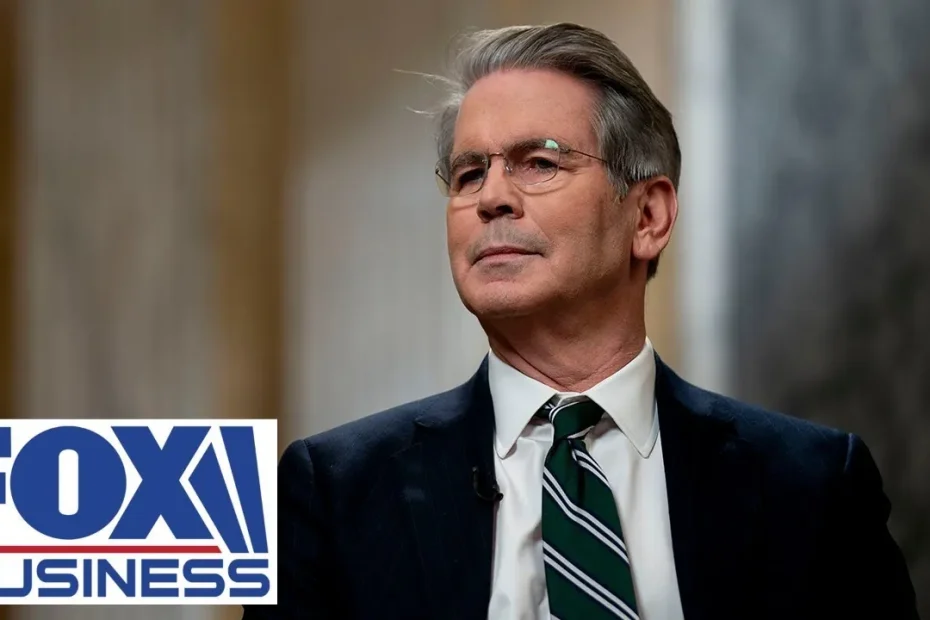

Read the full transcript of FOX Business’ Larry Kudlow interviews Trump Treasury Secretary Scott Bessent’s talk/lecture/interview at The Economic Club of New York event on March 6, 2025.

Listen to the audio version here:

TRANSCRIPT:

The Trump Tax Plan: Building on 2017 Success

LARRY KUDLOW: The tax bill is one big beautiful bill. The income tax rates would stay down. The small business deduction would be restored, if not more. We talked about the expensing. Corporate tax rate could come to 15% for made in America goods. 15% would put us at the very, very low end of the OECD. And this would all include tax-free tips, tax-free overtime, tax-free senior benefits, and it would be made permanent.

This is what the president called for, and it could be scored on a current policy baseline, which means in effect we don’t have to work. The issue here is to stop the $5 trillion tax hike. There’s no evidence that this tax bill and tax proposal would actually reduce revenues. In fact, just the opposite happened in the late 2017 bill.

SCOTT BESSENT: I think that certainty, the closer we get to the tax bill expiring, the more the what I would call an “uncertainty tax” goes up. So the sooner we can get this done, the better. I lead something, Larry, I believe you were part of it, called the Big Six. It’s myself, Kevin Hassett, the NEC director, Leader Thune, chairman of the Senate Finance Committee, Senator Crapo, Speaker Johnson, and the chairman of the House Finance Committee, Jason Smith. The six of us are going at this every day to try to get it done as soon as possible so that there is no glitch in what’s going on.

The longer we wait, the bigger the chance that the unthinkable could happen and we could have this catastrophic tax increase. And I know that President Trump believes that one of the reasons that the 2018 midterms were unsuccessful was that it was an amazing tax bill you put together, but that it wasn’t the focus in the first half of the year.

You believe, and I know the President believes, but you believe, and I know that Glenn Hubbard believes, that with good policies we should be able to project a 3% GDP growth baseline out over the next 10 or 20 years.

Washington Accounting and Budget Challenges

SCOTT BESSENT: For those of you, when I used to sit out there for 35 years, I thought I knew how Washington accounting works and I was wrong.

When Larry and I talk about current policy scoring, if we don’t use current policy, the current CBO protocol—and this is why I think now being on the inside, we’ve gotten into this spending mess, into this tax mess—the current baseline for any tax policy gets re-scored. I don’t know why we’re calling this extending the tax cuts. It is the current tax policy. Extending the current tax policy gets re-scored. Extending current spending, the spending that got put in, does not get re-scored.

So guess which is easier to do? You keep the spending going, but for the tax levels, you have to fight for every extension depending on when they expire. This is why permanence is so important.

LARRY KUDLOW: Yes, thank you for that. I think it’s a really, really important point. And so far as the Big Six is concerned, what you’re negotiating, you and Kevin Hassett and the House and Senate members, you will produce a Trump budget, and there will be a Trump tax plan that will be formally submitted at some point in the near future.

Tariffs and Revenue Strategy

SCOTT BESSENT: One thing we don’t talk about a lot, and I think we’re going to, is the tariff income. Right now we have substantial tariff income from China that President Biden left on, and if we have new tariff income, we won’t be able to score that since it won’t go through the legislative process, but I could tell you that could be very substantial.

When people say tariffs are a regressive tax, are they a regressive tax if you then use the income from tariffs for no tax on tips, no tax on Social Security, no tax on overtime, making auto loans tax-deductible? Those four policies, which President Trump put forward during the campaign, all accrue to the bottom 50% of wage earners and working Americans.

So could you have a tariff policy that finances income tax cuts and real income increases for the bottom 50%? I think that’d be pretty great.

LARRY KUDLOW: Have you ever met William McKinley?

SCOTT BESSENT: The President sends me text messages on William McKinley. I know I’ve been around, but I just missed him. I don’t know, perhaps you commune with him.

LARRY KUDLOW: I don’t.

SCOTT BESSENT: In anticipation of discussing with the President, I did read his biography.

LARRY KUDLOW: The Robert Merritt biography is very good.

Tariff Philosophy and Strategy

LARRY KUDLOW: Other questions? I know we’ve mentioned tariffs, Mr. Secretary, but I want to do it again. We have questions from Mr. Glenn Hutchins. There are two theories of tariffs. The first is they are a negotiating tactic, which involves short-term pain for average Americans, but long-term gain. The second is that they might be considered sound fundamental policy. What are your thoughts with respect to these two scenarios?

SCOTT BESSENT: In terms of tariff policy, I think one thing that has become clear to me over the past decade is Ricardian equivalence does not work if other countries have a very different economic and social policy. China is exporting their policies to us. They have decimated our manufacturing sector.

There’s a new paper out called “The China Shock,” and it said the community has recovered, the workers haven’t, so clearly the policy is not working for working Americans. China exported their policies, and tariffs are one way to push back on this.

I do think it is good policy. President Trump believes three things: One, that it is a good source of revenues. Two, it protects our important industries and the employees. And three, he’s added a third leg to the stool—he uses it for negotiating.

LARRY KUDLOW: The free-trade theory of Ricardian equivalence is a very interesting theory, but there is no equivalence, as you just noted. I’m just wanting to highlight that the Chinese economic system and the Chinese political system is not equivalent to the United States. We are a free-market democracy. They are an authoritarian, socialist, political entity.

SCOTT BESSENT: It’s like California versus Texas.

LARRY KUDLOW: Very well put. And I think that’s the problem when you look at the world trading system. It is unfair because it’s not equivalent. Foreign tariff rates are much higher than ours, but many of these countries are just not equivalent. We’re not playing on a level playing field for tariffs, it’s a non-level playing field for basic economies and basic polities. That has to be changed. The world trade system, World Trade Organization never took that into account.

Supply Chain Security and National Strategy

SCOTT BESSENT: The only good thing that I could say about COVID was it was a beta test for what we could have if we had a large scale economic disturbance or a hot war, and it showed us that optimal supply chains are not secure. I think it has made us refocus on many of the aspects.

When you see President Trump talking about the rarer strategic minerals, reshoring our medicines, reshoring the semiconductors, all of that is from the lessons we learned during COVID of not having reliable trading partners.

To your point, Larry, we can accumulate all of the strategic mineral deposits that we need, but China still processes 85% of them. Every time a private sector company tries to stand up a processing facility outside of China, China drops their prices and puts them out of business. There are several in the United States that are just sitting idle because the Chinese saw what was happening and dropped prices, and that’s unacceptable.

LARRY KUDLOW: I want to be absolutely fair and balanced. A question from Mr. Glenn Hutchins. He’s asking, a principal component of the Trump campaign was that our deficits and debt are too high. Now, you’ve talked about that…

SCOTT BESSENT: But I want to give you just another round on it. Yes, I just talked about that the spending is too high, and I think that, Larry, you and I have talked about it, I’ve seen Glenn Hubbard talk about it in ECNY seminars, but if you can change the growth trajectory, then we can grow our way out of this debt. And again, another one of the reasons that I’m sitting up here and not out there was I was afraid that four more years of like we just had would make it impossible to grow out of our debt, that the accumulated debt stock would be just too big, and you would have to go into a European-style system where you’re working all the time just to pay off the debt.

I do think we are taking this seriously. I do think this is the last chance bar and grill to get this done. And imagine if we think about a growth trajectory, and again back to CBO scoring, CBO scoring scores in the projections, they talk about or they use 1.7, 1.8 percent baseline growth for 10 years, whether you cut taxes or raise taxes.

So if we are sitting here in a year and we’ve just had the biggest tax hike in history, the CBO will not change their growth projection, will not have changed it, even though I don’t even want to think what growth would look like, could look like. So if we could get above 3 percent, if we could hold expenses in line, flat, or even if we could do the unthinkable, if we think about a kind of a naive reductionist model of government, G equals S minus T, spending minus taxes, Republicans, we like more spending, but we just want to do it slower. We like lower taxes, Democrats like higher taxes. What if the S actually held flat or went down? That’d be a pretty good story.

LARRY KUDLOW: Sure would. You know, I saw a study, just to finish this point, over 10 years the differential between 3 percent growth and 1.8 percent growth comes to about 3 trillion dollars of extra money, which could be poured in for any number of private sector uses.

SCOTT BESSENT: And again, Larry, it’s back to the predictability, that if we can do that and then all those benefits actually accrue out into the economy, not to the bondholders, not to the government.

Budget Savings and Government Efficiency

LARRY KUDLOW: And this one last point on the budget. Doge savings, I saw, it’s interesting, a poll, a Democratic poll, my friend Mark Penn, in his poll, let’s see, 69 percent favored the idea of a 1 trillion dollar budget savings, I’ll call it, from Elon Musk and Doge. This is a Democratic poll, so it’s quite interesting. As you incorporate your big six projections and you put out a Trump budget, you, Russ Vought, will be doing it at OMB, obviously. Is there a Doge, you know, is there a doge spot for this, and perhaps how much might that be?

SCOTT BESSENT: Larry, I don’t know yet, but to think that there’s no waste, fraud, or abuse in the U.S. government, think about it. Now that I live in D.C., 25 percent, 25 percent of U.S. GDP flows through Area Code 202. Everybody is trying, there are all these markers on there, same thing. Americans with health care, every Monday is paying for your health care, but when you think about 25 percent of GDP flowing through Area Code 202, everybody’s trying to skim a portion of it, trying to reallocate it.

I don’t know what the savings level can be, but I think examining a lot of these contracts, a lot of this employment, and I was with Glenn Youngkin, Governor of Virginia, the other day, and I thought he would, all these people are in a state over government layoffs, and so his northern Virginia would probably be the area most affected. And I said, Governor, how are you handling this? How are you messaging it? And he said, we have 350,000 private sector jobs available in Virginia. My office has a portal up, and anyone can go on the portal and come and join us in the private sector.

Re-Privatizing the Economy

LARRY KUDLOW: I mean, that goes to your theory, which I think President Trump has adopted, but it was your note, your idea. You want to, this has been a government-driven economy. You want to make this a private sector-driven economy. We want to, as I understand it, disempower the public federal bureaucracy and re-empower the kind of risk-taking and investment that goes along with private sector advances. You’ll see headlines, federal jobs are down, oh my God, but the fact is private jobs, the fact is the private sector should be vastly bigger than the public sector anyway, and you tax policies have a lot of incentives. So I want to end on your theory to re-privatize the economy, which I think is so important and should in fact be a global model for other countries.

SCOTT BESSENT: Larry, everyone knows what they should do, it’s just do they have the willpower to do it? For any of you who haven’t read it, Mario Draghi, two weeks ago in the FT, had a very good piece on European Competitiveness paper that he put together, and where he talks about that intra-Europe is actually tariffing themselves more than America ever could because of their high regulatory burden.

When I think that as we bring down the spending, and we’re not going to do it all at once, I’m not in the habit of repeating private conversations, but I will tell you, first time I went in to see President Trump talk about getting involved with the campaign, he looked at me and said, Scott, how are we going to get this debt and deficit down without killing the economy? I’ve been thinking non-stop about that for the past 15, 18 months now, and I really do think it’s this transition from public to private that will bring down, or will de-leverage the government, and as I talked about, that’s why I wanted to lead with it today to this group, that we will re-leverage the private sector, and part of the key to re-leveraging the private sector is cutting regulation, making the tax policy permanent, and getting our regulated banking system going again.

I have, I think that private credit is exciting, it’s the breadth, depth of our capital markets, it’s something that is new in our capital markets, but we also have to get the regulated entities lending again, I think that they can co-exist, and I think Main Street, in terms of the regulated entities being squeezed, it’s really happened at the smaller regional banks, small banks, and community banks, which hits Main Street, and like I said, Wall Street’s done great, Wall Street can continue doing well, but this administration is about Main Street.

Conclusion

LARRY KUDLOW: Anyway, Secretary, we appreciate your visiting here, and we wish you best of luck and Godspeed.

LORENZO: Thanks. Great. Thank you both very much, I think, Mr. Secretary, thank you for choosing Economic Club as the venue for you to describe your ideas as they’re developing, it was terrific and an honor for us to have you here today as a former club member and now as the Secretary.

SCOTT BESSENT: I’m still a club member.

LORENZO: Exactly. Okay, great. And Larry, thanks as always for engaging so thoughtfully, you know, to our fellow members, thanks to all of you for being here, we have a great series of events coming up, Larry Fink is coming, John Gray, Dan Loeb, also for those of you who are online or are going to be in Florida, we’re now trying to do events there, and tomorrow Governor DeSantis will be addressing people in Florida on behalf of the Economic Club of New York.

Let me also say thank you to the 400 Centennial members of our club who provide extra support so we can put these types of events on, and we’re very appreciative. Let me also say, too, that, you know, these events don’t happen because we snap our fingers. Barbara Van Allen and her team do an amazing job in a short period of time of making these things happen, so everyone, those that are online, thank you for joining, those in the room, please enjoy your lunch, and again, thank you, Mr. Secretary, for being here today.

Related Posts

- The Truth About Debt: Why 99% Rich Use It & Others Fear It – Dr. Anil Lamba (Transcript)

- Paulo Nogueira Batista: Decline of the IMF & Rise of the BRICS New Development Bank (Transcript)

- Ex-BlackRock Insider Reveals The Next 2008 Financial Crisis (Transcript)

- Transcript: CEA Dr V Anantha Nageswaran on Growwing India Podcast

- Transcript: Business Expert Natalie Dawson on DOAC Podcast