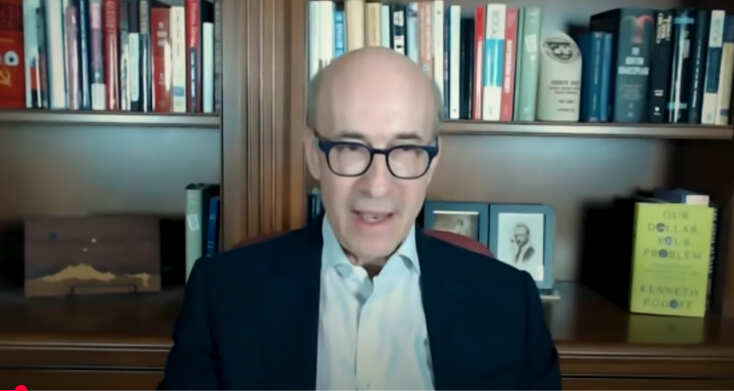

Read the full transcript of Harvard Economist Ken Rogoff’s interview on A Charlie Rose Global Conversation on debt, inflation and the dollar, (May 30, 2025).

The interview starts here:

Introduction

CHARLIE ROSE: Ken Rogoff is a distinguished American economist. He is professor of International Economics at Harvard. He is also a former chess grandmaster. Rogoff received a BA and MA from Yale University summa cum laude in 1975 and a PhD in economics from the Massachusetts Institute of Technology in 1980.

At 16, Rogoff dropped out of high school and found success playing chess. However, at 18, he made the decision to pursue a career in economics rather than to become a professional chess player. In 1998, he joined the faculty of Harvard. He served as Chief Economist of the International Monetary Fund from 2001 to 2003. He is currently the Moritz C. Boas Chair of International Economics at Harvard.

His book “This Time Is Different: Eight Centuries of Financial Folly,” which he co-authored with Carmen Reinhart, was released in October 2009. In “The Curse of Cash,” published in 2016, he urged that the United States phase out larger denominations of currency, leaving only the rest in circulation. His 2025 book, “Our Dollar Your Problem,” explores the global rise of the US Dollar and shows why it’s likely to be challenged in the future. He is a member of the National Academy of Sciences and the American Academy of Arts and Sciences.

In a world where trade and tariffs are in the headlines, it is an important moment to understand the risk to the global economic system. We will discuss many things, including the dollar, debt, deficits, bonds, national economies, interest rates, cryptocurrency, austerity, and inflation as elements of global economics. I’m very pleased to have Ken Rogoff join us. Ken, thank you very much for joining us.

KEN ROGOFF: Thank you.

CHARLIE ROSE: For me, it’s a kind of understanding of the global economic system, and I hope that we can provide a kind of master class as to the elements that make it up.

KEN ROGOFF: Well, I’m in the hands of a master class interviewer, so I hope it works out that way.

Chess Background and Life Lessons

CHARLIE ROSE: All right, so let me talk personal first. Having grown up, I think, in Rochester, you then went to Yale for master’s and an undergraduate degree, and then MIT and then served some time at the IMF. But there is also the chess background. Tell me what chess has meant to you and what lessons it has taught you.

KEN ROGOFF: No, I’m really glad you asked that. I actually weave chess a bit into the book, which I’ve never done before, but I figure I think about it all the time, so if I want to be authentic, you know, I should mention things I think about.

I was a professional chess player in my youth. I lived in Europe playing chess, supporting myself, probably earning more than I did as an economist for quite a while, which hardly tells you how low academic salaries were back then. And I met a lot of people. I had a lot of experiences.

But I think there are a lot of things that I took away from chess that went into who I am and economics and they range. You know, I’m going to start with a really big picture thing. I thought about nothing else. I thought I knew everything and yet. And I played with some, you know, the best, the world champions, the best players. And I watch how chess has evolved slowly, gradually. I knew nothing. And it taught me something about when I’m sitting in a seminar or reading an economics paper and thinking, oh, that’s a lot like I heard yesterday, nothing’s ever changing. We figured everything out. You just couldn’t be more wrong. So it gave me openness.

And I think another thing, example I picked was when I was a Young Turk and I was pretty good and I was improving fast. I would see when Bobby Fischer, he was the great player of our era, when I was playing, I would see him beat somebody who made a mistake on move 33, and maybe the number two or number three player in the world. And I’m thinking, oh, wow, they’re an idiot. I can beat them. I see that mistake and then of course, you get to play them and you don’t get to move 33.

And I say that because everybody’s always asking me, you know, Jay Powell, Ben Bernanke, they made a huge mistake. What a dumb mistake. You know, anyone should have seen this coming. I was like, you know, they made 50 decisions on the way to there. Things are very hard to know. So I’m just giving a couple examples of sort of insights about life that I think I’ve taken away from chess. And there’s a lot more.

CHARLIE ROSE: Well, you’ve underestimated yourself. You were a grandmaster. You played some of the best. Why did you choose to give it up?

KEN ROGOFF: So I can’t really give a totally coherent reason, but what I told myself was I wanted to do something more important with my life. And I think chess is art and sport and gives a lot of people pleasure. I did not like traveling so much. I mean, particularly I was 16, 17 years old, and I had sort of a normal social life back in Rochester, New York. Normal for a nerdy kid, anyway. And I was very lonely out on the road. I mean, it was. I didn’t have a parent going with me. And so the wear and tear of the travel was something. And yeah, probably I just said it that I wanted.

CHARLIE ROSE: You were about 17 or 18 by the time you made that decision, were you not?

KEN ROGOFF: Yeah, yeah, yeah. No, I was. And, yeah, I mean, I decided to go to Yale. I had an aunt and uncle that I loved there and figured that would be nice. I hardly applied anywhere, and I was lucky they took me because I didn’t really have much of a school record, but they did. And it was a struggle to go to college after I hadn’t been in high school much. I didn’t know how to write, to say the least. I hope the reader thinks I’ve improved since then. But anyway, it took me a long time to make a transition from only thinking about chess to being an economist. It took a decade, really, for that to happen.

CHARLIE ROSE: How often do you play today?

KEN ROGOFF: I can’t play at all. No, no, zero. I am so passionate about it that if I play, I can’t stop thinking about it. So, literally, I’ve only played one game in the last. Well, it’s now two. But I had played Magnus Carlsen. He’s the world champion in 2012, in a blitz game for charity. And then actually, just a few days ago, I played Alexandra Botez, who’s a huge celebrity in chess. She’s very good. She was featured in Rolling Stone recently. You can look for her, but that was a requirement of being on her very, very popular podcast. So that was my second game over the last, I don’t know, 40 years.

CHARLIE ROSE: And you also told Ezra Klein that one of the three books you would recommend is Queen’s Gambit, which is about.

KEN ROGOFF: No, absolutely. So I don’t know how many. I think many people. We all live through the pandemic. We all watch too many movies and TV. And I think a lot of people saw the Queen’s Gambit, which was magnificent. It was written by Walter Tevis, who only wrote a few books, but they were huge. I mean, he did the Hustler, the Color of Money. These one became movies, won Academy Awards.

I actually met him in 1975. And one of the scenes in the book and also in the series is based on this tournament where I finished second in the US Championship in 1975. And we all knew who he was, but being chess players, we didn’t care. You know, like, how good is he at chess? You know, I’m being a little sarcastic. No, we knew he was a celebrity. We didn’t really know what he was up to.

So to make a long story short, that’s a big scene in the book and also the movie. And he said in interviews he based characters in part on watching chess players. I don’t see myself, but my wife and my daughter insist that the nerdiest character is me. That’s who I am. But, yeah, the book. The book is a masterpiece. I mean, it just. The series follows it step by step, scene by scene. It’s just magnificent book. I mean, I used. I was giving it before the series. I would say I would give it as a Christmas gift or a house gift to people because I thought it was so beautiful. I mean, I wasn’t just saying it on Ezra Klein. I really meant it.

American Economic Dominance

CHARLIE ROSE: Yeah. I want to shift to the global economy now and the idea of American dominance since World War II. Give me a snapshot of how that happened and why it happened.

KEN ROGOFF: We were the last man standing after World War II. So first there was World War I, which destroyed a lot of Europe, and we fought in World War I, but we came in late and we lost a lot less people. And it didn’t hurt our economy nearly as much as the British, who are really the dominant economy. Germany was ascendant, by the way. Had Germany decided not to go to war in World War I? They were poised in some ways to pass the UK, that’s another story.

CHARLIE ROSE: But they did, and they had lots of talent there at that time.

KEN ROGOFF: Oh, huge. Huge.

CHARLIE ROSE: They still leaders in science and leaders.

KEN ROGOFF: Oh, every. Yeah.

CHARLIE ROSE: So many areas of. Of life.

KEN ROGOFF: No, just an amazing country. And they were both damaged. The UK won the war, but lost a huge number of people. People who watch. Name another series. Downton Abbey, you know, see all the elite having to go off to war and it changing so many things.

So we moved up a lot. We were sort of the China of that day in the sense we were growing and we were big and we produced a lot, but we weren’t really leaders. World War I thrust that upon us, but we weren’t very good at it. Which, by the way, is part of how the Great Depression happened. We screwed up.

Then there was World War II, which was kind of the same story again in that we fought in World War II and we lost a lot more in World War II than World War I. But the UK, Britain lost even more. Europe was destroyed, Japan was destroyed, Our competitors were destroyed. So by any measure, at the dawn, you know, after World, say, go to 1950, we were 40% of the global economy and maybe more in some ways, 40%. I mean, everybody was in ruins, right? So we weren’t. And that’s the point at which, just before then, it was decided the dollar had to be on top.

We used to have gold, and then we changed to a system where everyone, everyone being Europe, Japan, and the countries that were integrated into the global system, they were required to peg, to fix their exchange rates to the dollar. We were not. But believe it or not, I mean, a lot of people wouldn’t know this. We were required to give the governments of Europe, Japan, etc. Gold if they came to us and asked for it. If they said, here’s a Treasury bill, gold was still $35 an ounce, which is what FDR changed it to in the 30s, and we were required to give it.

The system put us on top. Well, the system worked very well for a long time for Europe. Europe grew. We got to be smaller. They were growing faster and faster. They needed more and more dollars. As you know, we’re very good at supplying that when the world demands. But our gold supply did not grow. And so eventually the system blew up in 1970, 71, and the title of the book comes from that episode, “Our Dollar, Your Problem.”

Because the Europeans and many others were holding dollars and they had been told they could exchange it for gold. They kind of knew it wouldn’t last forever, but I think a lot of people thought it would last another decade or two. And Nixon, for various reasons, financing the Vietnam War, the Great Society ended it. And he sent the. Our Treasury Secretary, John Connolly, over to meet his colleagues. And he’s a very colorful man. Did you ever interview him, by the way?

CHARLIE ROSE: I did, and I actually spent a wonderful lunch with him in Texas. And he talked about Lyndon Johnson a lot, which I was interested in. And he talked about Johnson sending him to the Democratic convention that nominated Hubert Humphrey and making sure that the Democratic Party didn’t change its position on Vietnam.

KEN ROGOFF: Well, and as you also know, he was in Kennedy’s car the day he was assassinated.

CHARLIE ROSE: Indeed.

The Dollar’s Global Dominance

KEN ROGOFF: So anyway, he sent Connolly, who was a pretty rough and tumble Texan, at least by reputation, and they’re. What are we going to do with our dollars? You’re going to inflate it to nothing. And Connolly said, well, it’s our dollar, but that’s your problem. And rewording it slightly. And of course, we did inflate it away. They lost a fortune.

So the European economies were holding the similar amounts of dollars to what the Asian economies are holding today. The Asian economies hold trillions and trillions of dollars. China alone 2 trillion, but a lot of even the small Asian economies hold a lot. And we inflated it down.

What spoke to me about the title was first the arrogance. I’m very proud to be an American, but I’ve never liked this edge of arrogance. But also the irony of it. It was our problem. Nixon got rid of this gold anchor. He didn’t know what to do, he didn’t have a plan, he didn’t understand. And so we ended up with this massive inflation in the 1970s, which was a disaster in many ways. It wasn’t just because of the oil shock and other things. It was, we just didn’t know how to anchor inflation. And it wasn’t only much later that we figured that out.

So I like the capturing the arrogance and the irony. When I finished the book, it was before I knew who would win the election. But I mean if I changed the title slightly and I’ve been Howard Donald, your problem or something like that. Yes, but I think it captures something very similar to what I saw in that expression.

CHARLIE ROSE: What strikes me and what I didn’t appreciate was how our friends resent our throwing around with arrogance, our power having to do with the dollar.

KEN ROGOFF: No, absolutely. So there are two ways we throw it around. One is we just do what’s good for us. Now to be clear, the Federal Reserve is by law required to do what’s good for us. It’s not supposed to say, well, if we raise interest rates to fight inflation, that’s going to cripple Latin America. We did that in the 1980s. We’re not supposed to look at that.

So our monetary policy, because the world is so dollarized, what happened after the 1970s is Europe split off. But the rest of the world as it came into the global system, it wasn’t there in the 1970s, China was communist, Russia was communist, India was socialist and very inward looking. Latin America, Africa, as they came in, they used the dollar. The dollar became their thing. So we colonized the world in a sense with the dollar. It’s something that gave us tremendous, tremendous benefits and it gives us a low interest rate.

But one of the things our friends don’t like is it gives us this incredible knowledge about what’s going on. I don’t know if you’ve ever been to, you know, look at one of the big credit card companies and, and they have these things. It looks like the war room at the Pentagon where they have all the little lights and these are all the transactions going on because the dollar’s at the center.

It’s a bit of a story, but the whole world goes through the dollar. So I once had the head of one of the biggest global central banks. I don’t want to say any further than that. Pop into my office at Harvard. He was at Harvard and popped by to say hello eight years ago. And he sat down. He wasn’t Christine Lagarde. I’ll give that much away. I was a he. And he said, you know, I just, I was on the continent and I just bought something for my wife using my Visa or something. And what really makes me mad is Donald Trump can see the transaction.

And this is a person who really understood the system. He was very high up. And, you know, and so the Europeans have floundered to try to form their own system. It’s not easy because the dollar’s everywhere. So you think they don’t like it? Think about the Chinese. I mean, they really resent it, but for the moment they’re kind of stuck with it. They’re trying to escape it.

America’s Debt Problem

CHARLIE ROSE: American debt, how precarious are we today?

KEN ROGOFF: Very precarious in the sense it’s not sustainable. People have been talking about this for a long time and I know that one of my favorite expressions in economics talks about financial crises take longer to happen than you think they should, but then they unfold faster than you think they could. It’s just not unusual for things to take a long time.

So one thing that’s changed is interest rates have gone up, in my opinion, they’ve normalized. In my opinion. That is the biggest story in the whole global macro economy. We had this period where the Federal Reserve short term rate was zero, where 10 year rates, that’s the bellwether rate in the global economy. The US 10 year rate, it was around 2% and it made everything seem free.

Now interest rates have, in my opinion, normalized. There’s a lot of debate around that, but that’s how I see it. And suddenly it matters. Are debts piling up? And our interest payments have more than doubled, almost tripled now compared to what they were just a couple years ago because interest rates have gone up so much, and that’s a problem.

And we’re the world’s biggest debtor by far. In fact, if you take all the big advanced economies, about half of the public debt is ours, measured in dollars. If you take corporate debt, bonds, more than half of it is ours. And when you owe a lot. And interest rates are going up, and they’re not going up because of what central banks are doing. They’re going up because we have geopolitical issues. We have AI demanding a lot of power, a lot of electricity. We have much more populism around the world, the splintering of the global economy. They’re forces driving them up. And suddenly it’s gotten quite uncomfortable. And we Americans have thought we were above it all, that everybody else had to adjust, but we don’t.

CHARLIE ROSE: Does it portend a recession?

KEN ROGOFF: No, I don’t. I don’t know that it portends a recession. But what it portends is that I believe longer term interest rates will continue to edge up. If there is a recession, they’ll come down, but not like they were five and 10 years ago. And interest rates will continue to edge up. And it’s a lot of pressure. It’s going to. Of course, it affects the government, it affects mortgages, it affects car loans, it affects student loans, it affects everything. And there’s a question of how that’s going to play out. It’s going to be painful if we don’t adjust. They’ll go up more. And so how do we deal with that?

CHARLIE ROSE: It’ll be painful if we don’t adjust. What do you mean by painful?

KEN ROGOFF: Well, at some point, we’ve already seen interest rates creeping up, and when the bond market doesn’t like something Trump is doing, the bond market reacts.

CHARLIE ROSE: Even Trump listens, it seems so far.

KEN ROGOFF: And so our debt’s gotten so high and we’re accumulating it so fast. Trump’s projected deficits seemed to be exceeding Biden’s, which I didn’t think was possible because Biden had had the biggest peacetime deficits. And now Trump, I guess he likes the biggest at everything, is going to have even bigger ones. And I think interest rates are going to continue to edge up.

And at some point, I think over the next few years, not 10 years, much sooner, it will start to get challenged. The bond market so far, you know, it’s all okay, raise the interest rate a little bit. But at some point, the dynamic will be more difficult. Maybe we’ll get hit by most often these things are dicey, they were weak. And then there’s a shock that happens. I don’t know what, maybe we can’t get rare earths or copper or something. You know, there’s some kind of shock. Maybe there’s a cyber war, maybe another pandemic, some kind of shock that catches us off balance.

We’re politically too inflexible. We’re on our heels. If you look at the history of all the financial crises, debt crises, inflation crises, they never happen because you couldn’t deal with the problem if you brought in, you know, some technocrats who had tons of power. They happen because people aren’t prepared to deal with it. And I see our governments as very much in that situation. I think if Harrison won, I would feel the same way. I think we’d be in a very similar boat.

CHARLIE ROSE: The consequence would be the same. Regardless of who’s in the White House.

KEN ROGOFF: I think regardless of who’s in the White House. The American people are not prepared, for example, to raise the Social Security age, like everybody but France has done, to raise taxes significantly or cut spending significantly or whatever. You don’t win elections by saying that. I think you’d be very hard pressed to find a congressperson or senator who would really, really go to the mat over that issue. I mean, there might be a couple isolated mavericks and you’re not going to win the presidency by doing that. It’s not that they don’t know. I actually think they do. But the American people just haven’t been conditioned to deal with this.

CHARLIE ROSE: They normally haven’t voted for pain.

The Coming Crisis

KEN ROGOFF: They haven’t voted for pain. And we are the world currency. But sort of translating that quantitatively, the rest of the world holds a lot of our. They hold a lot of dollars. That helps us to bigger demand. We get a lower interest rate, but it’s only a quarter. Sometimes it goes up to a third of our debt. Okay, so maybe we can have 25 or 30% more debt than say, the UK can have because the rest of the world’s absorbing it. But it can’t go on forever.

And other countries have run into this problem and we’re starting to, of the bond market starting to react. And these things are very volatile. I wouldn’t say the exact moment, but I think it’s likely to happen within Trump’s term that we reach a more critical moment where the heat from bond markets of interest rates going up starts to get painful and we lash out some way. Inflation, there are a variety of things. So it’s not.

CHARLIE ROSE: But let me understand, what do you mean by we lash out?

KEN ROGOFF: Well, Trump keeps telling Powell to lower interest rates. Biden, Obama were not so crude as to say that. But of course, every president wants the economy to grow. They don’t want interest rates to go up. And as interest rates get higher, it creates a lot of political pressures to pull it in. And I think that’s going to make it very difficult for the Federal Reserve, which is supposedly independent, I should say.

I wrote the first paper on central bank independence. I’m very pro central bank independence, but it’s not in the Constitution. It’s not like the Supreme Court. Recently, the Supreme Court actually ruled that they couldn’t fire the head of the Fed, but that’s a minor inconvenience over the fact the Fed is a creature of Congress. So.

CHARLIE ROSE: So you were saying that the Fed will not be able to cure the problem as Paul Volcker did when you had 19% inflation.

KEN ROGOFF: Well, we’re not going to get straight to the inflation right now. They’re trying to keep it down. But as interest rates go up, the Fed is going to come under a lot of pressure, and its independence is going to come under pressure, particularly if we’re hit by, I don’t know, a pandemic, a cyber war or something. Usually these. Or a war. Or a war. I’m afraid to say that a war. These inflations are nascent, but sort of happen in the fog of war or the fog of a pandemic, so.

I don’t. I’m not saying there’ll be a crisis tomorrow, but we’ve got. We’re way more vulnerable than we were when Paul Volcker came. You mentioned him. Our debt to income was 30%. It’s four times that big now.

CHARLIE ROSE: It’s about 120%.

KEN ROGOFF: 120%. So each time interest rates go up, that adds a lot to the tap, and we’re more vulnerable. When you have a lot of debt, you’re more vulnerable than when you don’t.

CHARLIE ROSE: What are economists like you on both sides of the aisle saying to each other in private? Are they saying exactly what you’re saying to me in private?

KEN ROGOFF: I think a lot more are. What I’m saying to you now was considered heresy. Ten years ago, you know, everyone was convinced interest rates would never rise. They had gone super, super low. My brilliant colleague Larry Summers, who I’m sure you’ve also interviewed, was telling people, we’re always going to have low interest rates. They’re going to go lower and lower. Paul Krugman was saying that they’ll never go up. There’s never anything to think about. And many other people.

I was debating it with these people around the world, and I said, look, look at history. They’ve been low before until they weren’t. Why would you bet the Ranch on this. I spoke to the U.S. treasury. They asked to speak to me, just to be clear. And they asked, are we doing anything wrong?

CHARLIE ROSE: Was this during Biden or Trump?

The Debate on Interest Rates and Debt

KEN ROGOFF: This was actually at the end of Obama where I was doing this. Jack Lew was the treasury secretary. And I said, well, you’re borrowing very short term. Why don’t… In other words, you can choose to borrow 30 year debt, 5 year debt, 1 year debt. We borrow very short term because the interest rate’s lower. Just the same reason you or I might choose a flexible rate loan. And I said, why would you take that chance? Why don’t you lock in these low interest rates?

And I met with the team and they said, well, what would make you think interest rates would go up? So I started naming things and they would think and go, nah, they’re going to go down if that happens.

And it reminded me, actually, in January 2008, I was at Davos, the World Economic Forum, and I ran into Chuck Prince. He was the head of Citibank. He grabbed me and he said, I hear you’re going around saying there could be a financial crisis. And I hear you going around saying there could be a problem, which I was back then, based on my research. And he said, what? What would make it happen? So I started listing one thing, another. And he said, no, that won’t happen. It was just like that. People just were convinced that interest rates weren’t going up.

But I think that’s changed a lot. Where there’s a debate, there’s people who say AI will save us, we just borrow whatever you want. And the AI will produce so much miraculous growth, it’ll raise taxes and pay for everything. And by the quizzical look on your face, I think you’re having a common sense view that that’s pretty speculative. And I think it’ll take a long time before that happens.

There are people who think interest rates are going to go back down. A lot of my young colleagues think that. But I would say my work, which is less mathematical than theirs, but more historical, would suggest it’s kind of normal now and we should worry about them going up and not just going down. There’s debate about it is sort of the short answer to your question. But 10 years ago you couldn’t debate about it. I think I would close to the lone voice saying this, at least in the academic world. And now, of course, a lot of…

CHARLIE ROSE: Are the same factors that may cause interest rates to go up the same factors that make the dollar, the US Dollar, the reserve currency, vulnerable?

The Dollar’s Vulnerabilities

KEN ROGOFF: So, absolutely, because we’re the world’s biggest debtor, it’s inconvenient to have interest rates go up for us. I mean, the vulnerabilities to the dollar, it’s like the fall of Rome. They’re partly from the outside. The Chinese need to break away, and they’re doing it. And believe it or not, Asia is half the dollar block. When you look at how we’ve colonized the world and measure it by size of the economy, I mean, of course, China is very big, but so is the rest of Asia. Asia is very important.

As China breaks away, we’re a major trading partner. But as President Trump’s finding out, there are other major trading partners, and China’s one of them that they trade with. And Europe, Europe’s doing better than it was. It had the European debt crisis and that held back. But they have a single currency in Europe. It’s actually the most credible other thing you can use besides the dollar.

But just as with the fall of Rome, you know, the real problems are on the inside that we just think we’re invincible. We think we can just have debt, do whatever we want. We’re the special country. And I think we’re testing the limits of that. And I think both parties actually don’t support central bank independence as strongly as they should. I mean, deep down they’re willing to take it away.

So I think we have these vulnerabilities now. Trump’s trade war, I just, okay, I knew he was going to have tariffs. I didn’t know it would be so dumb.

CHARLIE ROSE: I mean, you thought, what, 10% across the board or something?

KEN ROGOFF: I didn’t know what he was going to do, but I didn’t know it would be tariff theater. I mean, where, you know, 145% on China, he gets mad at somebody and raises it.

CHARLIE ROSE: So what’s the impact of all that?

KEN ROGOFF: Well, I think it’s a few things. One is, one of the strengths of the dollar is we’re a big economy. We’re on top already. But there are others, the rule of law. I have a friend, an acquaintance that is a very rich person, and he said to me, you know, I used to own property near Tiananmen Square. I don’t own it anymore. I never sold it, but I don’t own it anymore. He’s being sarcastic about most…

CHARLIE ROSE: You mean the Chinese took it away?

KEN ROGOFF: Yeah, exactly. Most countries. Your property’s not that safe. Maybe they’re going to give you a special tax, something. The United States, we really protect investors. If you’re a French person and you come in and you buy an apartment in New York, okay, maybe you’ll pay a non-resident tax that someone in New Jersey pays. But we’re not going to penalize you for being French.

And you know that if you’re unfairly penalized, you can go to court and it might not be perfect, but you’ll get a reasonable hearing. There are other things that are big strengths of the dollar that I think are also under assault here. Another one would be openness to trade. If you’re not open to trade, it’s very hard to be top dog as the currency because you need to get your goods.

CHARLIE ROSE: So what do you then say to those who argue that we have been victims of an unfairness in trade policy and that other countries have taken advantage of us?

America’s Economic Position

KEN ROGOFF: Well, the first thing to say is that we’ve been huge beneficiaries from the system, whatever the system’s done. We have just left everybody in the dust. Our lower 20%, say the 20th percentile in the U.S. we want to transfer money and make them better off, but they would be in the top, I don’t know, 15%, maybe even 12% in the world.

It was much more true than it was 25 years ago. Europe was as rich as us. They were as big an economy as us. 25 years ago, the European stock market was as big. Japan was richer than us. At one point, believe it or not, their stock market in around late 1980s was worth more than our stock market. Their land was worth more than our land.

CHARLIE ROSE: Real estate was worth more.

KEN ROGOFF: Real estate was much, much more than us. Even though it’s the size of California, we have just left everybody in the dust. So somehow in this process of everybody exploiting us, okay, you know, you can say, well, not everyone got rich the same way, but I think you could track out the 20th percentile in the US and compare them to the 20th percentile in Italy. And they still, they’re way ahead of them.

And so it’s certainly wrong to say that the system’s terrible, but also, okay, we are. The fact that everyone loves the dollar does make the dollar worth more and it does make it a little less competitive for us.

CHARLIE ROSE: Privilege?

KEN ROGOFF: Yeah. The fact that everyone’s holding dollars helps bid up the dollar, but there are a lot of other things that do. The fact we have oil bids up the dollar, the fact that we’re great at tech bids up the dollar.

CHARLIE ROSE: About military.

Military Power and the Dollar

KEN ROGOFF: Well, I consider our military very important to the centrality of the dollar. I think that’s something a lot of people don’t understand. Trump is very crude about it, where, you know, if you don’t do things the way we like it, I’m not going to protect you. But, you know, you’re someone who knew Lyndon Johnson and Richard Nixon and Ronald Reagan. Believe me, behind closed doors, they were saying the same thing. We got our way, the whole global financial system, the way the international institutions are, the way the banking system is. It’s on our terms.

CHARLIE ROSE: The point I was making at the beginning is that not only did we get our way or part of getting our way was the fact that we would use that pressure and that power to turn a decision around that went against us by our friends.

KEN ROGOFF: Absolutely. And I play on this point a lot in the book that you think military has nothing to do with the dominance of the dollar, which is very much. The whole system’s built around us. It has a lot to do with it and in fact, are forcing Europe to become geopolitically relevant. I don’t know if they’re going to or not, but if they do, it’ll help their currency a lot, because part of what marginalizes them is they have no power.

I’m sure you recall that when we wanted to put sanctions under Obama on Iran, the Europeans said, we don’t agree with you. We don’t want to do it. And so we said, okay, but then you can’t use our banking system. And they had to fold immediately. They had to fold because everything runs through our banking system.

So, yeah, a lot of our friends don’t like it either. So the people coming from the outside who are chipping away at the system, our weaknesses on the inside, I don’t see the dollar becoming third to the other things or even fourth. If we add cryptocurrency, the renminbi and the euro, we’re going to be first. But we were here and now we’re going to be here and the others are going to be much closer and their market share is going to go up.

CHARLIE ROSE: We’re unlikely to be replaced as the reserve currency. The dollar is by any. By a Chinese currency, a European Union currency, the euro or some other currency.

The Future of the Dollar

KEN ROGOFF: We’re not going to be replaced, but a lot of places won’t use it the way they now use the dollar. So let’s remember we colonized the world. Asia, Africa, Latin America. The renminbi is going to be used in lots of parts of the world where the dollar was over the Chinese currency.

The Chinese currency is going to be used a lot in the way. What it hasn’t been, you say, well, why would anyone trust the Chinese? They don’t trust us. I mean, if you’re talking to a typical African or Latin American leader, I think they should trust us a lot more than the Chinese. But they don’t. And so they’re going to gain share.

And Europe, I think it’s also going to gain share. And some people say to me, well, we still have so many problems. We’re not unified in everything. And I like to make a comparison to basketball, where, okay, your team might not have improved, but if the other team, star player got injured, I’m in Boston, and, yeah, Tatum got injured, you’re going to be able to win in ways that you didn’t.

And so Europe’s there, and when we get weaker, they will also be used more in Latin America and Africa. So it’s not that suddenly something is going to take over, but we’re not going to have the exclusive that we have. That means our interest rates will go up because people will need less dollars. And it also means our sanctions will be less effective because there are other routes that people can go.

So there’s a big loss to us. I think being reserve currency is fantastic. If Donald Trump can find a way to have other countries give tribute to the United States, go for it. No, I don’t think they’re going to, but I don’t think it’s deserved necessarily.

CHARLIE ROSE: So what does it mean for the average American?

KEN ROGOFF: Well, I think where you’re going to notice it the most, you’ll notice it a little bit in further rises in interest rates as the dollar becomes less dominant. There’s less demand in the world. Your mortgage is being held more in the United States and less somewhere else, raises the interest rate in a complicated way, but it does.

I think where you’ll really feel it is when we have another pandemic war cyber crisis, and we go and say, okay, let’s spend 20% of income because that’s what we do when this happens, which, by the way, nobody else does at that level. And we go to do it and the bond market’s not so friendly as they’ve been in the past. We start doing it and the bond rates start going up, we’ll pull back, maybe we’ll inflate. I don’t know what we’ll do.

But that’s where you’ll feel it, that suddenly there’ll all be these articles. Privilege isn’t what it used to be. People don’t love the US the way it used to be. So, I mean, I think that’s the most visceral way people will feel it.

CHARLIE ROSE: And what can we do today to, to make, to soften the impact?

Trump’s Impact on American Institutions

KEN ROGOFF: So Trump is undermining some of our strengths and accelerating the day this is going to happen. And I want to say the Democrats are far from perfect and I’m guilty of teaching at Harvard, but I regard myself as centrist and I actually think Trump’s right about some things. But not on this. I mean, not on Harvard, not on the rule of law, not on soft power.

CHARLIE ROSE: What about on Harvard? I mean, just say central dispute. That’s every day there’s a reference to it on one side or the other. And Harvard is suing or Trump is suing.

KEN ROGOFF: Well, I mean, to be fair, we have problems at Harvard, as do a lot of universities. We have problems with anti-Semitism that are still there. We have problems with diversity of thought that I think conservative ideas have been pushed out. I regard myself as a centrist. If I had to use a description, I’d say Clinton. I mean, Bill Clinton, Democrat. But that’s it. That makes me one of the 3% of Harvard professors who identify as a conservative.

CHARLIE ROSE: So how do they identify themselves?

KEN ROGOFF: They do a survey every once in a while and ask how you identify yourself. And they last did one a couple years ago. And I don’t think there’s a lot of debate about that. There’s a faculty group that did a similar survey. It didn’t used to be that way 25 years ago. It was, of course, colleges are left leaning strongly, famously. But it wasn’t as extreme. It’s gotten too extreme.

And I think this whole idea of you can’t have a conservative speaker, that the students won’t feel safe, they boycott and block it. You can’t teach certain conservative ideas. Let me give you a very concrete example. Economics. So I was a student of James Tobin, the great liberal economics Professor Nobel prize winner back in Yale in the mid-1970s. He taught us that government’s not always the solution. You need to also use markets. It’s not command and control.

Boy, you know, when I look at like the syllabuses, the papers that people are publishing, the answer is always what can the government do? And that’s just wrong. I mean you need to, of course we need the government. The government should do lots of things. But the private sector is very important. Markets are very important. It makes us a great country. So I think we need diversity of thought.

The problem, of course, I’m a Harvard professor, you know my view. But the problem with what Trump’s doing is he just seems like he wants to destroy Harvard. The business about sending the foreign students at 27% of our student body away. What does he think is the engine of innovation in the American economy? These. But we’re getting the cream of the crop from the rest of the world. They study, they very often stay, they’re running. Our most innovative companies are certainly high skill immigration, which this is, this is the jewel.

Everyone’s jealous of us. France wants to be like us, Germany, the United Kingdom, Japan, and they can’t. And suddenly to say, oh, it hurts us over some, you know, anti woke war or something. I mean it’s, he has good points, I want to say, or the Republicans. But is this the solution? I mean to just try to decimate Harvard?

So I hope that doesn’t happen. I hope it’s worked out. But it’s not good for the dollar. I mean if you’re talking about undermining U.S. soft power. These foreign students connect us to the whole world. They’re a part of why everyone’s holding dollars. They’re a part of our soft power. So I’d certainly say in general, particularly on the foreign students issue, I hope we find a way to balance and I want of course the Chinese spies. That’s real, that’s real. You have to do that. But my Canadian graduate student’s probably not a Chinese spy. And we have to have some balance of these things.

The Need for Crisis to Drive Change

CHARLIE ROSE: When you look at the future, what else do we need to make sure that the worst doesn’t happen?

KEN ROGOFF: Well, I’ll start by saying I think we’re going to need something, a crisis to happen to convince us that we need to make sure the worst doesn’t happen.

CHARLIE ROSE: We need a crisis in order. I think the urgency and the imperative of change.

KEN ROGOFF: Exactly. I think the American voter is just not going to go for it until. So, I mean, it’s simple things to raise the retirement age for Social Security. I think US and France are now about the only countries that haven’t done that. That would help a lot. I hate to wade into all the other things, things I do generally feel our size of our government by some measures is pretty small compared to the rest of the world. That’s complicated. But there are a variety of sensible things to do. They’re sensible people who could make these adjustments, but we just don’t want to. And the big beautiful tax bill, you know, has some very good elements.

CHARLIE ROSE: Just passed to Congress.

KEN ROGOFF: Yeah, it has some very good elements, but also a lot of things making Social Security tax exempt and tips tax exempt, which just, you know, will need to be pulled back.

CHARLIE ROSE: And Medicaid.

KEN ROGOFF: Well, I mean, the Medicaid. I’m not an expert on this, Charlie.

CHARLIE ROSE: Yeah, but you know, you know what’s in the bill.

KEN ROGOFF: No, no, I mean that, you know, clearly you have to decide what your priorities are. Franklin Roosevelt famously didn’t make Social Security just for low income people because he thought there wouldn’t be support. And I think people like Bernie Sanders sort of see that as a model. But the trouble is, if everything becomes a middle class entitlement, it’s very hard to have a dynamic, innovative economy.

Trump’s Economic Advisors

CHARLIE ROSE: Is Trump getting alternative advice?

KEN ROGOFF: Scott Besant, he’s the Treasury Secretary. I don’t know when you’re going to release this interview because you never know in a Trump White House how long.

CHARLIE ROSE: We’re going to release it tomorrow.

KEN ROGOFF: Okay. We’ll probably make it to tomorrow. He’s been great. I’ve been very pleasantly surprised when he talks about tariffs. He sounds not good, but he has to. If he said anything else, Trump would fire him. But I found him very sensible. But then they have these people like Peter Navarro, Howard Ludnick on tariffs that just where are they coming from? I mean, they’re just saying these things that are very destructive.

They have some very good people on the Council of Economic Advisors. The question is, who does he listen to? Does he listen to these people? Does he listen to some friend that he calls up? You know, it’s funny, somebody said, I mean, in the first term he had some advisors there, he kept firing them. But who were telling him the right thing? Not just in economics, but they were there. There were adults in the room.

It is a weaker team overall in Trump too. Across the board they’re more loyalists and less these seasoned experts. I had one person say facetiously to me, I’m not worried about an adult being in the room. I actually would prefer Trump were in the room because he’s more sensible than a lot of the advisors. Not sarcastic, but yeah, he’s very pragmatic. I mean, the thing about Trump, one that I think I respect, he was very pragmatic. When something didn’t work, he would change.

CHARLIE ROSE: But as you suggested, there were people who said no to him at that time.

KEN ROGOFF: Exactly, exactly.

CHARLIE ROSE: Both in the White House and. And at the Pentagon and at other.

KEN ROGOFF: Now he’s terrified everyone. Even probably when he’s calling up business people, they’re terrified. It’s funny, that one interview that really got his attention was Maria Bartiromo. She’s at Fox, was interviewing Jamie Dimon. He’s the head of J.P. Morgan, very respected. And they were talking about the tariffs and Jamie Dimon was saying, I think there’s going to be a recession. And Trump respects her and she respects him. And he adjusted a little bit.

But that was a rare instance where we were sort of, you know, really hearing him hear outside advice to make a difference. We can hope. But if he’s talking to his sons or JD Vance is very bright man, but clearly not the person saying no in the room. I’m worried. I mean, I want Trump the pragmatist to somehow come back. We have almost four more years with him, and I hope we find a way. He finds a way to do that.

CHARLIE ROSE: But listening to you in this conversation, it’s not good news for America. It’s not a disaster, but it’s less powerful as it was, less options as there were less opportunity.

Leadership Challenges in the US and China

KEN ROGOFF: No, absolutely. And if you don’t have a really good team or your leaders inflexible, what happens when there is a crisis? He didn’t really face one in Trump one in the same way Obama did when he took over. He had the pandemic eventually and he did some very good things, like with the vaccines. He did some good things. Trump, you’re speaking of Trump absolutely did some good things. But as you said, he had a different team.

And the questions will the new team or the people he listens to in the new team deal with things and just to go to the other side of the world for a second, the same things happened in China where Xi has only had loyalists suddenly. China used to have this really trial by fire rise where you had to prove yourself. You had to prove you were competent. And if you proved you were competent, you moved up. Not anymore. And Xi is China. And I worry. What’s going to happen in China?

CHARLIE ROSE: He’s president for life.

KEN ROGOFF: Well, not just that he’s president for life, but he’s appointed loyalists, so no longer do they have the technocratic expertise. So they don’t have it. The United States is weaker than it was. What happens if the US and China, you know, start sparring over something? I, of course, China still has some very good people. And I mentioned, you know, there are a few and we have still. But it’s not as strong a team. What if there is a crisis? So it’s a very vulnerable situation.

CHARLIE ROSE: Their economic future and their growth rate is ticking back up. I believe you have spoken to the housing crisis. They have. Have they overcome that?

KEN ROGOFF: No, I don’t think they’re picking up. I don’t think they’re doing okay. I think they’re in the thick of it. I don’t think you should believe any numbers coming out of China. If you have your prices going down and your interest rates collapsing, things aren’t going well, they can announce.

CHARLIE ROSE: So they’re not getting stronger as a challenger to us?

KEN ROGOFF: No. So one of the interesting things, and I think six chapters on China in my book, was the overestimation everybody had of China. Goldman famously said they were going to be twice the size of the United States before you could blink. And that’s not happening. They’re in trouble.

And I want to give Trump credit where credit is due. If historians come back in two decades and say, boy, that was great that Trump was president, if anyone else was president, we wouldn’t have been saved, it would be because he’s hit China while they’re down. China’s not doing well. They’re in trouble. And he’s starting this trade war. I mean, Xi is much more politically entrenched, but he’s definitely hitting China while it’s down and taking China on.

I don’t see the logic of some of the entities he takes on. I say this, you just asked me about Harvard, but also Canada, Mexico, the European Union, China, Denmark.

CHARLIE ROSE: Denmark, Greenland.

KEN ROGOFF: Like, he has a little bit of an issue there with our security. But China, maybe somebody will say, you know, like Winston Churchill, everybody thought was nuts, and then suddenly they thought he was right back. He was always saying, the Germans are a threat, the Germans are a threat.

CHARLIE ROSE: During the 30s when he, he was in the 1, he was in the wilderness.

KEN ROGOFF: He was in the wilderness. So, you know, maybe it’ll work out. I think again, I live long enough to know. You should never think, you know, but the way things look right now is it’s hard to see how we surpass China without allies. I understand, you know, getting down on China, I understand that. But France and Denmark and Canada and Mexico, it’s harder to grasp.

CHARLIE ROSE: Not to speak of South Korea, Australia.

The Need for International Cooperation

KEN ROGOFF: Yeah, but like, South Korea is a really good example. Okay. He wants to bring manufacturing back here, which, by the way, ain’t going to happen anytime soon. And we’re never going to have jobs because it’s all going to be automated. But one of the reasons. Good argument. National security. We’re not good at building ships anymore. China’s just eating our lunch. They’re just creaming us at building ships. And they’re much faster at building warships and military ships.

Well, you know what? South Korea is really good at? Building ships. They’re our ally. Instead of putting a massive tax on South Korea for running a surplus, we could cooperate with them. That’s just an example. We need allies. We have. I don’t know that China has five times as many people as we have. They’re growing. They are even growing slowly. Quite a threat. So we need allies and we need to court our allies. And, and also we’d like our allies to keep liking our currency. And we’re walking away from all of this.

CHARLIE ROSE: Are institutions that sort of came out of Post World War II, like the World bank and like IMF and like other institutions. Are they up to playing a significant and important role?

KEN ROGOFF: They’re not. I mean, they do a great job with what they’re assigned. But there’s this sort of, you know, old saying about the United Nations. When a small country meets a small country, the United nations intervenes. When a small country meets a large country, the small country disappears. And when a large country meets a large country, the United nations disappears.

I mean, it’s a little bit like that with the IMF and the World Bank. I mean, China and the US or Europe are disagreeing and they can provide a platform for discussion. But when you have these great power battles, they’re limited, they’re very good as technocrats. They are great institutions. I don’t want you to misunderstand me, but it’s very hard for them to get in the middle of all of this.

CHARLIE ROSE: But are we therefore being creative, we being the world, in creating new entities that can meet the challenge of the second quarter of this century?

The Retreat from Globalization

KEN ROGOFF: Well, I mean, at the moment, the United States is in full blown isolationism and retreat. And without The United States. It’s very hard. I have proposed an idea. It’s discussed a little bit in my book, although it’s not a centerpiece of having a world carbon bank that helps emerging markets have new technologies, that helps with the transition away from coal. And there are other people have lots of ideas out there.

But we live in this world where we globalists are facing the firing squad, and nobody wants to hear it. So we go through these cycles in history. We did after World War I, where there was this retreat from globalization that had been a big period, and look at how that worked out. And the United States saw that. And after World War II, we promoted integration, we promoted these institutions, and now we’re at war with everything.

CHARLIE ROSE: We’re at war with globalization, where we.

KEN ROGOFF: Absolutely. No, absolutely. Trump seems to believe that, you know, we can produce everything ourselves without being very selective about it.

CHARLIE ROSE: But there are other countries in which there is. Populism has taken root and the rally is anti globalization.

KEN ROGOFF: Yeah. And again, I don’t. It’s partly America. I think the Democrats have a large strand of that. I mean, Bernie Sanders rose to fame by campaigning against the North American Free Trade Agreement and saying that was the worst idea ever. There’s these things going waves. There’s a lot of hostility to immigration in Europe. It’s really horrific the way Germans are and French are. We’re struggling with things.

It’s definitely a difficult moment. But it’s one of the reasons the dollar going back to my book is going to be in retreat, because we have benefited from this globalization. Everyone is using us. But as the world becomes more divided, people will see things differently.

Looking to the Future

CHARLIE ROSE: So look forward to me as we close to 20, 35, 10 years. What’s the global economy going to look like?

KEN ROGOFF: I mean, the two things that jump to my mind are not about economics or in a way, about what happens with AI. I think AI will evolve very slowly. I don’t think it’s going to rescue us from everything, but it’s a source of incredible anxiety. There’s this concern it will move very fast. I watched it in chess from the 70s, and it didn’t move fast. It moved in steps. And people tend to get ahead of themselves. But that’s a big question.

Another big question is, what’s going to happen with global peace? What’s going to happen in the Middle East, Pakistan and India? We have a lot of powder kegs planted in all these places, and will we have stability? And actually, AI is a problem there because there are all sorts of new weapons being developed.

I think if we have global peace, probably things will be pretty good. I mean, I think, you know, the core of development and society is pretty good. But I do think the United States will not be as exceptional as we are in 2025. We are just not headed that way. And this period where I just, we just surged ahead of everybody else, Europe’s going to catch up a lot, in my opinion. China will catch up some. The rest of the world will be a little less centered on us. And that could be a less stable world.

I mean, political scientists tell me having one big dog or hegemon is the word they use. Controlling things is stabilizing. And when you have a lot of competitors, it’s destabilizing. Graham Allison, who you probably also interviewed at one time.

CHARLIE ROSE: Yes.

KEN ROGOFF: Has this, you know, wonderful book about how it’s very hard when there’s an existing power and a rising power. Most of the time there’s a war. There isn’t always, but most of the time there’s a war. So we’re, we’re still, you know, certainly looking at that. And getting back to Trump, maybe that’s the biggest thing to look at, and maybe focusing on China’s is genius, but, you know, again, it’s happening in this very chaotic way that’s hard to understand.

Cryptocurrency and the Dollar

CHARLIE ROSE: We haven’t talked about the cryptocurrency and its role in terms of the dollar before. I sort of sum up what I how I have seen this conversation.

KEN ROGOFF: So cryptocurrency is not really a challenge to the dollar and the legal economy as long as we regulate it. Donald Trump says he’s not going to regulate it, but I don’t think that’s going to last forever because there are just too many problems it causes.

But there is a big part of the economy which is we call underground. A lot of it’s tax evasion, but it’s also arms dealing, human trafficking, the drug trade mafia, you name it. It’s a big part of the global economy. I want to say 20%. I discussed this, and that is wide open for cryptocurrency right now. Actually, the dollar rules there, and a lot of cash, particularly rules. But cryptocurrency is making big inroads on the dollar there.

And so those people who say cryptocurrency is worthless, well, they’re wrong that they’re worthless if somehow we never have any underground activity again. But I don’t see it competing with the dollar. And here I’m going against what a lot of the, I’ll call them Tech Bros in Silicon Valley, will tell me. And they’ll often cite Yuval Noah Harari’s book. Right, of course, you’ve interviewed him. They’ll often cite his book which says money is whatever we want it to be like. If everyone thinks Bitcoin’s money, it’s money that is just so wrong.

The government has incredible leverage over what’s money. The government can insist you pay your taxes in dollars, it can pay its suppliers in dollars, it can force banks to pay dollars, which creates these network effects that always put the government currency on top. And the government will step in to regulate Bitcoin and these other things at some point, but they’re not worthless. I don’t know what the worth should be, but if we’re not controlling the global underground economy, they still have a lot of value. So maybe I’m giving a half glass, half full glass, half empty. But that’s where I see it.

The Impact of Technology

CHARLIE ROSE: I would only add to this conversation. We are living in a world of instant communication and we’re living in a world of instant access to all kinds of information because of the Internet, obviously. So we know more faster than we ever have. I’m not sure what the consequences of that are. Not always are they positive, often can be negative, but it’s a fact of life.

KEN ROGOFF: I totally agree. I don’t even know how to think about it. I don’t know how people’s minds work. It affects the way young people think and it probably affects the way their brains, which. We evolve, right? We’re humans, but we evolve. And I don’t know where things are going. I’m an old person and so I just wish we didn’t have social media. I think it’s an evil. My children would not agree with that.

But AI, boy, I don’t even have an idea. I’m sure you experience this like you talk to younger people. They don’t even think for themselves anymore. They start every time. They just ask AI, what do I think about it?

CHARLIE ROSE: Exactly.

KEN ROGOFF: That’s the starting point. So it was already. You didn’t have to remember everything because you could look it up. Now you don’t need to think anything. You don’t need to know anything. How is it going to rewire us? What’s it going to value? It’s fast changing. Maybe people. I’m 72. Maybe people my age have always said that, you know, just, I don’t know, these railroads, you know, change everything. But. But I feel like AI is different. It’s more like the printing press. It’s more like something that’s just explosive and it’s a fact. But we shall see.

CHARLIE ROSE: This is such a pleasure for me.

KEN ROGOFF: Well, it’s such an honor for me. I mean, you are just one of the all time greats and to get to be interviewed by you is. Is cool, so.

CHARLIE ROSE: Oh, well, thank you. I. I hope to be cool. The book in this very interesting cover is Our Dollar Your Problem, An Insider’s view of seven turbulent decades of global finance and the road ahead. Ken, thank you so much.

KEN ROGOFF: Oh, well, I mean, I’ve already said it’s an honor and I’m so glad you’re back doing this because you’re so great and it’s a gift of the world and I’m glad you’re doing it.

CHARLIE ROSE: I have great confidence that the audience does not have the information I have, but they have the intelligence to appreciate smart conversation. That’s always been what I believed in, that the audience is there if you provide, engaging, in an engaging way, smart, interesting conversation about things that touch their lives, even though they may not be obvious to them.

KEN ROGOFF: Well, absolutely. And a thing and impression I had about you over the years and also hearing from other people. You prepared like you’re prepared. And I’m sure you know, because you’ve been interviewed a lot yourself, that is not the norm. It’s like, who am I interviewing today, Gail?

CHARLIE ROSE: I do.

KEN ROGOFF: Yeah. No, I mean, that’s part of. Anyway, to be continued.

CHARLIE ROSE: Indeed. Thank you.

Related Posts

- The Truth About Debt: Why 99% Rich Use It & Others Fear It – Dr. Anil Lamba (Transcript)

- Paulo Nogueira Batista: Decline of the IMF & Rise of the BRICS New Development Bank (Transcript)

- Ex-BlackRock Insider Reveals The Next 2008 Financial Crisis (Transcript)

- Transcript: CEA Dr V Anantha Nageswaran on Growwing India Podcast

- Transcript: Business Expert Natalie Dawson on DOAC Podcast