the things that those technologies get us. In other words, it’ll be wonderful. Our life expectancy rises, we become smarter, all of these wonderful things. Who could argue about their life expectancy rising and so on. And sometimes we lose sight that that may not even be the most important things in a world that’s in conflict.

I did a study of the well-being of 24 top countries using a lot of statistics. It’s online. Anybody could see it. It’s called “Great Powers Measures” and it’s very interesting. I measure different measures of power: income, military power, education power, different types of power. And then I measure happiness and health. And past a certain basic level, there is no correlation between income and happiness and health.

PETER DIAMANDIS: Yeah, I remember that number was around $70,000 or thereabouts for happiness.

RAY DALIO: It actually is considerably less than that number. I don’t know what it is but I know, like for example, Indonesia.

PETER DIAMANDIS: I was thinking the United States. Yeah.

RAY DALIO: Has a much happier population in terms of per capita income and in terms of health, it’s much lower, but they have a much happier population. It’s mostly above that which is needed to be out of pain, to have food. And the United States in terms of health has a five-year lesser life expectancy than Canada and comparable income countries, in other words, the developed countries. And if we think back in time, were your parents, were my parents, were they less happy or well off? And then think about wars and things. So it’s not just optimized by technology and getting more life. We have to pay attention to these other things too.

The Question of a New Social Contract

PETER DIAMANDIS: So part of the question becomes, is there going to be a new type of social contract that’s going to have to be created? I mean, I do believe, and I write about this and think about this a lot, that technology is a force that turns whatever was scarce into abundance. We’ve created massive energy abundance and food abundance to the point where obesity is the new issue. Abundance of information, abundance of all the entertainment you could possibly want.

There’s very little that, if you pushed me, I couldn’t paint a picture of increasing abundance, even life, the amount of things you can do per unit time, per second today. So the efficiency of how we spend our time. But even with that increasing abundance, if people are unhappy and it turns us towards civil strife, then we’ve got real issues.

Tailwinds vs. Headwinds

RAY DALIO: I think we can agree on the fact that technology and AI is going to be a force and it’s a tailwind. And then we also have to realize that the other four or five forces are big headwinds. And the question is, is the tailwind greater than the headwind in the appropriate time?

We’re going to come into budget season over the next several months. And if they don’t do something, we’re going to have a major debt problem. But it’s a headwind. The internal conflict is a headwind. The external geopolitical conflict is a headwind. The climate thing is a headwind. The demographic thing is a headwind.

When I think of the miracles that I’ve experienced, and you’ve experienced – I remember when I used to do charts that I would literally do with a ruler and colored pencils and graph paper.

PETER DIAMANDIS: Sure.

RAY DALIO: And I remember when the calculator came along and I remember when spreadsheets came along. When we think of digitalization and devices, they were pretty amazing over a 35-year period. They were revolutionary. And connectivity instantaneously. Wow. And then we live our lives. We’re born, we get older, we die, we live, right?

PETER DIAMANDIS: Yes.

RAY DALIO: And so then I think, okay, what force will this be, this AI revolution as a multiple of the force that we experienced from rulers and colored pencils and going to spreadsheets and being able to do models. That was one hell of a force. And when I look at the industrial revolution and I look at these things now, I think it’s going to be a bigger revolution.

But when we actually say, okay, what is its magnitude? I’m sort of like, I don’t know if it’s 1.25 or 1.5 what the other one was, because when you look back on it, it may not look big when you’re in it. And then we have the headwinds and we have a timing issue. Because that baby better come on and we better get there in time.

I think about what the 20s were like. The 20s was the most patents, the most innovation. And then we came to ’29 and the Great Depression. I think of the bubbles that have been in quite often, they were matched also with the greatest innovations. So we cannot just simply say that these innovations will necessarily quickly and in time create such a productivity miracle that the others don’t matter.

Demographics – there’s going to be a lot of people who go from working to needing and so on who aren’t going to be productive and are going to be needing. So I don’t know how that works exactly. I am impressed with it, but I don’t know exactly.

Every Generation’s Perspective

PETER DIAMANDIS: I had this conversation with Neil DeGrasse Tyson. He was saying every generation feels like they’re at the most extraordinary period of technological and societal growth ever.

RAY DALIO: Right.

PETER DIAMANDIS: It feels that way. I mean, the stuff that is coming, Ray, I think I have to believe it’s transformational. And the question is, is it unlike what it was in the past in terms of the level degree of transformation?

AI Decision Making

RAY DALIO: Let me give you what it was for me. I computerized all of my decision making. I have artificial intelligence decision making. Data comes in, criteria are specified, orders get placed, analysis is done. My decision making is efficient, all programmed literally in terms of markets. Data comes in, things get done – no people. It’s like one of those factories that has just a few people looking after it and everything happens.

That came to me from the old world way of thinking, which I think most people are still in, which is “I’m a smart guy and I will make my decisions.” We are still a long way from you turning it over to the AI for decision making.

PETER DIAMANDIS: There is debate, but what is a long way? Is a long way three years, five years?

RAY DALIO: I find it so interesting that so many people are users of AI but they do not follow AI. If I ask it, “Okay, tariffs came in and should I do this, this and this,” I get bullshit. If I ask, “What would you do?” I get bullshit because it still comes back to understanding cause-effect relationships.

PETER DIAMANDIS: And human relationships, human emotional relationships.

RAY DALIO: But even the relationship between understanding the mechanics of how the tariffs affect this, this, and the other thing. You’re a long way from actually that decision making, of having the criteria and the cause-effect. That’s even more so in the markets because the markets are a zero-sum game. I have to be better than the consensus to beat the markets.

All I’m saying is when we say we’re going to turn it over to AI – I do believe that the idea of it’s a partner and an associate, and boy, it could teach you and do wonderful things. But you need this as a partner.

So AI – we agree, a super plus for productivity. We agree a super probably divider in who benefits and who doesn’t and that it becomes a social question as to how we deal with that. Don’t also assume that it is in an environment of law because laws are local, laws are within countries, laws do not exist between countries. And so there are competitions between countries to win at all costs. So I don’t think it’s going to be regulated or controlled. And we also have to look at it as a weapon because it can be a very important weapon too.

The Concept of Abundance

PETER DIAMANDIS: And we’ll get to that conversation about US and China, which I think is the dominant conversation in that realm right now. Before we get there, I want to talk about this concept of abundance. I wrote a book 13 years ago now called “Abundance: The Future is Better Than You Think” and the argument for increasing global…

RAY DALIO: I know the book. That’s a good book.

PETER DIAMANDIS: Thank you. The follow-on “Age of Abundance” is going to come out in ’26. But looking at access to food, water, energy, healthcare, education, almost every particular factor and the demonetization and democratization has been just off the charts and accelerating. We’re on the verge of fusion potentially. The Chinese just held a fusion reaction for 18 minutes. You’ve got Helion and many others looking at fusion by turn of the decade here, solar exploding onto the scene. And energy of course drives everything else.

So I guess the question is, when you think about abundance as a concept for America and Americans and for the world, I’d like to know how you think about that. Is it a world of increasing abundance? Are there factors that are going to basically shut that down?

Factors That Could Disrupt Abundance

RAY DALIO: The factors that could shut it down are the factors that shut it down before and they are in the conflict. If you look at how it was shut down before the Industrial Revolution or the Great revolution of the 1920s when there were more patents than any time, all of those times it was a combination of an economic and a war and conflict.

PETER DIAMANDIS: But you showed that technology is a continuous force.

RAY DALIO: That’s right.

PETER DIAMANDIS: Building on itself despite the up and down cycles.

RAY DALIO: Yes, but the chart that we see looks like that. And life expectancy, if you look at life expectancy, it looks like that. If you look at GDP, it looks like that. If you’re listening to that upward arcing, what you don’t see, ironically, when you look at all of these things and you see the wiggles – okay, that’s World War II. And so you hardly pay any attention to it. But it mattered.

These wars last maybe three years typically. And you don’t stop that unless you destroy mankind. And you won’t stop that. So when I say stop it, I’m assuming, like what happened in the 30s, a temporary slowdown.

PETER DIAMANDIS: Yeah, yeah.

RAY DALIO: Because you don’t forget, you still have it. You don’t go backwards. And then you build on that, but that upward movement is slow. If you had a bust now, you could imagine how that would change allocations of money, how that would change innovations and so on. To some extent, I think that we’re in a position that might be somewhat analogous to 1998 or 1999.

PETER DIAMANDIS: Dot com bust, right?

The Debt Cycle and Investment Wisdom

RAY DALIO: Well, yeah. What happens is assets become more and more expensive, and then there’s a universal view that that is a great miraculous company and that’s a great miraculous thing. And they’re right. It’s a great miraculous company and a great miraculous thing. But the question is, how much does it cost and is it expensive? And so what happens is, actually, as an investor, you’d be much better off to buy bad companies at good prices than good companies at bad prices.

PETER DIAMANDIS: Yeah. When my mom starts telling me, should I buy this stock? Or my Uber driver starts telling me about that, you know, you’re in trouble.

RAY DALIO: And so if you look at pricing and who is the owners and so on, I’m not saying we’re there. It looks more like maybe ’98. But you also have a situation if you have that together with an interest rate change, and we’ll get into the interest rate discussion in a minute, I suppose you then have expensive, and you have interest rates, and then you can have what we had in 2000, you know, and pets.com and there’s a sword. And things change. And also we get so used to the idea that the disruptors don’t get disrupted. Like, that’s funny, isn’t it? I mean, everybody. They all get disrupted.

PETER DIAMANDIS: Of course, it was interesting when Jeff Bezos at one of his earnings calls said, yeah, Amazon might not exist in 30 years. I mean, it shocked people for him to say that.

RAY DALIO: But that’s… I mean, like, how… Wake up! Like the Dow 30, you know, go back 30 years, go back 20 years, you know, they didn’t exist. They don’t exist any longer. And the ones that are on top do exist. And that’s the nature of this evolutionary process.

Economic Cycles and Entrepreneurial Advice

PETER DIAMANDIS: I’m still impressed that Microsoft is doing as well as it’s done for the last 50 years or 40 years. Yeah. Let’s get into the big debt cycle and the five stages you break it down into. And again, the lens I’m coming at this from is we have a lot of entrepreneurs who are building companies and, when time is good… We just entered a new administration where we’ve got a pro-technology, pro-M&A mindset, minimized regulation. And I can vibrantly feel the energy in the biotech world, in the AI world, people are building, building, building. Capital is beginning to flow again and people are not looking at what’s likely to be coming in the next two to five years. They’re just like, the time is good now. Borrow, build, go, go, go.

So what’s your advice to entrepreneurs right now? And let’s do that in the context of the five stages we’re in. And I’d like to understand where you think we are in the United States. What’s the impact of that? Elon’s having. And Doge, you know, can we hold off these debt cycles? Is there any chance for that or is it just too far gone? It’s a lot of questions, but let’s take it.

RAY DALIO: No, no. And I’ll give you my thoughts on them. I want to emphasize before I do that, that study. This is the draft of my book and it’s free online so that people can read about the cause-effect relationships. Because I’m 75 years old, I’m at a stage in my life that I want to pass along things that are valuable. I’m not earning money and that’s not my goal anymore, any of that. And I want to… Everything is cause-effect relationships. There’s mechanics to it. And if I give you less than I’m able, I’m not in this conversation going to be giving you enough. And so it’s free online. Go get it and you’ll see.

PETER DIAMANDIS: I know it’s on LinkedIn. Is it just Google?

RAY DALIO: Yeah, you can go.

PETER DIAMANDIS: Just Google how countries go broke. The principle navigating.

RAY DALIO: Yeah, yeah, yeah. What is so amazing to me, because I’ve experienced it throughout my life, is everyone pays attention to how they feel at the moment and how they feel at the moment. And they don’t see the changes. And the changes, the cycles and everything are so important. And there are certain classic things of euphoria.

So there are two classic things of euphoria. First, where we are in the economic cycle, there’s an economic cycle. There’s always been an economic cycle and there always will be an economic cycle. So we are about 65, 70% through the economic cycle that we’re in, judging by measures. I won’t digress into all of them though I can if you want. But in other words, the cycle will go on.

And in the political cycle, we are in the classic first hundred day honeymoon of the new administration, which is a time of euphoria and is a time that the new beginning begins. Okay, so we’re at an unusually good moment that if you see it in the cycle in a cyclical sense and you say what is likely, okay, our aspirations are high because we have capitalism, business free markets combined with technology to produce that and the United States is on top of the world and we should be very optimistic and so on.

But first of all, you’re not looking at the pricing, okay? So if you look at the pricing of assets in the United States relative to other countries right now, it’s expected that that will improve relative to the United States. So there’s a hurdle rate you always have to keep in mind, like it’s a horse race, you have to bet on that. You have to keep in mind the handicap.

So, and then if you take the cycle, I bet you as we take 1, 2, 3, 4, 5 years, do you think you’re not going to have an economic downturn? Do you think you’re not going to have a bear market? Do you think that everybody’s going to be as enthusiastic about how things are going with how the government is handling it? Do you think you’re not going to have any of those other problems really?

Balancing Optimism with Realism

PETER DIAMANDIS: And it’s the, I mean the challenge of an entrepreneur is you’ve got to be especially a moonshot entrepreneur. You’ve got to be super optimistic even to get into the game. But people don’t see the long term writing on the wall. So how do you properly capitalize yourself? How do you protect against the downside? How do you not over burden yourself with debt or too rapid growth? I mean, this is what I, this is the message I want folks to be listening to. Listen, I’m the guy who, not the glass isn’t half full, the glass is overflowing. I’m Mr. Optimism, Mr. Abundance. But I, as I said, reading your book, it’s got me thinking a lot. So I want to pass this on.

RAY DALIO: I think first of all, one of the great things about the United States and our system is that you can fail and you could start again.

PETER DIAMANDIS: Yes, it differentiates us from most of the world.

RAY DALIO: That’s right. Then you think, okay, whose money is it failing? And how does that work? And am I straight and upright and honorable with people? But, you know, okay, in this world of, you know, you got to go for it. You want to go for it, and then you be straight, upright, and you go for it, and you could fail. Just don’t get permanently knocked out of the game.

PETER DIAMANDIS: There’s a great talk that Bill Gross, not the economic Bill Gross. Bill Gross. My daily gives about what’s the single most important aspect for a successful company. And it’s timing. It’s living long enough to live forever. If you can live through the downturn and be there at the upturn, then…

RAY DALIO: In my case, I never raised a dollar of debt or a dollar of equity. I built the largest hedge fund in the world and did very well, but I never… And now I’m not saying that’s the right thing, but the “don’t die” mantra was my mantra. And I always… And I did certain things like I would always say, is my profitability X relative to that? How much do I have in this way? And so on. So I constructed the finances in which it couldn’t die. It could contract, but it couldn’t die.

So now I’m not sure that that’s even the smartest way. I’m saying that’s how I did it, but I’m not saying it’s the smartest because it’s also… Sometimes it’s okay if you die and people will understand it because of what you’re like. So invest in your character, okay? Your reputation, you can damage, you can kill your reputation. But if the company dies and you do it the right way and your options right, then that’s almost allowed in our system. But be of good character and be of good capability.

Understanding the Big Debt Cycle

PETER DIAMANDIS: Let’s get into the big debt cycle and the five stages and give us understanding of where we are in that process, if you would.

RAY DALIO: Okay, so there are these cycles that you know, the short term debt cycle or the business cycle that’s six years typically described. We know what those look like and then they rise. Debt keeps rising relative to income. Okay. And the income is needed to service the debt. Okay. So the way I view it is after the war, debts are basically written off. You’ve got, you know, you start with…

PETER DIAMANDIS: Clean sheet of paper.

RAY DALIO: My parents didn’t have, they didn’t have any debt, they didn’t have much. And then they begin the cycle, and it’s almost what we talked about earlier. They don’t want to spend money, you know, they don’t want to get… And in the early stage of the cycle, it’s the sound money stage. And the sound money stage can be measured by… First, does the debt create more income than it’s needed to pay it back? I mean, that’s basic.

PETER DIAMANDIS: It’s a good use of capital.

RAY DALIO: Right. It makes everybody happy. Yes. I lent you the money. I got paid back with my interest rates. I’m happy. You borrowed the money. You used the money in a way that allowed you to move forward. You came up with the good ideas and so on. Productivity increases and debt is not rising fast relative to income.

PETER DIAMANDIS: Confidence is high. Financial systems are stable.

RAY DALIO: Yep. The confidence being high starts to be a red flag.

PETER DIAMANDIS: Ah, okay.

RAY DALIO: You see? So what happens is you’re at that stage. And by the way, the monetary systems at that stage are hard. In other words, when we came out of World War II, this is the beginning of the new debt cycle. The new cycle, gold was there. You couldn’t lend more than gold because they had it back and so on. So you had sound money and sound finances. Okay. And then time goes on.

PETER DIAMANDIS: And by the way, I’ll want to speak about Bitcoin at some point as an alternative to gold, but not right now.

RAY DALIO: Great. And confidence builds. And everybody, those who are doing it are making money. The prices go from cheap to expensive. Like I told you, the earnings yield on stocks were twice the bond yield. I mean, wow, you could just take the dividends, but everybody was worried about going down. And then it changes. The prices go up, the optimism.

And, you know, they say, “Peter, what? You’re not in the market. I mean, come on, what’s wrong with you, man?”

PETER DIAMANDIS: You start your house and put it in the marketplace.

RAY DALIO: Yeah, okay. And you go in there, and then you come really to getting invested. Asset prices become expensive. You borrow money to do it. And so you have a debt bubble. In other words, you get to the point where the income produced doesn’t service the debt. And then you begin a dynamic. Very simple.

PETER DIAMANDIS: Is that where we are today?

RAY DALIO: As I say, it looks to me like we’re in 1998. You know, these all become how extreme? Okay. And so I have measures, I have indicators like that give it. And it looks like 98. Okay.

PETER DIAMANDIS: Which we still have a year and a half of good times ahead.

RAY DALIO: I don’t. It’s not so precise. It’s a thing that goes like this and you know, I know that we’re over here and then what happens is that goes on and you see unsustainable debt growth. Now the unsustainable debt growth that we’re seeing right now is particularly the government. The government is going to be in financial trouble. And I’ll get into that in a minute. But what happens is you see that debt growth and then you see a rise in interest rates is the classic. And a tightening of monetary policy. Put some brakes on and that pops the bubble and then you go through the debt liquidation phase.

PETER DIAMANDIS: And Ray, can I just ask a question here, which is these cycles have been over and over and over again. There are historians and printed books and so forth. Is it the politicians are just unable to make hard decisions in order to keep in political power. Is this just in human nature that we.

RAY DALIO: Yes, both of those things. You’re asking why in these cycles.

PETER DIAMANDIS: You.

The Cycle of Debt and Credit

RAY DALIO: You know, if you look at let’s say debt to income, it goes like this and why we keep going. Why does this thing exist and why don’t we sort of keep it debt to income more of the same. And there were the reasons politics and human nature, you touched on that. First of all, credit creates buying and stimulation and everybody wants up.

PETER DIAMANDIS: But that’s historically because the credit employed people that then consume when you spend.

RAY DALIO: I mean the government, when they say I’m now going to give you money, they’re going to give you money. And credit, it’s mostly credit and they make credit available and then you go take credit. That’s how when they lower interest rates and they make credit more available, you go, that’s. You get your car, you get your house on credit. Okay, but credit creates debt and debt serviced.

Yeah, okay, so what happens is every time you get one of these, then a local dip, they want to give you credit. But it’s like giving an alcoholic a shot to get him out of the hangover, or an addict – you give them a dose. And politicians like credit because credit comes before debt payments. So I give you credit, we get in debt. You love me, you know, that’s why they want the Federal Reserve and the central government to be separate, to try to do that.

But still what happens is human nature wants the credit. So that’s why debt to incomes go like that. And so, show you in this book, this is the government. And this is the cycle and that. And then this is the debt service payments that we’re going to have going forward. So, yeah, human nature. We all want up. We’re all betting on up.

PETER DIAMANDIS: All the time.

RAY DALIO: Unless to buy things that’ll go up.

PETER DIAMANDIS: Yes. So the party ends, the bubble pops.

RAY DALIO: Yeah, that’s right. You have the debt problem. And then historically, what they would do is then they would give more credit. So. Except when you hit zero interest rates, you had a problem.

PETER DIAMANDIS: And I mean, I found that incredible to get into negative interest rates even.

RAY DALIO: Right.

PETER DIAMANDIS: Why do I think that’s incredible?

RAY DALIO: No, I said right.

PETER DIAMANDIS: Right. Yeah. Okay. Yeah.

Zero and Negative Interest Rates

RAY DALIO: I was with central bankers. You know, I’m in that group, sort of. And when they had zero interest rate, negative interest rates, and they were calculating, they said, how negative can we make interest rates? And they calculated, they estimated for a very short period of time it could be up to 400 basis points.

And the way that they calculated that is by how much paper money that you could store in storage. Because your arbitrage, if you had the paper money, you wouldn’t have to have a negative rate. You know that. Why not hold the paper rather than to hold something that had a negative rate? And so how much negative rate could you have? And that was the essentially the arbitrage. Well, anyway, when that happened and it happened in history, by the way, it happened 1933, same thing.

PETER DIAMANDIS: Wow.

RAY DALIO: And what they do is then what they do is they print money and they buy the bonds. So like in 2008. Excuse me, they did that starting in 2008 and then 2020 when there was Covid, they had to send out checks. So the government had to send out checks. The government doesn’t get to print money. Where do they get the money to send out the checks?

PETER DIAMANDIS: They borrow it.

RAY DALIO: So they send out the checks and the central bank lends them the money and prints the money and lends them the money. So everybody gets all this money and there’s like a surprise that there’s inflation. Everybody gets all these checks and all this money, and there’s a surprise that there’s inflation. I mean, there were other things going on too, but disruption in supplies and things like that. But mostly it was the amount of money going in.

So there are two things that happen at that deleveraging point. So I want to make that clear here. Here are the things that caused the deleveraging. Supply, demand and debt service. Okay, so let’s take the government. Supply, demand. The government is going to have to sell a lot of bonds to owners because there’s so much debt around. One man’s debt, another man’s assets.

So because they are all the world is holding all these debt assets that actually for various reasons they don’t want to add to in a big way because it’s already such a high percentage of their portfolio. And there are geopolitical issues going on, okay. That the huge amount that will be sold will likely over be substantially greater than the demand for it.

PETER DIAMANDIS: And so people start selling their debt.

The Debt Spiral

RAY DALIO: And when they start seeing that it’s going to be bad because they know it could be one of two things. Either you have a problem paying and interest rates go up and you have that dynamic, or the central bank comes in and buys the debt which prints the money and devalues the value of money. Okay. Either way, when there’s too much debt and a supply and demand imbalance, you don’t want to own debt, which is where I think we are. Unless there is a change. It’s what I call my 3% solution. But we won’t get into that now, I assume. But you know, there is a path here to deal with this. But if they don’t deal with it, you’re going to have a supply demand problem, I believe.

And then in addition to that, what happens in debt service when debt service fills? The way I think about it is the credit system is like the circulatory system in our body. And the blood, which is the credit, brings nutrients all through the system. But what happens is that when it accumulates debt, it’s like accumulating plaque in the system because you have more and more debt service that constricts that amount that can pass through the system like the government debt service payments are.

And then you hit a part of it which in markets is called, and this is usually for private creditors is called a death spiral, a debt spiral. And the debt spiral, what happens is as debt service payments rise so that you have to borrow money to pay the debt and then the creditor sees that, so they pull back and the credit spread rises. And as the credit spread rises, you have to borrow more money. That is the death spiral. And that’s when you see that dynamic. And that’s close to where we are in the government debt.

PETER DIAMANDIS: But for a company that will drive a bankruptcy in the United States, that drives what?

RAY DALIO: It drives the central bank to come in and buy the debt and depreciate the value of money. That’s what a monetary inflation is. A lot of people think, when I started, I think, why do you have an inflationary depression? In other words, how can you have. When demand is not working, how do you do it? You have money production.

And then I say, well, why don’t they just stop producing the money? Well, because if they stop producing the money, the debt, they’ll have a deflationary debt problem. That’s the dynamic. That’s the mechanic. And I want. That’s why I want to explain these mechanics in this book, so people could see it. Because I show it in the book.

PETER DIAMANDIS: And everybody thinks I’m a genius. My house prices are going. My house is going up. The value of my stock portfolio is going up, but it’s all in massively inflated dollars.

RAY DALIO: I know, it’s so funny, because people think they get richer if the price of their houses and the price of things that they’re owning in a sense, go up. But it’s the same house. It’s the same stuff. Right. When it goes up in price because of inflation. I mean, buying power is what matters, not price.

PETER DIAMANDIS: What can a dollar value today. Which is why I still like the meme, you know, one bitcoin equal one bitcoin. Unfortunately, one dollar does not equal one dollar. So we’re in these five stages of the debt cycle. And just to wrap this up, we’re in the deleveraging stage. And.

RAY DALIO: Well, the government. You mean now?

PETER DIAMANDIS: Well, no, I’m saying in your five stages.

RAY DALIO: And then that deleveraging stage, typically if the debt is denominated in the currency that the central bank can print, you always get the printing.

PETER DIAMANDIS: Yes.

RAY DALIO: And you always get the devaluation of money. And then what happens is then the debt becomes so cheap that it’s easy to pay it off. So if you’re watching, like Japan is a good example, if you owned a Japanese bond, you would have lost about 80% of your money relative to something stable, like, let’s say, gold.

And you would have lost about 60% of your money relative to a US bond because you got 3% less interest rates and the currency depreciated by almost 4% a year. And that 7% a year is what you would lose. And then what happens is, if you’re in Argentina, take it to the extreme, you take that debt and you pay it off because it’s worthless with barrels.

PETER DIAMANDIS: Of pesos or whatever it might be.

RAY DALIO: Yeah.

Government Efficiency and the Future

PETER DIAMANDIS: Where are we in terms? I mean, let me ask the question I started with, which is, we’re in this administration. Elon jumped in the department of Government efficiency is created. The goal is cut back government waste, try and get us more towards a balanced budget. I mean, clearly, had we not done anything, there is no hope, we’re heading towards disaster. Is there any. Do you think that Doge can make an impact on this?

RAY DALIO: I honestly, I honestly don’t know the consequences, the realities of that. I can’t answer your question. It’s too complicated for me. I’m not at the nitty gritty of being able to say, if you shut this thing off, what are the repercussions of that and how that works.

I would need to have a much more, I need to have not only a much more detailed, but I would also need to be able to anticipate, you know, there’s an action or reaction and what the reaction is. It’s something like the tariffs, you know. But you are very difficult for me to answer your question.

PETER DIAMANDIS: Okay, I appreciate it. But you are clear, if we doing nothing, there’s a, there’s a definitive wall we’re racing towards.

Ray Dalio’s 3% Solution

RAY DALIO: Yes, this goes back to my 3% solution. It’s covered in there under the existing budget. If there’s not a rolling forward, if there is a rolling forward of the Trump tax cuts from before, the size of the deficit will be about 7.5% of GDP. You’re going to need about 3% of GDP to stabilize it. So I call this my 3%, 3-part solution.

First, get 3% in your mind, okay, can we get the deficit down to 3% of GDP? And there are three things that can do that. The first two is spending taxes. And by the way, when I mean taxes, I mean tax revenue, which isn’t the same as tax rates, spending taxes and interest rates, because the interest rate on the debt is such a big factor.

I’ve gone through the calculations and have studied this and in that study you can read it. If, one way or another, I don’t care how you do it, how you do it is almost an ideological question. The fact that you need to do it is important. So it’s like the patient that has too much plaque and they’re eating and they’re not exercising. I don’t care whether you eat greens or you exercise, but you got to get that plaque, you’ve got to get that going the other way.

And so that’s the 3%. You could do it from some mix. Now in my studying these, if you do it with the right mix, so that it’s not too much of anything, it’s not traumatic. And if you do that, you will get a fall in rates naturally. Because the market will be better off. Less risk. And if there was any weakness due to the fiscal restraint, the central bank will ease monetary policy.

That’s always been the case. I show, I don’t know how many cases, like 20 cases there around the world. This happened from 1991 to 1998 in the United States. So there’s a way, the real issue, I don’t really care that I think all the policymakers should make this 3% pledge because whoever it is, they’re going to argue over the way.

PETER DIAMANDIS: Yeah.

RAY DALIO: And they won’t do it. That’s my worry.

The Impact of Longevity on Economics

PETER DIAMANDIS: There’s a few high flying solutions out there and I want to throw one towards you, Ray. You know my passion about longevity and extended healthspan. Dario, who’s the CEO of Anthropic, I don’t know if you know Dario.

RAY DALIO: No.

PETER DIAMANDIS: Was at Davos and saying something that’s been discussed by a number of other individuals that in the next five to ten years we will see fundamental breakthroughs in human healthspan and longevity. That we may see his words, not mine, a doubling of the human lifespan.

You know, we have $101 million Healthspan Xprize going on right now to add 20 healthy years. And so one of the factors I find fascinating is the notion of if people are vibrant, have the cognition and the fortitude, the vitality to keep functioning so that at 80 or 90 you’ve got the wherewithal you had in your 50s or 60s. I have to imagine that would have a fundamental impact on the economics here.

RAY DALIO: Here’s my confusion. I don’t have the answer. A number of those studies I’ve seen said that extending lifespan is going to raise the cost.

PETER DIAMANDIS: The cost of health care.

RAY DALIO: Okay. You would know this better than I. But, and then there becomes the retirement age question, which is very much a political question. So the question is, are you productive or are you a consumer of productivity?

I would say that if you’re watching around the world extending working years, you don’t see it. I mean, you see the fight against it almost political. It’s a political non-starter source of fight. So you have to ask yourself, does the working years get extended, let’s say.

And then what I had read was you have more years that you have to take care of that person and so on. So it’s not like you go to become young again. Now, I’m not arguing that that’s the case. I’m saying I don’t know the answer.

PETER DIAMANDIS: Today in the US the average lifespan is around 79. The average healthspan is around 63. Meaning you’re spending the last 16, 17 years of your life in some level of pain and decrepitude. And I think the goal is, can we actually change that so that you’re healthy initially and then extend the.

RAY DALIO: You’ve got it engineered beautifully. But I suspect, longevity, because you were just talking about longevity, not health in those years. You know, I mean, like the one thing we got this baby boom and these people, these old people of my generation and you got a lot of them living and then when they die, they’re not a burden. Okay, so dying from actuarial tables or financial tables can be good.

PETER DIAMANDIS: Remember Logan’s Run, the movie?

RAY DALIO: Oh, yeah.

PETER DIAMANDIS: You were supposed to be, you know, knock yourself off at age 35 and turn yourself into a food supply. Anyway, that’s a different story.

I believe that if this person is got the energy and the drive and is not in pain and is not restricted by regulation, that at the peak of your capability, you’re going to want to keep in the game. And that’s the hope. That’s at least the work.

RAY DALIO: Well, I would say if you actually look at what happens in countries, your hope is not consistent with the realities. In other words, when people come to their working, their retirement age, they will fight for that retirement age.

PETER DIAMANDIS: We’re going to find out soon enough. What I keep on telling people is, you know, we’re alive during the 99th level of the gameplay. And a lot of these questions, I.

RAY DALIO: I want to be alive. I’m with you. Keep me alive, keep me alive. I’m trying to, you know, even if I get decrepit in my years that I wouldn’t have been alive.

PETER DIAMANDIS: Tony Robbins, who’s a mutual dear friend, and I both invite you to come and join us at Fountain Life and let us.

RAY DALIO: Well, you know, I will. Thank you.

Bitcoin vs. Gold

PETER DIAMANDIS: I appreciate that. Let’s talk about bitcoin a second. I know you’re a bitcoin holder, but you’re still more excited about gold, if I remember correctly. How do you think about bitcoin? You know, Mike Saylor was my roommate, fraternity brother at MIT and he’s probably one of the most outspoken individuals. I’m sure you’ve heard Michael speak about bitcoin. Are you sold by his vision?

RAY DALIO: Let me tell you what I think about it because I’ll speak for myself and I think these things are accurate. First thing is we agree on anti-money, we agree on anti-debt. Okay, that’s important.

PETER DIAMANDIS: When you say anti-money, define anti-money please.

RAY DALIO: That there are two purposes of money and that is as a storehold of wealth and medium of exchange. Being on exchange, it’ll exist. Store hold wealth, you store it in a bond. Money and debt are the same thing because when you’re holding money, you’re holding it in a debt instrument. Anything you’re going to put your money, your dollars, you’re going to be in debt instrument. Otherwise, you know, you lose 5% a year or something.

And so money and debt are the same because debt is a promise to get the money. So they’re the same. We have a supply demand problem with this money and debt, okay? So I don’t want to own money and debt. And so we’re aligned. Anybody who’s going to want to say it as a store holder of wealth is because the quantity of it cannot be increased other than through the mining activity, you know, but without that restrictions.

And that’s that. So the first thing I want to emphasize is are you there? Is that part of you there? And then how much should be in your portfolio of that thing or those things. So I may kind of those things guy that prefers gold for the reasons I’m going to explain. But I have some bitcoin, but I’ve got much more gold.

And the amount that I think is a prudent amount. If you look at correlations and the systems and all sorts of things, the least risk amount to have in terms of maintaining your buying power is somewhere between 10 and 15% of a portfolio.

PETER DIAMANDIS: So I think they should be bitcoin or gold.

RAY DALIO: Anti-money.

PETER DIAMANDIS: Anti-money. And you’re putting the two together in that bucket.

RAY DALIO: Okay, yeah. Now on the bitcoin versus gold, here’s the thing. Bitcoin is not a private asset. The governments watch it. They know what you’re going to have, they know where you are, they can tax it, they can take money away from exists at their pleasure and they can do anything they want with you. Their comfort of you being in bitcoin is better than their comfort view being in gold, let’s say.

PETER DIAMANDIS: Well, I agree the fact that it can be monitored, the movement of it can be monitored. But it doesn’t exist at their pleasure. Are you saying that the government could shut down?

RAY DALIO: They could if they wanted to, under regulation and so on, tax you? Yes, as a matter of fact, like I was saying, I was with the central bankers who said the reason that we when negative interest rates. How much could it if they had a digital currency? There was no floor on the negative interest rates because they could tax you.

PETER DIAMANDIS: Okay.

RAY DALIO: So, you don’t have the privacy. You can get taxed and so on. Whereas the saying of gold is it’s the only asset that you can have that’s not somebody else’s liability, meaning you have it in your possession. And that’s somewhat different.

The second thing is central banks holding it as reserves, watching the periods of conflict and so on. They go to gold, even in terms of their enemies. Because like what governments do in periods of conflict or whatever is they print money. They make bonds. And that’s not good. And they don’t want to hold each other’s bonds. Nobody wants to hold the bonds. And that’s why they hold gold. They don’t trust each other. And that wouldn’t work that way for Bitcoin because governments can control it.

PETER DIAMANDIS: We do inflate gold every year. What percentage is mined every year?

RAY DALIO: A pittance.

PETER DIAMANDIS: Okay.

RAY DALIO: I don’t know, like 1% or so of the stock of gold.

PETER DIAMANDIS: Yes.

RAY DALIO: And consumption for jewelry. And that’s it. Anyway, it has been for thousands of years in all different places.

And another thing is I can understand price changes in gold. In other words, if prices change, if this changes and that changes, I can make sense why the gold price changed that way. I have a problem doing that with Bitcoin. It still very much moves in a way that it wouldn’t be necessary. It’s a supply, demand, speculative market that’s tougher for me to nail down.

PETER DIAMANDIS: I am curious by the way. I just asked Anthropic here and it’s. We inflate gold about 1.5 to 2% per year.

RAY DALIO: Yeah, that makes sense.

PETER DIAMANDIS: I would expect bitcoin to go up when there is international strife or instability or difficulty predicting what’s coming next. But we’re seeing swings that are not related to anything that’s really explainable today.

RAY DALIO: That’s right. So when I go down that list of things I say I favor gold for those reasons.

PETER DIAMANDIS: Could you imagine changing your mind if some.

RAY DALIO: Sure. If something came along that tell me why. I also. Some people have said and I’m not sure if this is right. It’s been quite amazing, but that with quantum computing and so on, there’s a good chance that you can break it.

PETER DIAMANDIS: Yeah, I don’t know if that’s true.

RAY DALIO: I’m not an expert. I’m just throwing another thing in there.

PETER DIAMANDIS: Yeah, I’ll give you another answer to that, Ray, just so you have it in your quiver. If quantum computing were to allow us to break encryption on Bitcoin, we have a lot bigger problems. That same quantum decryption would give us the nuclear codes, would allow anybody to enter your bank accounts, allow us to do a lot more.

Finding Balance in a Complex World

RAY DALIO: You know, we need to go to some island paradise. It was so funny. I was in Bali in this paradise. And then I fly up to China. In Bali, there was this spot off the grid and they have this food plot. I didn’t even know how much land produces how much food. I didn’t realize that you can have a plot of land that’s not very big and you could live wonderfully. And everybody’s in peace and they’re going to their meditation and they’re doing this and they’re enjoying life.

And then I get up and fly to Beijing, and I’m with leaders in Beijing, and they’re fighting for control of the world.

PETER DIAMANDIS: You’re in the first place.

RAY DALIO: Okay, yeah, off the grid. And they’re going to get me and they’ll take my phone. I mean, we do have to reflect on some of these things.

China, Technology, and Global Competition

PETER DIAMANDIS: Let’s cover two final subjects if you’ve got the time. I know it’s getting late there, but I want to talk about China and I want to talk about what your 2025 predictions might look like.

There’s a lot of conversation right now about China versus us. We’ve got a new administration coming in. My concern, of course, is we’ve seen recently with Deep Sea, we’ve seen with nuclear fusion – while the US is vibrant in terms of an entrepreneurial and technology ecosystem and engine, China should never be misjudged as someone who is pushing across the board. How do you think about China? How should an entrepreneur think about China?

RAY DALIO: We are at war with China, and it hasn’t turned to a military war, but it’s actually turned to very much a subversive war in which each would overthrow the government and do all sorts of stuff. And it’s not going to go back, it’s going to be that way.

The two countries fight wars differently. A leader in China, one of the top leaders in China, was describing the Chinese way of fighting war and the Western way, which he calls the Mediterranean way of fighting war. The Mediterranean way is that you go in and you fight and you fight to win and you kill each other. The Chinese way of fighting is so that your opponent doesn’t even know they’re fighting. If you’re not smart enough to win the war without actually fighting, you stop being very smart. So it’s a war of deception.

And then there’s this desire to have these separate parallel universes in technology. I don’t believe that you’re going to be able to maintain control of intellectual property that is something that is publicly used. Maybe if you go inside your spot and you have sandboxing and you never bring it out and you never look at it, then maybe you can intellectually protect it – that’s sort of how the atomic bomb was built.

By the way, both countries are trying to secretively build weapons that the other one can’t fight against. Because the way you rarely win is you build the weapon that the other one can’t fight against secretively, you show it to them, they find out that they can’t win and then you win without fighting. That’s the best way.

We’ve changed the world order. It’s been very clear by Donald Trump that we have gone from a multinational multilateral environment to a unilateral, each country for their own might as right kind of environment. And so we are in that unilateral might is right. If I can exert pressure on you to get what I want, that’s the way it is, which is historically what most of history has been like.

We’ve had a few wars. We had the Ukraine-Russia war, which I think will come to some kind of a ceasefire, which will be temporary. You’ve had the Israeli-Iran and proxies war that Israel won. And you’ve had a conflict between the United States and China, where the United States did much better and China did much worse than they would have expected.

The Chinese have domestic issues. We have domestic issues. And I think nobody wants to go to worse war. So I think that probably over the near term you’re going to have this behind the scenes, subversive kind of war.

But in terms of economics and technologies, the winner of the technology cannot lose the war. And by the way, that’s also something that’s economically important. I think in terms of the super scalers – you must win the technology war. Not only countries must win the technology war, those companies must win. And profit may not be the number one thing.

I think the opportunities are in the applications and the usage of it. China is doing a lot better in terms of actual applications. We’re advanced on chips, but in terms of actual usage and embedding in Chinese society, they have advantages. So we have this dynamic going on and China has its own set of issues. I think that probably over the near term you’ll have a lot of pushing the edge, but probably not going over the edge. But that’s not a permanent set of circumstances.

PETER DIAMANDIS: Yeah, you said a few things I think are really important to hit on here. Number one, any kind of restrictions we put on China for AI like chips from Nvidia and so forth, all that does is force them to basically start building capabilities internally. And with Huawei chips right now, the second thing it forces them to do is to become a lot more efficient.

So Deep Sea was an example of, okay, we don’t have the chip resources, so how do we change the algorithms and just do it a lot more efficiently? Intelligence brings a new sort of Darwinian evolution of a constraint. Evolution will find a way around it.

I’m a bit concerned – I’m curious what your thoughts are. You mentioned that 60% of the US doesn’t read above the sixth grade level, which is kind of shocking. We do have a leveling of the education playing field happening very soon, when this device becomes a polymath in your pocket, right? Where in a conversation with your AI agent, you’re able to deduce or learn or create or serve anything that you need, both in China and the U.S. I mean, so we’ve got an augmented population. You don’t think so?

Education and Technology

RAY DALIO: Well, I just go back to my experience. I happen to have a son whose passion is ed tech. And he’s gone into the third world and gone to the poorest areas to make this connected, to make computers and all of that. And the original theory and expectation was, why shouldn’t they not only get educated by this – he made a device so that it connects to TVs and makes computers and all of that. And why shouldn’t they do that? And then if they do, not only do you educate those, but you have them have different kinds of jobs that they can do remotely and so on.

And so when I look at the wealth gaps or these gaps, I was surprised that that didn’t happen. So I’m hesitant to leap to the notion that technology alone solves these problems. A lot has to do with parenting. A lot has to do with who’s giving the guidance, what is it like.

We have an issue with parenting. We have an issue – okay, why does 60% of the population have less than a sixth grade education? There’s almost a leap that those people are going to take this technology and they’re going to be productive and so on. Well, I was surprised that it didn’t happen and I can kind of see maybe why it might not happen. At least I’m not assuming it necessarily will.

2025 Predictions

PETER DIAMANDIS: Fair enough. 2025 year ahead. What are you seeing? What are your predictions for what’s the best we’re going to see in this year?

RAY DALIO: Obviously, 2025 is a year of great, great uncertainty. I think that the first big issue that we’re going to deal with is the budget issue. Right now, it’s not the issue. And everybody thinks of it not as the issue in the first half of the year. It’s going to be the issue. And how they deal with that is very important to me in terms of the supply demand.

Because let’s remember that the treasury market is the basis of all markets. It’s the foundation of all markets. And if you create a reverberation for supply demand, then it changes all that capital raising and funding. I mean, the world gets disrupted. So that’s the first thing I’m watching.

Then we’re going to see the first hundred days of a new administration, which is a time of great optimism and also a time when priorities have got to be set. It’s real world time now. It’s game time. So the theories are going to be put to the test. Does the cost cutting happen? Is that realistic? How many numbers can you do that? And then there has to be prioritization.

I think the prioritization is also going to be smartly on energy for data centers and the building of AI to win. Because whoever wins the tech war is going to win the military war with China. But how that game goes, it’s going to be a tough game.

So when I look at that, I think we’re not going to be as happy a year from now as we think we’re going to be. Because things are pretty expensive if you have interest rates rising. There are these issues we face with AI, and it’s got to be done within two years. And it’s got to stick because midterm elections are going to be harder for the Republicans because they have more seats up. So it’s going to be interesting.

Advice for Entrepreneurs

PETER DIAMANDIS: You’re an entrepreneur or I’m an entrepreneur. What’s your advice, looking forward, thinking about planning your business for the next year or two years? What’s your wisdom?

RAY DALIO: You’re at a time of relatively good capital markets. Credit spreads are narrow. There’s a lot of money. Plan on surviving droughts as well as the difficult times.

PETER DIAMANDIS: Fill your equity coffers.

RAY DALIO: Yeah.

PETER DIAMANDIS: Don’t take on too much debt. Plan for realistic growth.

RAY DALIO: And make great partners with the investors that are in it. Ultimately it’s going to be not only your numbers, but it’s going to be your character. Don’t be overly greedy, but have the relationships as well as the money that is your foundation.

PETER DIAMANDIS: Yeah. I think that’s beautiful wisdom, Ray. Grateful for you. Thank you for making your research available and writing these books.

I sure wish we humans were a bit more intelligent or had longer memories. I do wonder sometimes whether AI can help us get out of these repeated cycles and support us in more logical planning and growth. I guess we’re going to find out.

RAY DALIO: Maybe if we ask it the right questions.

PETER DIAMANDIS: Good to see you, my friend. Thank you again for your time. Grateful for you.

RAY DALIO: It’s always a pleasure. Thank you, Peter.

PETER DIAMANDIS: Thank you, buddy.

Related Posts

- Michael Saylor Responds to Bitcoin Critics @ Coin Stories (Transcript)

- Why Multilingual Human Support Still Matters in Digital Banking

- To Buy Or Not To Buy Cryptocurrency? That’s The Question On Everyone’s Mind

- Ajay Banga on India, Migration and a Youth Jobs Time Bomb (Transcript)

- A Global Monetary Crisis Is Coming & AI Could Make It Worse – James Rickards (Transcript)